Looking at a 60-month auto loan? This calculator will display your monthly payment, as well as a full schedule of principal and interest payments for the next 5 years.

How Much Interest Will I Pay on a 60 Month Car Loan?

Before buying a new car or used car, be sure to use our 60-month auto loan calculator to determine what payments you can expect.

How to Use This 60-Month Loan Calculator

This car loan calculator determines your monthly payment and displays a full repayment schedule based on your:

-

loan amount

-

interest rate, and

-

the total time period of your loan (i.e. loan term)

Note: If you’re considering another auto loan term, analyzing interest rates, or looking at multiple loan amounts, you can insert these numbers into the calculator as well.

60 Month Car Loan Example

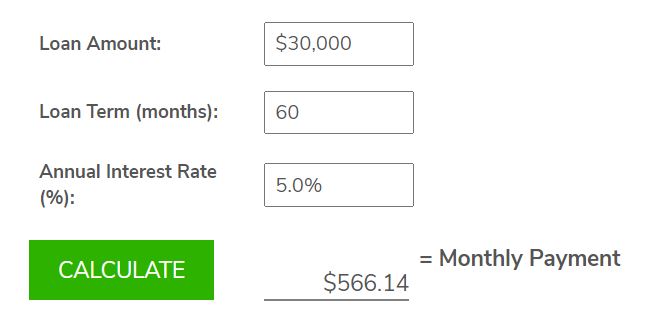

If you plan to borrow $30,000 for a term of 60 months at an annual interest rate of 5.0%, you would enter:

-

"$30,000" as the Loan Amount

-

"60 months" as the Term, and

-

"5.0%" as the Interest Rate

If you took out a $30,000 new auto loan for a 60-month term at 5.0% interest, then your monthly payment would be $566.14.

Note: Although your monthly payments won't change during your loan term, the amount applied to principal versus interest will vary based on the amortization schedule. After running your calculation, you can find your amortization schedule for your 60-month auto loan.

Pros and Cons of a 60-Month Car Loan

A 60-month car loan is a common choice to finance a car, but you need to make sure it’s right for you.

Advantages of a 60-Month Car Loan

-

You have a locked-in monthly payment for 5 years.

-

You’ll likely have a lower interest rate than with a 72- or 84-month auto loan.

-

If you have a 5-year warranty, you shouldn’t have to worry about paying for major auto repairs while paying off the car.

Disadvantages of a 60-Month Car Loan

-

The interest rate you pay will be slightly higher than a 36-month car loan.

-

You will take on additional debt.

60 Month Auto Loan vs. 72 Month Auto Loan

Instead of a longer 72 month auto loan, 60-month terms mean that you'll be expected to pay the debt off sooner. You’ll also pay less in interest and will be less concerned about owing more than the car is worth.

60 Month Car Loan vs. 84 Month Car Loan

While an 84-month car loan carries a lower monthly payment than a 60-month auto loan, you’ll be paying a substantially higher interest rate.

Pro tip: It’s good to be cautious about 84- or 72-month auto loans because you may end up owing more than the car is worth (due to depreciation).