Roth IRAs have become one of the most popular retirement programs in America. That’s because they offer the promise of tax-free income in retirement.

Unlike a 401(k), which is provided through your employer, to take advantage of this type of account, you’ll need to open a Roth IRA at a broker. To help you make the best choice, we've prepared this guide of the seven best Roth IRA accounts.

What is a Roth IRA?

A Roth IRA is a type of retirement account. You can make investments inside the Roth IRA and they are taxed differently than if you made them in a non-retirement account.

Contributions to a Roth IRA are made after tax. This means you'll pay taxes on the income you earned, including the amount you put into the Roth. Earnings grow tax free and when you retire you will owe no taxes on any withdrawals you make from your Roth.

That is very different from how a 401(k) or traditional IRA are taxed. In both of these accounts contributions are made before tax. This means that any contributions you make to these accounts is deducted from your income and you don't pay income taxes on it. The account grows tax deferred and when you retire you will owe taxes on the withdrawals you make from the account.

Here's a more in depth guide to the differences between a Roth IRA and a traditional IRA.

In most other respects, Roth IRAs work just like a traditional IRA. You can open a self-directed Roth IRA account and choose the investments you’ll hold in your plan.

What to Look for When Choosing a Roth IRA Account

In choosing a Roth IRA account, first consider your own investment preferences.

For example:

Self-directed investing or a managed option. If you prefer to choose and manage your own investments, you can open an account with investment brokerage. But if you’d rather take advantage of professional management, consider a robo-advisor.

Some investment brokers offer both self-directed investing and a robo-advisor option. This will give you the opportunity to use a hybrid investment management strategy, having part of your portfolio professionally managed and participating in self-directed investing at the same time.

Minimum upfront investment requirement. This will be a consideration if you’ll be starting a Roth IRA account from scratch. That being the case, you may want to start with a broker or robo-advisor that has no minimum initial investment requirement.

Fees. Though most investment brokers now offer commission-free trading of stocks, options, and exchange traded funds (ETFs), and many robo-advisors charge very low annual management fees, you want to compare those fees and other charges among different providers. A small difference from one company to another can have a major effect on your investments over several decades.

Other accounts offered. If you prefer to hold your Roth IRA and other investment accounts with the same provider, look for one that offers all the account types you may need.

Customer support will be an important consideration, especially if you are a self-directed investor, and may need help from the broker.

Special features. Many brokers provide certain specializations. For example, some brokers offer abundant investment tools and research. Others provide 24/7 customer service. And some even provide you with an automated means to save the money that will go into your Roth IRA account.

We considered all the factors above in compiling our list of the seven best Roth IRA accounts.

Best Roth IRA Accounts

To help you find the right home for your Roth IRA, we’re providing this list of what we believe to be the seven best Roth IRA accounts available.

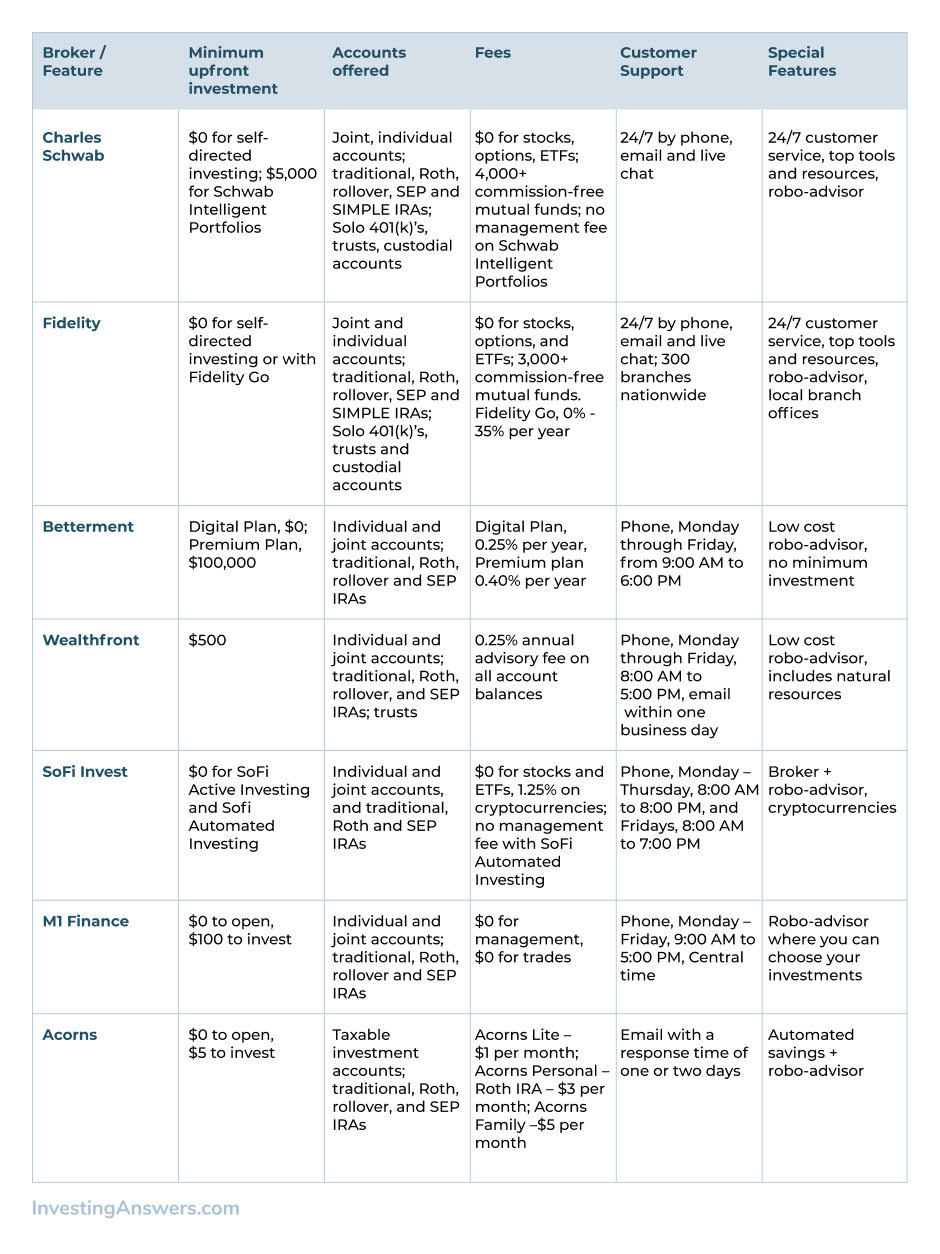

The table below summarizes each of the providers, with in-depth reviews to follow.

Charles Schwab

Charles Schwab is the largest retail investment brokerage in the world, with nearly $6.7 trillion in assets under management. It’s a full-service brokerage, offering commission-free trades of stocks, options, and ETFs. But they also offer plenty of tools and resources to help you become a better investor, as well as 24/7 customer service that’s among the best in the industry.

And not only do they offer self-directed investing, with no minimum initial investment, but they also offer a managed option with their robo-advisor,

Schwab Intelligent Portfolios. You can either hold your entire account with Intelligent Portfolios, or just a portion while you keep the rest in self-directed investing.

All these factors combine to make Charles Schwab an excellent choice for your Roth IRA.

Minimum upfront investment: $0 for self-directed investing; $5,000 for Schwab Intelligent Portfolios.

Accounts offered: Joint and individual accounts; traditional, Roth, rollover, SEP and SIMPLE IRAs; Solo 401(k)’s, trusts, and custodial accounts.

Investments offered: Stocks, bonds, ETFs, mutual funds, options, futures and CDs. ETFs investing in US and international stocks and bonds for Schwab Intelligent Portfolios.

Fees: $0 trades of stocks, options, and ETFs; 4,000+ commission-free mutual funds. No management fee on Schwab Intelligent Portfolios.

Customer support: 24/7 by phone, email and live chat.

Learn more about Charles Schwab here.

Fidelity

Fidelity is second only to Schwab as the largest retail investment broker in the US. And like Schwab, it’s also a full-service investment platform providing commission-free trades in stocks, options, and ETFs. There’s plenty of investor education and training tools on this platform as well, in addition to 24/7 customer service and about 300 branch locations throughout the US – just in case you prefer face-to-face contact.

Like most major brokerage firms, Fidelity does offer their own robo-advisor. Fidelity Go provides complete investment management, with no annual advisory fee on the first $10,000. You can choose to divide your portfolio between self-directed investing and Fidelity Go, making Fidelity an excellent choice for your Roth IRA.

Minimum upfront investment: $0 for self-directed investing or with Fidelity Go.

Accounts offered: Joint and individual accounts; traditional, Roth, rollover, SEP and SIMPLE IRAs; Solo 401(k)s, trusts, and custodial accounts.

Investments offered: Stocks, bonds, mutual funds, ETFs, options, and other securities.

Fees: Commission-free trades of stocks, options, and ETFs; 3,000+ commission-free mutual funds. Fidelity Go, the first $10,000 managed free, then $3 per month up to $49,999, and 0.35% on account balances of $50,000+.

Customer support: 24/7 by phone, email and live chat; 300 branches nationwide.

Learn more about Fidelity here.

Betterment

Betterment is a robo-advisor. In fact, they’re the first robo-advisor, and one of the largest and most popular in the industry.

There’s plenty of good reasons for their popularity. Not only can you open an account with no money at all, but they also offer a very low annual advisory fee of 0.25% per year. That means you can have $20,000 managed for just $50 per year. And if you choose Betterment Premium, you’ll have unlimited access to financial advisors.

Your portfolio will be invested in a mix of US and foreign stocks and bonds, through ETFs. You can also choose to have some of your uninvested cash held in Betterment Cash Reserve, which is currently paying an APY of 0.30%.

Minimum upfront Investment: Digital Plan, $0; Premium Plan, $100,000.

Accounts offered: Individual and joint taxable brokerage accounts; traditional, Roth, rollover and SEP IRAs.

Investments offered: ETF investments in US and foreign stocks and bonds.

Fees: Digital Plan, 0.25% per year, Premium plan 0.40% per year.

Customer support: Phone, Monday through Friday, from 9:00 AM to 6:00 PM.

Here's our full review of Betterment.

Wealthfront

Wealthfront has grown to become Betterment’s major competitor, providing similar services, as well as certain enhancements.

For example, they similarly provide complete portfolio management, but also add real estate and natural resources to your investment mix of stocks and bonds. And while they also offer a high interest savings option – currently paying 0.35% APY – it comes with a no-fee checking account.

Wealthfront does have a minimum initial investment of $500, but their fee is also 0.25%, and applies to all account balances.

Minimum upfront investment: $500.

Accounts offered: Individual and joint taxable accounts; traditional, Roth, rollover, and SEP IRAs; trusts.

Investment offered: ETF investments in U.S. and foreign stocks and bonds, real estate, and natural resources.

Fees: 0.25% annual advisory fee on all account balances.

Customer support: Phone, Monday through Friday, 8:00 AM to 5:00 PM, Pacific time; email within one business day.

Here's our full review of Wealthfront.

SoFi Invest

SoFi Invest offers both self-directed investing and a robo-advisor. For self-directed investing, you can take advantage of commission-free trades on stocks and ETFs. But there’s also no management fee on the robo-advisor, SoFi Automated Investing.

SoFi Invest offers something unique, and that’s cryptocurrency trading. In fact, they offer trading in no fewer than 20 cryptos, with a flat trading fee on all trades.

But what also makes SoFi Invest a good choice for a Roth IRA account is that it’s rapidly becoming a comprehensive personal financial platform. Best known for providing student loan refinances, they offer other financial services, including free access to financial planners.

Minimum upfront investment: $0 for SoFi Active Investing and Sofi Automated Investing.

Accounts offered: Individual and joint taxable brokerage accounts, and traditional, Roth and SEP IRAs.

Investments offered: Stocks, ETFs and cryptocurrencies; Sofi Automated Investing uses ETFs invested in US and international stocks and bonds.

Fees: Commission-free trades on stocks and ETFs, 1.25% on cryptocurrencies; no management fee with SoFi Automated Investing.

Customer support: Phone, Monday – Thursday, 8:00 AM to 8:00 PM, and Fridays, 8:00 AM to 7:00 PM, Eastern time.

M1 Finance

M1 Finance is a robo-advisor, but they do it a bit differently. The reason we’ve included this service on our list of the best Roth IRA accounts is because M1 Finance gives you the ability to choose the investments that will be managed in your portfolio.

They work on a system they refer to as “pies”. Each pie is a mini portfolio that can be filled with up to 100 individual stocks and ETFs. You can choose the stocks and ETFs yourself, or take advantage of one of dozens of prebuilt pies. And you can have as many pies as you choose.

Once your pie has been filled, M1 Finance will provide complete portfolio management, including periodic rebalancing. Pie management is offered with no management fee, and stocks and ETFs can be added to your pies commission-free.

Minimum upfront investment: $0 to open, $100 to invest.

Accounts offered: Individual and joint taxable investment accounts; traditional, Roth, rollover and SEP IRAs.

Investments offered: Individual stocks and ETFs.

Fees: $0 for management, $0 for trades.

Customer support: Phone, Monday – Friday, 9:00 AM to 5:00 PM, Central time.

Acorns

Acorns is yet another robo-advisor, but one with a special feature that makes it worthy of being included on this list. Not only do they manage your investments, but they also help you to accumulate the funds that will fill your account.

They do this through a process called “round-ups.” You’ll connect the Acorns app to a primary spending account, like your checking account, and the app will round up your debit card purchases to the nearest dollar, transferring the change to your investment account.

The process enables you to accumulate savings for investing in a largely passive manner, though you will have the ability to make one-time or recurring investment contributions as well.

Minimum upfront investment: $0 to open, $5 to invest.

Accounts offered: Taxable investment accounts; traditional, Roth, rollover, and SEP IRAs.

Investment offered: ETFs invested in U.S. and foreign stocks and bonds, and a real estate investment trust index fund.

Fees: 3 Plans: Acorns Lite – taxable investment account – $1 per month; Acorns Personal – taxable investment account + IRA – $3 per month; Acorns Family – accounts for the whole family – $5 per month.

Customer support: Email with a response time of one or two days.

Roth IRA Limits

Like all retirement plans, there are certain limits imposed by the IRS.

Contribution limits. For 2022, you can contribute up to $6,000 to a Roth IRA, or $7,000 if you are 50 or older.

Income limits. Unlike traditional IRAs, where you may be able to make contributions even if those contributions won’t be tax-deductible (due to participation in an employer-sponsored retirement plan), if Roth IRA income limits are exceeded you cannot make a contribution at all.

For 2022, the income limits are as follows:

Married filing jointly, or qualifying widow(er): full contribution allowed up to a combined income of $204,000; phased out between $204,000 and $214,000; disallowed with an income above $214,000.

Married filing separately (and you lived with your spouse): partial contribution only allowed on an income up to $10,000, after which none is permitted.

Single, head of household, or married filing separately (and you did not live with your spouse): full contribution allowed to an income of $129,000; phased out between $129,000 and $144,000; disallowed with an income greater than $144,000.

Backdoor Roth IRA

If you exceed the income limits for a Roth IRA contribution, there is a workaround. It’s commonly referred to as a backdoor Roth IRA.

A backdoor Roth IRA is based on a Roth IRA conversion. The IRS permits taxpayers to convert other retirement plans to a Roth IRA. In doing so, you’ll pay the income tax due on the distributions from other retirement plans, but the 10% early withdrawal penalty will be waived.

Though this is normally done by converting funds from accounts like traditional IRAs and 401(k) plans, it can also be done with IRA contributions.

The short version of the process is this:

1. Make a nondeductible contribution to a traditional IRA. (Remembering that these contributions can be made even if you exceed the income limits for a tax deduction.)

2. Immediately do a Roth IRA conversion of the amount contributed to the traditional IRA.

3. Since no deduction will be taken on the nondeductible traditional IRA contribution, there’ll be no tax consequence for the Roth IRA conversion.

Using this strategy, you’ll be able to make regular Roth IRA contributions even if your income exceeds IRS limits.

IRA Withdrawal Rules

Roth IRA accounts provide many advantages over traditional IRAs and other retirement accounts. One of the biggest benefits is in the area of withdrawals.

As discussed earlier, Roth IRA withdrawals can be taken tax-free – including both contributions and investment earnings on those contributions – in retirement. To be eligible for tax-free withdrawals, you must be at least 59 ½ at the time of the withdrawal and have had a Roth IRA account in place for a minimum of five years.

But another major advantage on the withdrawal front is early withdrawals.

Just as is the case with other retirement plans, distributions taken on a Roth IRA prior to turning 59 ½ will be subject to ordinary income tax, plus a 10% early withdrawal penalty.

However, unlike other retirement plans, taxes and penalties on early distributions on a Roth IRA apply only to the accumulated investment earnings withdrawn – not the contributions you’ve made. The contributions themselves are not taxable if withdrawn early because no tax deduction was taken when they were made.

Under what are known as Roth IRA ordering rules, the IRS allows you to prioritize contributions among early withdrawals.

For example, if you have $50,000 in your Roth IRA account, which includes $20,000 in contributions and $30,000 in accumulated investment earnings, you’ll be able to withdraw up to $20,000 (your contributions) without incurring ordinary income tax or the early withdrawal penalty.

Only once your withdrawals exceed your contribution amount will tax and penalties apply.

Required minimum distributions (RMDs). Virtually all retirement accounts require you to begin taking withdrawals from your account no later than age 72. However, this provision does not apply to Roth IRAs. Not only are RMDs not required, but you can allow your account to continue to grow for the rest of your life.

Can a Roth be Used for College?

Contributions made to a Roth IRA can be withdrawn at any time, including paying for a college education.

But even if you might need to withdraw funds that represent accumulated investment earnings, the IRS does provide some relief. You’ll still need to pay ordinary income tax on the amount of investment earnings withdrawn, but the 10% early withdrawal penalty is waived for early withdrawals due to education.

To qualify for the penalty waiver, the withdrawal of accumulated investment earnings must take place in the same year that payment is made for college-related expenses.

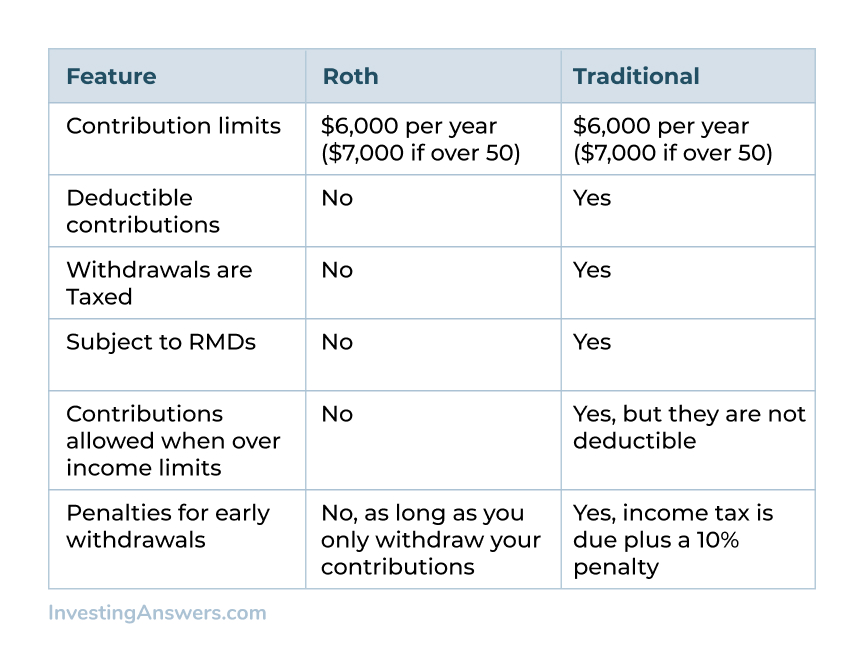

Roth IRA vs Traditional IRA

In some respects, Roth IRAs and traditional IRAs are the same. Each allows you to make an annual contribution (subject to the limits listed above) and provides for tax deferral of the investment income you earn on those contributions. The contribution limits for both plans are the same, and each requires those contributions to be based on earned income only. Both plans also allow you to choose your own broker and investments.

But here are the significant differences between the two:

Traditional IRA contributions are tax-deductible, Roth IRA contributions are not.

Withdrawals taken from a traditional IRA in retirement will be subject to ordinary income tax. Withdrawals taken from a Roth IRA in retirement will be tax-free.

Traditional IRAs are subject to RMDs. Roth IRAs are not.

If income limits for a Roth IRA are exceeded, you cannot make a contribution to the plan. If income limits for traditional IRA contributions (when you are covered by an employer retirement plan) are exceeded, you can still make a contribution, but it will not be tax-deductible.

You could split it up, say do $3,000 in each, but the total contribution to an IRA is limited to $6,000 per year. Note that the contribution limits for IRAs apply to all the IRAs that you own. For example, you couldn't contribute $6,000 to a Roth and then also contribute $6,000 to a Traditional IRA.

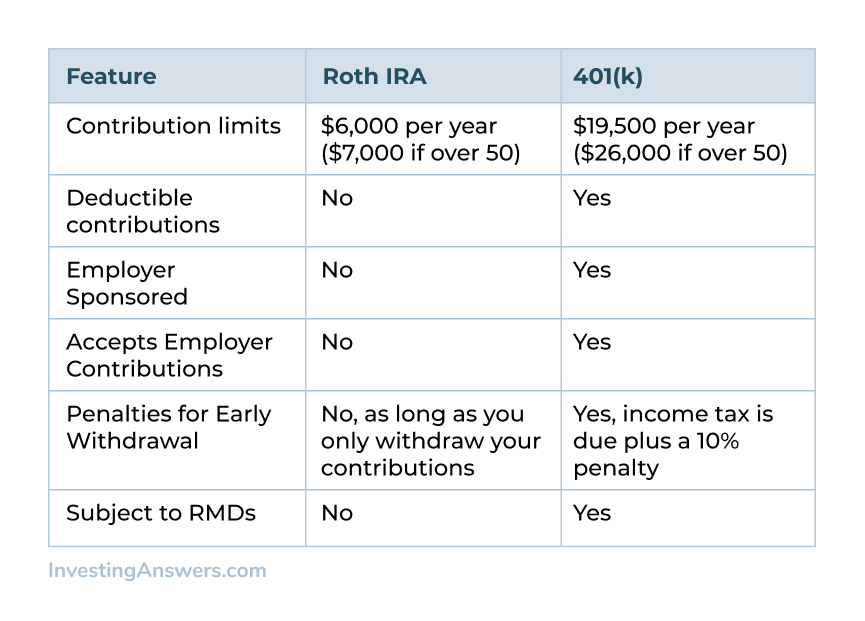

Roth IRA vs 401(k)

If Roth IRAs and traditional IRAs are similar in many respects, Roth IRAs and 401(k)s are at best distant cousins. Apart from tax deferral of investment earnings, the two plans are quite different from one another.

For example:

The contribution limit to a Roth IRA is $6,000 per year, or $7,000 per year if you’re 50 or older. The contribution limit for a 401(k) is $19,500 per year, or $26,000 if you’re 50 or older.

Contributions to a 401(k) plan are tax-deductible. Contributions to a Roth IRA plan are not.

401(k) plans are generally employer-sponsored. Roth IRA plans are maintained individually.

An employer can make a matching contribution on a 401(k) plan for the employee. No similar match exists for a Roth IRA.

Distributions taken from a Roth IRA in retirement are tax-free. Distributions taken from a 401(k) plan in retirement are fully taxable.

Early withdrawals of contributions taken from a Roth IRA are not taxable, and are not subject to the 10% early withdrawal penalty. Early withdrawals taken from a 401(k), are subject to both.

401(k) plans are subject to RMDs. Roth IRAs are not.

Note: you are able to contribute up to the max contribution limits on both accounts in the same year. So you could contribute $6,000 to your Roth and $19,500 to your 401(k).

Roth 401(k). Some employers offer a Roth 401(k) option with their plans. If so, the employee will get the benefit of a higher contribution amount, which can be up to the maximum allowed for a 401(k) plan. Any matching contributions from the employer on Roth 401(k) contributions must be placed into a regular 401(k) account, since they do not have the benefit of tax-free distributions.

Summary

Roth IRAs are unique among retirement plans. That’s primarily because they offer tax-free income in retirement. That may be more important than many people think because of the possibility that income tax rates may be higher in the future than they are right now. But there’s also the possibility that you’ll be earning more money in retirement than you expect, due to multiple income sources.

Consider a Roth IRA as part of your retirement planning if you believe either situation may apply.