Albert Einstein said that compound interest is 'the greatest mathematical discovery of all time.'

The concept of compounding is at the heart of investing and is especially vital when it comes to value investing. The power of compounding achieves its wonderful results when time works with your rate of return to automatically grow your investment.

Take $10,000 and invest it at 10% for one year. At the end of Year 1, you earn $1,000. You now have $11,000 to invest. Invest that $11,000 at 10% for another year and at the end of Year 2, you earn $1,100, $100 more than the year before. By reinvesting what you earned instead of spending it, you automatically made more money. You didn't have to lift a finger.

If you were to continue this process for 40 years, you would have $452,593.

The process is simple, but it's not necessarily easy. To succeed, you need to follow the three basic rules of compounding:

1. You MUST Reinvest Your Earnings

Many investors are tempted to take their investment earnings and spend it. But when you do this, you're lowering the principal amount generating your gains. Spend $30,000 on a new car and you are taking away $201,825 from your net worth in 20 years and $325,041 in 25 years. Hope the car was worth it.

The first secret to success with compounding is to reinvest all your gains. Value investors by their nature are frugal because they understand that every dollar they spend is a dollar that is not compounding. To the value investor contemplating a new car, the $30,000 sticker price may as well say $325,041 because that's what the ultimate cost will be.

2. You MUST Generate a Positive Return

To grow your portfolio you must have positive returns. Negative returns are like climbing a mountain and slipping backward after reaching the half-way point. The slip costs you a lot because now you have to climb back to where you were before you can continue climbing higher.

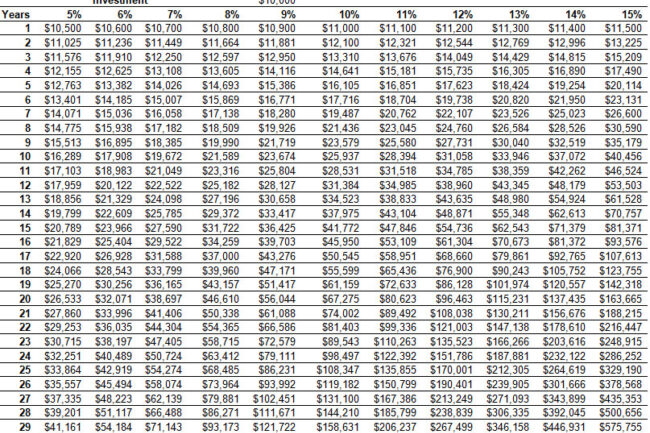

To illustrate the importance of positive returns, the table below shows the impact of different compound annual growth rates (CAGR) on an investment of $10,000. As you can see, what may seem like relatively small differences in rates of return, maybe only a percentage or two, add up to tens of thousands of dollars after 30 years.

Value investors are always on the lookout for opportunities to earn superior returns without a proportional increase in risk. For example, assume the market is expected to grow at 10% per year. If you invested $10,000 at this rate, in 20 years you would have $67,275. Not bad.

What if you were especially good at buying stocks at bargain prices, and you were able to beat the market by 2% each year? In 20 years, your investment would be worth an astounding $96,463! Your investment would be worth +43% more than if you settled for broad market returns. That is the power of compounding.

3. You MUST Use Time To Your Advantage

The final important compounding factor is the length of time you have to achieve your investing goals. The longer you are able to compound your return, the faster your portfolio grows. Time works in your favor. This makes compounding an especially potent force for young investors with 30, 40 or 50 years of time before retirement.

It's surprisingly easy to calculate the future value of your investments, and it's something even a novice investor can do for himself or herself. To calculate the future value (FV) of your investment, you can use this formula:

PV = present value

i = annual interest rate

n = number of years the investment will compound

You can also use our Compound Annual Growth Rate (CAGR) calculator, found here to test out different assumptions on the growth of your investments.