It’s simple: Pick 6 numbers, match the numbers drawn on TV, win millions.

Winning the lottery is what many consider the ultimate dream. Even just thinking about what you’d do with unexpected millions invites fun conversation around the dinner table. But is winning the lottery actually a curse?

Here are 5 common sense lotto realities that everyone ignores.

What Are Your Chances of Winning the Lottery?

Though many buy lottery tickets thinking they could possibly win (“you can’t win if you don’t play”), the reality is much harsher.

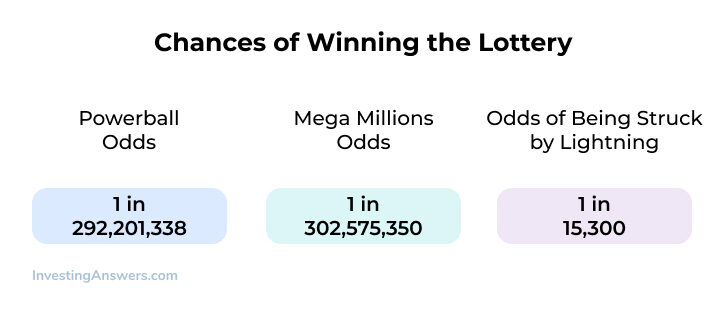

Here are the current odds in 2021:

As you can see, the possibility of winning the lottery is dismal. In fact, you’re nearly 20,000 times more likely to be struck by lightning. Despite these odds, millions still play each week.

Quick Pick vs. Your Own Numbers: Which is Better?

Do you have a set of “lucky numbers” that will help you win the big prize? Unfortunately, they may not give you an advantage in the lottery.

In fact, more lottery winners use the quick pick option vs. those that choose their own numbers.

Considering more people use the Quick Pick option, it makes sense there are more Quick Pick winners. In reality, however, the percentage of winners using the quick pick option vs the percentage of winners using their own numbers is nearly identical.

So...Should I Pick My Own Lottery Numbers?

It doesn’t really matter how you pick your numbers, the odds are the same.

Whether you’re continuing to use your children’s birthdays and ages as your lucky numbers – or you just let the machine “quick pick” for you – you have the same probability of winning. There's no predictable method for picking winning numbers in the lottery.

Negative Effects of Winning the Lottery

You watch the broadcast, the numbers are called and you stand there in shock, holding the winning ticket. Your life is about to change forever, but there are a few downsides of winning the lottery to consider.

1. Lottery Tickets Are Like Cash and Can’t Be Replaced

Even if you've picked the winning numbers, you still might not be considered a winner. In fact, if you happen to misplace your winning ticket, you can’t collect your prize.

Just ask Lerynne West, Iowa’s biggest prize winner in the Powerball jackpot in 2018. She was just moving into her new home, heard there was a winning ticket purchased in Iowa, and couldn’t find her ticket.

After searching everywhere, she finally called her daughter who luckily found the winning ticket in her car. She took a picture of the numbers, sent them to her mother and Leyrnne realized she had won. If she hadn’t found that ticket, she wouldn’t have been able to collect her $343,900,000 prize.

Lottery tickets are considered cash unless you sign the back of the ticket. The best way to protect your lottery ticket is to immediately sign the back of it, which prevents anyone else from cashing it in.

2. You Might Have to Split the Jackpot

Sometimes, winners don’t get the full prize. In fact, sometimes they have to share the winnings with one or many other people.

While a $100,000,000 jackpot might sound amazing, if 4 other people win, you’d only be going home with $20,000,000.

Consider the North Carolina Pick-4 lottery that was valued at $7,800,000. Since 2,000 people had chosen the winning numbers (0-0-0-0), the winnings were roughly $3,900 per person.

3. You Have to Pay Taxes on Your Winnings

Even if you don’t have to split your winnings with another lottery player, you always have to split your winnings with the IRS.

Lottery winnings are taxed as ordinary income, whether you take the “lump sum” or the “annuity” option. Before you can receive a single dollar, the IRS automatically takes 25% of the winnings for federal tax purposes. The rest of your taxes are based on your income tax bracket (to be paid when you file that year’s return).

In addition to the 25% immediate tax hit, you’ll also need to comply with your state income tax code and pay tax at the ordinary income tax rates for your state.

You may even need to pay an additional penalty if you bought the ticket out of your state of residence. Both Maryland and Arizona will tax you on your winnings – even if you reside elsewhere. No matter the amount or location of your win, the government will get its share of taxes.

4. A Lottery Win Isn’t Always a “Win”

As mentioned earlier, winning the lottery doesn't mean you can always collect the prize. If you fail to present the winning lottery ticket in a timely manner, you forfeit the prize and lose the chance to claim your winnings.

In June 2011, a winning Powerball ticket was purchased in Georgia for a $77 million prize and the winner had 180 days to claim the prize. But no one showed up. In fact, the entire $77 million prize was forfeited, making it the largest forfeited prize in U.S. history.

No matter where you play, make sure to sign the back of your ticket and don’t lose it.

If Your Lucky Numbers are Drawn, Have a Financial Plan Ready

We’ve all heard of the lottery winners who end up completely broke a few years later. In fact, nearly one-third of all lottery winners end up declaring bankruptcy. If you happen to win a major lottery prize, you need to be ready with a financial plan to handle the sudden influx of wealth.

Here are a few quick steps to make sure you’re prepared for such a windfall.

Assemble a Financial Team

Finding a trusted lawyer, CPA, and financial advisor who are experienced with sudden wealth can help you immensely. They can walk you through the legal, tax, and investment implications of your new money – and help you build a plan for your future.

Before handing over any money for management, make sure that your questions are answered and you understand everything that's being recommended.

Don’t Rush Into Decisions

Make purchasing and investment decisions slowly, giving yourself time to think things over first. It may be tempting to go buy a new house, car, or other large purchases, but waiting to understand your total financial situation (with the help of your financial team) will help you make more informed purchasing decisions.

Stay Out of Debt

Many lottery winners who declare bankruptcy overextend themselves and get into massive debt. Having more wealth means you may qualify for more debt (due to your increased ability to pay it off), but this can quickly get you into trouble.

Avoiding debt can help keep you out of financial trouble and make your wealth last longer.

Don’t Quit Your Job

While the most tempting thing might be quitting your job, it’s a good idea to wait until you have a financial plan in place. The winnings may take a while to hit your bank account, so you should continue working and collecting a stable paycheck in the meantime.