What Is Dollar Cost Averaging?

Dollar-cost averaging (DCA) is an investment strategy when individuals invest a fixed amount at regular intervals into the same stocks, mutual funds, or ETFs (exchange-traded funds). No matter what the financial markets are doing, the dollar amount never varies.

At times when the market price per share is high, the invested amount buys fewer shares of the investment. Conversely, at times when the market prices fall, investors are able to purchase more shares.

When Does Dollar Cost Averaging Work Best?

DCA works best when discipline is needed to enforce investing and time is on the investor’s side. Few people have the financial discipline to save for a lump sum investment. Dollar-cost averaging enables investors to buy more shares (over time) than they could with a single lump sum investment.

Dollar-cost averaging also takes a lot of fear and uncertainty out of the short-term markets and volatile investments. It is not, however, a guarantee for making money. No single strategy fits every person and situation. That said, understanding how dollar-cost averaging compares to lump sum investing (more on that below) can help an investor sift through their choices and make better financial decisions.

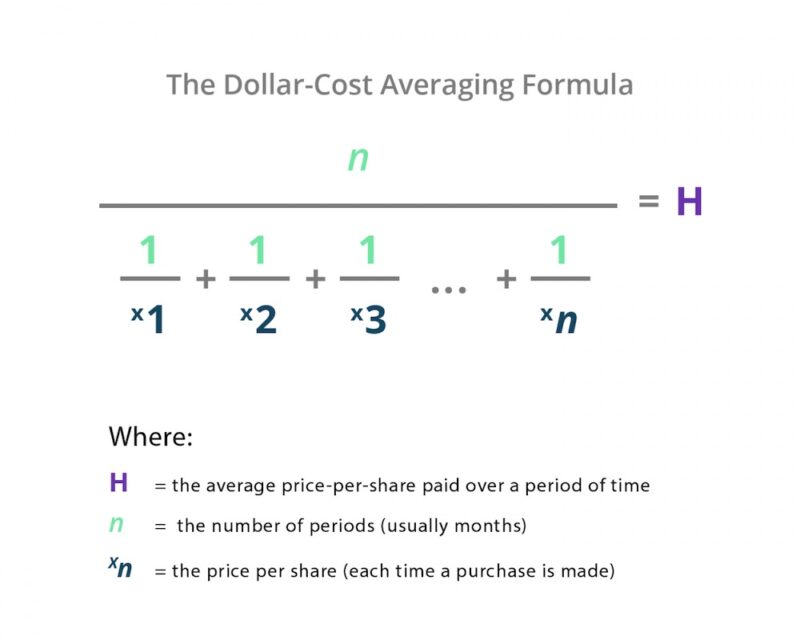

Dollar Cost Averaging Formula

The DCA formula is as follows:

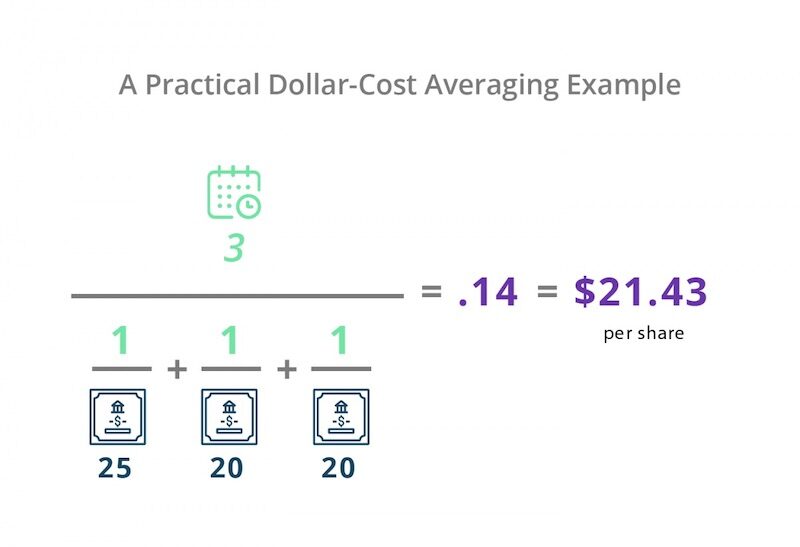

A Practical Dollar Cost Averaging Example

Jeff wishes to invest in a mutual fund. He selects Fund A (a mutual fund consisting of a number of blue chip stocks) and decides to invest $3,000 using dollar cost averaging. He will invest $1,000 each month for three months.

During the first month, Fund A’s share price is $25, meaning that Jeff is able to buy 40 shares with his $1,000. The next month, Fund A’s shares are $20 each, so he buys 50 shares ($1,000). The third month, the fund’s share price remains at $20 per share, so he buys 50 more shares ($1,000).

How to Use the DCA Formula

The formula may look complex, but it becomes much clearer once you plug in numbers from the above example:

If Jeff had invested the entire $3,000 in Month 1, he would have owned 120 shares. Using dollar-cost averaging, his $3,000 purchased 140 shares.

Dollar-cost averaging results in lower average costs when the stock price is in a downward trajectory (like in the example). If the stock price has an upward trajectory, the investor could end up with a higher average cost.

Reasons to Use Dollar Cost Averaging

There are plenty of reasons why people lean on dollar cost averaging. The most notable advantages of DCA include:

Eliminates the Need for Market Timing

The majority of investors cannot adequately time the financial market (and may lose money trying to do so). Dollar-cost averaging eliminates the need for market timing, or trying to “buy low/sell high.”

Helps Investors Contribute Regularly

It's an attractive option for investors who want to contribute to their investment portfolios on a regular basis. Most people find it easier to invest small amounts at regular intervals than to save up a large amount to invest as a lump sum.

Reduces Stress

If you put all of your money into the market as a lump sum – and the market takes a sudden downturn – you may panic and sell at a loss. However, if you’re using dollar-cost averaging and continue to invest during the downturn, you’ll be adding more shares at a lower price. When the market recovers, you’ll end up in a better position with more shares in your portfolio.