If you are sitting with a loss on a fundamentally sound investment, what can you do?

Here are some options:

Buy

You could buy more shares now and reduce your cost basis. This, of course, isn't the easiest thing to do. If the market continues to drift downwards -- or even sideways -- over the short-term, you'll have that much more invested in a nonperforming asset.

Sell

Bite the bullet and sell at a loss. Then, sit on the sidelines and wait for some positive movement and try to pick up the stock on the upswing. Of course this strategy isn't without its issues.

If the stock starts to move within 30 days of your sale, there might be some tax implications if you buy it back. If you need to wait longer than 30 days to avoid the wash rule, you might miss out on some nice gains. (Read this explanation of the wash rule)

Or you could just invest in something else. But if this is fundamentally the same company as it was when you bought it, why wouldn't it still be on your short list to buy?

Hold

Just hold on to the stock and ride it out. You'll avoid spending any more money on trading commissions. And you won't miss any price appreciation on the upswing. Of course there is the possibility we are heading into a sideways-trading market -- so you might spend a long summer staring at your losses.

Or...You Could Get Paid To Hold

Every day, investors get paid to hold stocks in their portfolios. In fact, it's a tried and true investment strategy employed by retirees and income investors.

How do they do it? They write -- or sell -- covered call options. When someone buys a call option, they pay a premium to buy the right to purchase a stock at a specified price, called the strike price. They buy the right, but are not obligated, to go though with the sale. In fact, most options are bought, but not exercised, by the time they expire.

So to make a little extra income off of a holding, an investor can sell a call option and collect the premium. When the call writer owns the underlying stock, it is called a 'covered call.' The vast majority of time, the call option is not exercised, and the investor keeps the underlying shares. Investors can then write another covered call to collect even more income. If the call is exercised, the call writer has to surrender the shares at the specified price.

Here's an example:

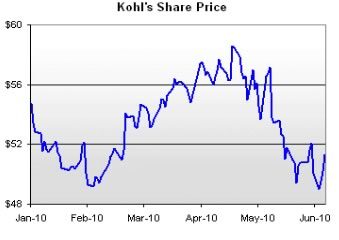

Let's say you bought 100 shares of the department store chain Kohl's (NYSE: KSS) on January 5th for $54.00. The store seemed busy over the holidays and you believed the performance of the retail sector was going to be rosier than expected. And to some extent, you were right. Your position gained throughout the year -- until May came along. Today, it is hovering at about $51 a share.

You still very much like Kohl's outlook and would like to hold on to the stock. But May's retail sales were just released and were lower than expected -- down -1.2%. So it might be a while before the market bids this stock back up to your breakeven price.

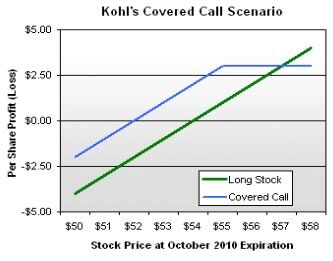

In the meantime, you could write a call on Kohl's at a strike price of $55.00 and collect a $2.00 a share premium. The option would expire in October.

By collecting the $2.00 per share call premium, you are now breakeven at $52 a share -- instead of your original purchase price of $54 a share. And if the option never gets exercised, you'll keep the shares and collect even more income by writing subsequent call options. If the share price runs past $55, you'll have to surrender you shares, but at a +5.7% profit.

Before the call option is exercised, you can buy a call option at any for the same strike price and expiration date to erase the trade.

Options are offered at many different strike prices above and below the current market price. They also have different expiration dates. It might take a little shopping around to find the right combination that fits your needs and goals.

With the tough decisions investors are facing, it's nice to have another choice -- one that can turn a loss into a profit -- or a long unprofitable wait into to an income-producing exercise. (Read more about options selling strategies here.)