With a little patience, planning, and access to a computer or smartphone you can easily save money on gas starting tomorrow. Below are seven no-brainer tips for how to save money on gas.

Editor's Note: All savings estimates are based on a national average of around $2.50 per gallon of gasoline, average driving of 15,000 miles per year and an average 25 MPG fuel economy.

1. Carpool to Spend Less on Gas

Carpooling is a great way to save money. If your car gets 25 miles per gallon with one person, then it effectively gets 50 miles per gallon with two people riding in the same car.

If you're the one doing the driving, request to split the cost of gas with your co-riders. Alternately, each person in the carpool could take turns driving so that fuel costs even out among the group.

Carpooling saves money on gas but it also comes with another added benefit: HOV lane access. High Occupancy Vehicle (HOV) lanes allow you to fly past traffic on main highways, which requires less stopping and more saving (on time and money).

Total Possible Gas Savings: $175 per year (14-mile round trips into town, five times a week)

2. Drive Calmly for Fuel Efficiency

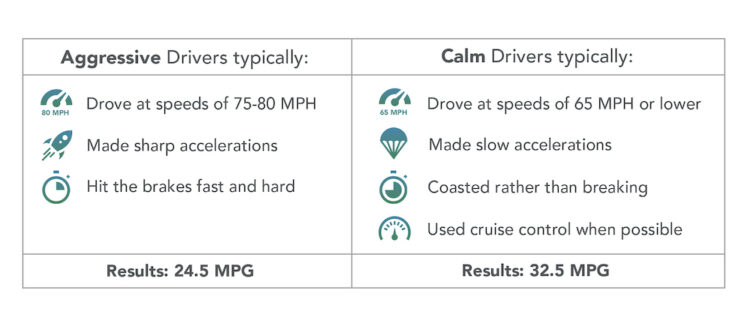

In a study done by the car resource experts at Edmunds.com, calmer drivers saved a significant amount of money by improving their fuel efficiency.

The study compared aggressive drivers and calm drivers in the same course and test:

The study found that the fuel economy improved from 24.5 MPG (aggressive drivers) to 32.5 MPG (calm drivers). That's a fuel economy boost of 35%!

So don't speed, tailgate, or gun it at a green light – you'll thank yourself for saving serious money on gas.

Gas Savings: Up to $450 per year, depending on your driving habits.

3. Avoid Traffic: Opt for the Scenic Route

Getting stuck in a traffic jam is a common occurrence for the daily commuter, especially if you live in a major city. Sitting in traffic gets you 0 MPG and is a huge waste of time.

Before you head out for the day, use Google Maps or Waze to check out live traffic conditions around your metro areas. Apply this information to find the least-congested (and thereby most fuel-efficient) route to take.

Gas Savings: Up to $375 per year, depending on how much traffic you face daily (city-like driving estimates: 20 MPG).

4. Use an App to Save Money on Gas Fill Ups

When it's time to fill up your car, be sure to check out the following apps. Each of them has a slightly different interface, but all will point you to the lowest gas prices in your vicinity.

Gas Savings: You could save anywhere between $0.50 to $1 per fill-up using one of these apps.

5. Combine Your Errands

You drive to the grocery store to pick up eggs for breakfast. Then you head back out to drop by the bank an hour later. Then you realize that you need to go to the post office. Sound familiar?

A lack of planning can cause a lot of back and forth driving. Not only does this waste time, but it also keeps your engine from reaching peak efficiency. Instead, reach for a pen and paper or use your smartphone to write down all the errands you're planning for the day. Get them done in one go to maximize your MPG and minimize unnecessary trips.

Gas Savings: $210 per year (By avoiding three extra 14 mile round-trips to town per week)

6. Call Ahead Before You Drive

Have you ever driven all the way to the store to pick up one or two things only to find that they’re sold out? That wastes gas and costs you money. If you're not sure whether the store carries the exact product you want, give them an old-fashioned – and gas-free – phone call. They'll be happy to tell you if it's in stock and you know you won't be wasting a trip.

Gas Savings: $120 or more (assuming 8 mile round trips to the store, three times a week) depending on how often you go shopping and how far you live from the store.

7. Shop Online

You could avoid making any trips at all by shopping online. Most major stores offer free shipping on orders between $25 to $50. If you really want to save money on gas, consider shifting your purchases to online shopping.

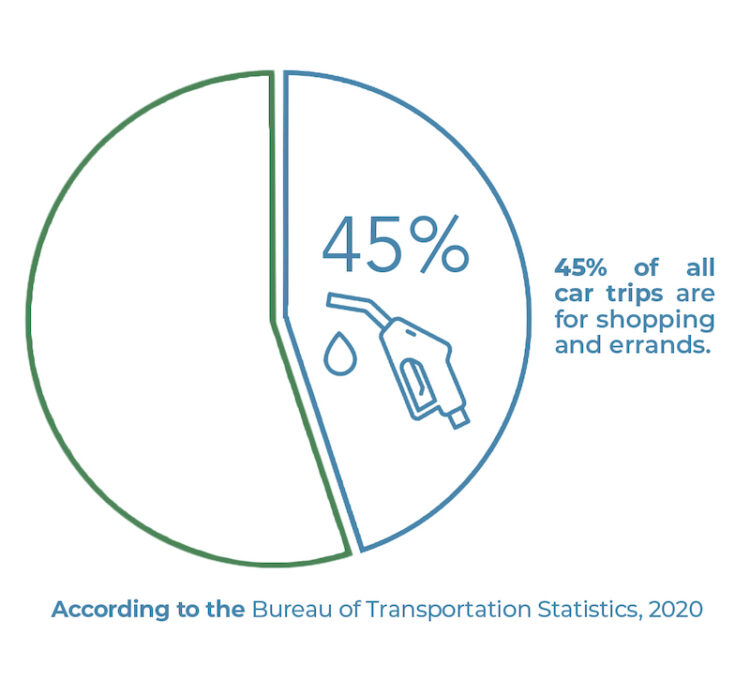

Gas Savings: According to the Bureau of Transportation Statistics, 45% of all car trips are for shopping and errands. This means almost half of your gas money goes to something you could avoid altogether.

8. Use the Right Rewards Credit Card

Another way to save a few cents per gallon is to use a credit card that offers cash-back rewards for fuel purchases at gas stations. Some cards provide up to 5% cash back on gas purchases. Make sure to read the fine print for gas cash back rewards cards as some big-box stores may not be included.

Gas Savings: If the average family spends $2,200 per year on gas according to the Bureau of Labor Statistics, this step alone could save $100 in cash back.

How to Save on Gas When Traveling

Planning your next road trip but want to save money on gas? Use the same tips mentioned above but consider a few extras for longer trips.

Change the oil for optimal efficiency

Check your tire pressure and make sure they’re inflated to the proper PSI

Stick to the speed limit

Turn off your car if you’re waiting in a line

Park in the shade so you don’t need to crank on your air conditioner (which uses fuel)

Use cruise control on the highway and drive the speed limit