What Is the Money Market Yield?

The money market yield is the interest rate earned by investing in highly liquid and short-term securities.

It is calculated by adjusting the holding period to its bank year (360 days) equivalence. The money market yield is also called the CD-equivalent yield or the bond equivalent yield.

How Does the Money Market Yield Work?

The money market connects borrowers and lenders to their counterparts who are interested in short-term investments. Investors who are interested in the money market could be banks, funds, dealers, or brokers.

Financial instruments traded on the money market include certificates of deposit, Treasury bills, commercial paper, municipal notes, short-term asset-backed securities, Eurodollar deposits, and repurchase agreements. Because these investments have shorter-terms they are often classified as cash equivalents.

Given the low default risk in the money markets, the money market yield will be lower than the yield on stocks and bonds—though higher than the interest rates on standard savings accounts. Interest rates are usually variable and are set by the current interest rate in the economy.

To earn the money market yield, you need to have a money market account. Money market accounts are offered by banks as a way to borrow from their account holders in an effort to meet minimum reserve requirements, as set by the Federal Reserve.

How to Calculate the Money Market Yield

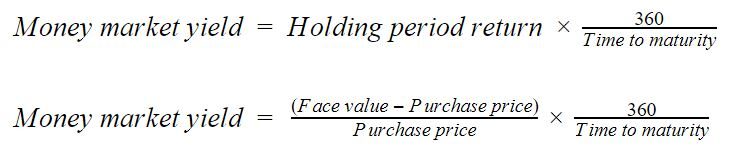

Interest rates are typically quoted annually but could be compounded semi-annually, quarterly, monthly, or even daily. The money market yield is found by using the bond equivalent yield, which is based on a 360-day year.

This helps an investor compare the return of a bond that pays a coupon on an annual basis with the return of a bond that pays semi-annual, quarterly, monthly, or any other coupon frequency.

The money market yield is calculated as:

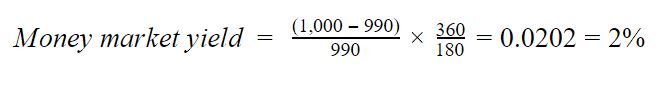

For example, a certificate of deposit with $1,000 face value is issued for $990 and due to mature in 180 days. The money market yield is found by calculating: