What Is a Cash Market?

A cash market is a market for securities or commodities in which the goods are sold for cash and delivered immediately. In some cases, 'immediate' means one month or less. For example, foreign exchange markets are considered a cash market since investors can immediately receive currencies in exchange for cash.

Cash markets are also called spot markets because transactions occur “on the spot.” Compare this to a futures market, where investors have to purchase the right to receive a commodity or security at a predetermined date in the future.

Example of a Cash Market

For a clearer idea, let’s look at a cash market example:

Paul’s Meat Company manufactures several types of jerky using beef. Instead of raising their own cattle, the company turns to the cash market. Paul’s Meat Company purchases large quantities of beef each quarter (in cash) and stores them in their warehouse facilities.

Cash Market vs. Futures Market

The difference between the cash and futures markets lies in the time spread. Cash market transactions are done on the spot compared to futures markets (which are done at a later date).

For the most part, cash markets are influenced solely by supply and demand. In contrast, futures markets are influenced by factors such as expectations about future prices, insurance costs, storage costs, and weather predictions (especially true for perishable commodities).

What’s Traded on a Cash Market?

You can trade all types of major asset classes. For example, investors can trade gold on the gold spot market, currencies on the currency market, or types of securities on relevant stock exchanges.

How to Trade on a Cash Market

Trading on a cash market means that all transactions need to be paid for at the time of settlement – with the money that’s available in your account.

The time of settlement (or settlement date) is when the transaction is set to occur. This means that the buyer needs to complete the full payment at that time. Two business days are required for settlement (cash that’s housed in a settlement account) for stock trades in cash accounts. At the time of the settlement date, the money is then transferred to the seller’s account and the securities are moved over to the buyer’s account.

Exchange vs. Over-the-Counter

Cash markets can occur both on regulated exchanges or over the counter (OTC) transactions, which are fairly unregulated. This can include cash markets in the NYSE, also known as the New York Stock Exchange.

Regulated exchanges tend to offer institutional protections against some risks. OTC markets offer traders the opportunity to create customized contracts. Factors such as the trader’s risk tolerance and goals will indicate which option is best.

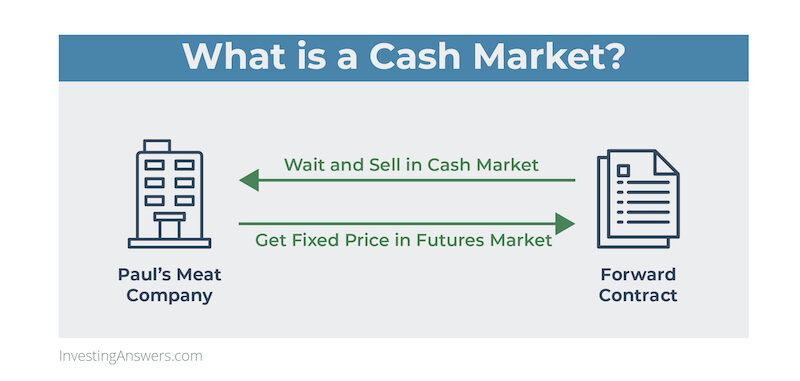

How Cash Market and Forward Contracts Function

Cash markets and forward contracts can both be customized based on delivery date, amount, and commodity (e.g. precious metals, oil, natural gas, meat). A settlement for a forward contract can occur via a cash or delivery basis. However, forward contracts are seen as OTC instruments since they’re not traded on a centralized exchange. They’re not as available to retail investors because of the higher degree of risk involved.

Key Concepts Investors Should Take Away Regarding Cash Markets

Since cash trading is completed on the spot, investors can’t use margin trading accounts. It’s viewed as less risky since an investor will be less likely to lose more than the original investment amount (such as paying interest costs that might occur).

That being said, cash trading offers less leverage — some may see this as a downside since there’s less upside potential. Investors also need to have the required amount of money in their accounts before the settlement date. This could mean waiting several dates, depending on your brokerage before funds are available to be used again.