What Is Aggregate Demand?

Aggregate demand is the total demand for goods and services in an economy. It's an economic term that describes the total amount of purchases.

When the economy is in equilibrium, aggregate demand is approximately equal to aggregate supply. In other words, aggregate demand is equal to the gross domestic product (GDP) of that economy.

What Are the Four Components to Aggregate Demand?

Aggregate demand is measured by four components:

Consumer Spending

Consumer spending is what families spend on non-investment products. This can include any number of items.

The choice to spend money can be influenced by the interest rate environment. Lower interest rates can encourage consumers to spend more on large purchases since it's cheaper to borrow money. However, high interest rates could deter consumers from making a purchase due to the increased borrowing cost.

Another factor that can influence consumer spending choices is trends in income and wealth. An increase in household wealth will usually accompany an increase in aggregate demand. But on the flip side, a trend of decreasing income or household wealth will likely pair with a decrease in aggregate demand.

Investment Spending by Businesses

Investment spending by businesses includes purchases of equipment, buildings, and inventory.

Like consumers, businesses may be more likely to make a purchase when interest rates are low. With that, the interest rate environment could impact this component of aggregate demand.

Government Spending

Government spending includes purchases of goods and services. However, it does not include transfer payments, like Medicaid and Medicare.

Government fiscal policies can have a major impact on aggregate demand. An increase in taxes or decrease in spending could lead to a decrease in aggregate demand.

Net Exports

Net exports is exports net of imports or the value of products made domestically and consumed overseas net of the value of products made overseas and consumed domestically.

The demand for imports and exports can be affected by fluctuating currency exchange rates. Also, as the value of the U.S. dollar falls, imports will become more expensive and potentially affect demand.

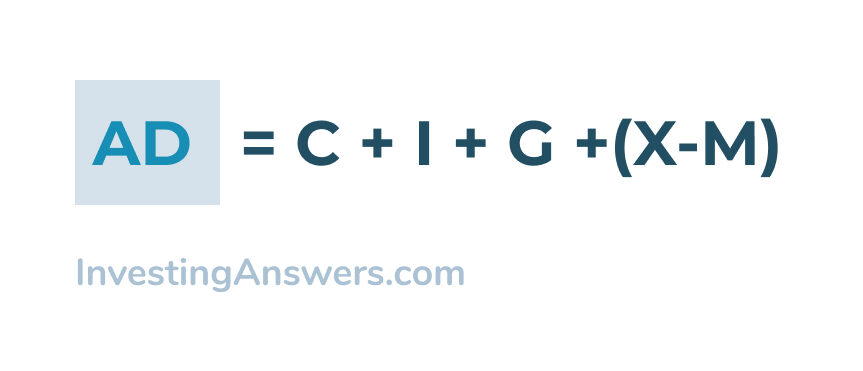

How Do You Calculate Aggregate Demand?

Aggregate demand is the sum of its four components and is calculated as:

Where:

AD = Aggregate Demand

C = Consumer Spending

I = Investment Spending

G = Government Spending

X = Exports

M = Imports

How Aggregate Demand Works

The law of demand states that consumers will want more goods and services when prices decline. However, there are other factors that affect demand, including income, prices of related goods or services, tastes, and expectations.

Another factor that influences aggregate demand is the total number of buyers in the economy.

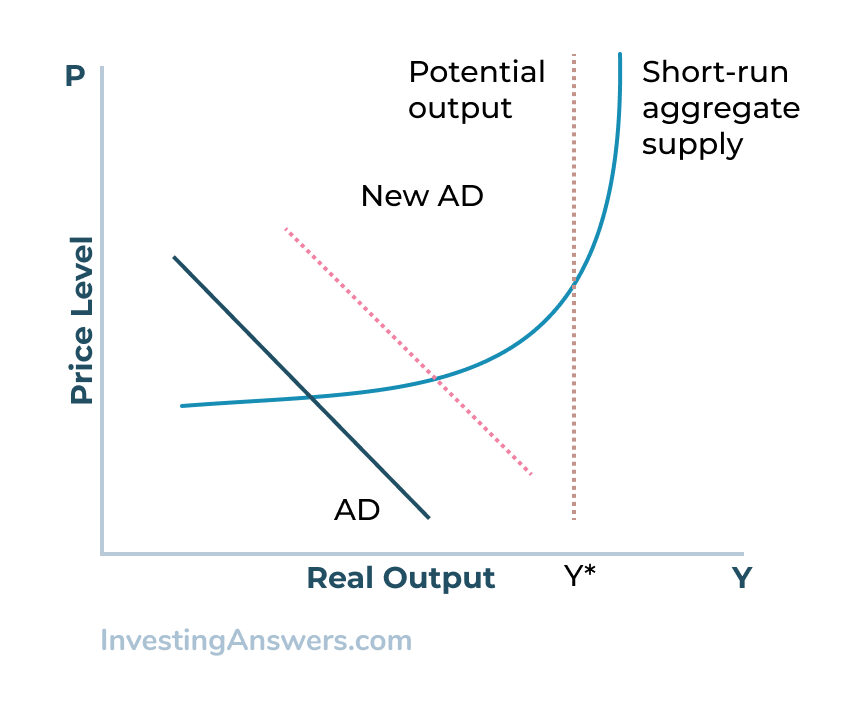

The aggregate quantity demanded at each price point is displayed by using the aggregate demand curve. This aggregate demand curve illustrates how a country's demand responds to changing price levels.

Much like the microeconomic demand curve, which shows how the quantity demanded of a particular good or service changes with price changes, the aggregate demand curve shows how the total quantity demanded of all goods and services changes with price level changes.

An example of a change in aggregate demand can be seen in our current economy. As wage levels rise, consumption increases, which in turn increases aggregate demand.

The Aggregate Demand Curve

The aggregate demand curve can be visualized as a chart.

Take a closer look at this chart:

Aggregate Demand Example

With the right information available, it is possible to calculate the aggregate demand of any economy at any point in history. As you explore swings in aggregate demand, you can uncover patterns.

Let's consider the U.S. economy in the 1920s. In the early 1920s, the aggregate demand was increasing at a rapid rate. In part, this rapid expansion was due to the acceleration of American manufacturing that came with mechanization.

When the Great Depression began in 1929, aggregate demand dropped steeply.

In the years to follow, the federal government began to utilize fiscal policies to promote a more stable aggregate demand. Instead of watching large swings in aggregate demand come and go, the government utilizes a range of fiscal policies to steady the economy when aggregate demand begins to rise or fall too sharply.

How Aggregate Demand Affects Inflation

Aggregate demand is one factor that can cause inflation to rise or fall.

As aggregate demand rises, consumers are buying more. With that, companies can charge more because consumers are willing to make the purchase. Over time, increasing aggregate demand can create moderate inflation.

On the flip side, shrinking aggregate demand can cause inflation to slow.

Criticism of Aggregate Demand

The connection between growth and aggregate demand has been a controversial economic theory for many years.

As it is quantified by market values alone, aggregate demand represents consumption at a set price position -- but doesn't reflect the quality or standard of living. Also, it ignores demands that are met outside of legitimate markets, which can represent significant economic activity.