What if I told you that there was a single variable that determines whether stocks prices will go up or down?

Would you want to know what it is and why it has such a profound impact on stock prices? Would you also like to know if it is currently positive or negative?

I had a hunch that one condition -- or lack thereof -- was a predictor of stock market performance. But I wasn't quite ready for the results I found.

Over the past 110 years, the variable I tested was positive for 67 years and it was negative for 43 years -- a decent enough sample size to make a statistically relevant conclusion (assuming a 90% confidence interval). After running a statistical analysis of the data, the impact of this one variable on stock market returns turned out to be 'statistically significant.'

Over the past 110 years of stock market history, the Dow Jones Industrial Average (DJIA) has returned an annualized +8.15% when this variable is positive. But when the variable is negative, the stock market has a dreadful average annualized return of -1.25%.

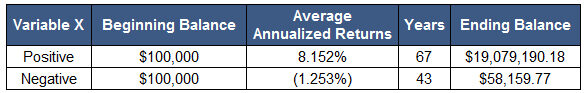

While those figures are certainly stark, the difference is considerably more impressive when you consider the long-term impact on investment returns. The following table shows how an initial investment of $100,000 grows under each of these scenarios (assuming no taxes or distributions were paid):

Under one scenario, an investor doubles his money every nine years, and in the other scenario, an investor loses half of his money over 43 years. Which investing environment would you choose?

Close, but no cigar.

Here are a few good guesses as to the identity of this mystery variable:

Republicans vs. Democrats in power. While the stock market has performed marginally better since 1921 with Democrats in office versus Republicans, the variance is far less significant than the most critical indicator. The Dow has returned 10% while Dems are in the White House while only returning 6% when Republicans reside at 1600 Pennsylvania Ave.

Accommodative interest rate policy by the Fed. No, this isn't it. The Fed was established in 1913, and some of our stock market data pre-dates it. Furthermore, the Fed has been more than accommodating the past 10 years, keeping rates far below inflation (i.e. negative real rates), and yet the Dow is down during this low-rate period.

Adherence to the gold standard. Since currency debasement typically favors stock prices (and prices for virtually everything), you might expect, and you’d be correct, that the stock market has performed a little better since the gold standard was abolished. The Dow returned on average 8.1% annually without the gold standard versus 5.2% with it. Under both, the market has been up, which doesn't make it a very good directional indicator.

Positive real GDP or GDP above a certain level. Sorry, that’s not it either. GDP was very strong in the 1970s but the stock market didn’t perform terribly well. While positive GDP should have a positive impact on the stock market, the relationship is not as direct as some might think -- just ask the Japanese. Japan’s GDP has been remarkable the past 20 years and their stock market is still 75% below its 1989 highs.

High or low P/E ratios. The mystery variable is not the venerable P/E ratio, although there is a strong correlation between buying stocks at a low P/E and higher long-term returns.

So, what in the world is it?

The most critical factor in determining whether the market will go up or down is the existence or absence of the Glass-Steagall Act, enacted in 1933 to regulate the banking system and repealed in 1999.

When Glass-Steagall was in force, the stock market generally went up. An effectively regulated banking system resulted in the efficient allocation of capital in our economy.

Between the years of 1933 and 1999, the Dow delivered average annualized gains of 8.15%. Another interesting point: the gains were fairly consistent, with major declines only taking place in a few calendar years.

Prior to Glass-Steagall’s passing and since its repeal in late 1999, it's been a totally different story. The odds of winning in the stock market have been no better than on a Las Vegas roulette wheel. There have been some terrific gains, such as those in the late-1920s and the recent 2009-2010 rally. But there have been even more catastrophic failures, like those suffered in 1907, 1920, 1929-1932, 2000-2002 and 2008.

How in the world can one piece of legislation be so important? Well, the complete answer is very complicated, but the simple answer is this: without the regulation framework of Glass-Steagall, banks are granted far greater powers to manipulate the capital markets. Nothing is limiting them. When you combine immense power with remarkable intelligence, add a dash of hubris, strip out any sense of morality and, finally, inject copious amounts of leverage, you end up with a recipe for capital markets disaster.

The absence of Glass-Steagall allows the Wall Street banks to siphon wealth out of the capital markets. The schemes they use are terribly sophisticated, so much so that average investors, industry regulators and even government bureaucrats have a difficult time seeing through their plan.

Glass-Steagall forced the banks to police themselves as no one else can. I wrote a previous post that explains this phenomenon, which you can read here.

The Investing Answer: The critical take-away from this discovery is simple: If we want our economy and stock market to experience a meaningful recovery, the banks don’t need to be saved, they need to be regulated by and forced to comply with Glass-Steagall.

Unless this policy is reinstated, gains in the stock market will be tough sledding. In the meantime, if you want your investment accounts to appreciate, you’ll need to seek out alternative investments like Global/Macro and Long/Short Funds.

This is a guest post from Matthew McCracken, a Texas-based Registered Investment Advisor (RIA) and founder of McCracken & Company. Matt founded his own advisory firm in 2005 with the goal of providing financial security to middle-class Americans. He takes a Global/Macro approach to the markets which he marries with analytical tools to time trades in his preferred investment themes. Matt has held long positions in gold, silver and agricultural commodities since 2006, and shorted the investment banks and housing stocks from 2006 though 2008.