What Is a Call Option?

A call option is a contract between a buyer and a seller that gives the option buyer the right (but not the obligation) to buy an underlying asset at the strike price on or before the expiration date. The buyer pays a premium to the seller in exchange for this right. They can either sell the option before it expires, exercise the option to purchase the asset at the strike price, or let the option expire.

Why Call Options Are Important

Call options are important because they offer investors more flexibility in their investment strategies and allow them to get involved in the stock market without directly purchasing shares. They can help reduce risk, increase returns, or provide leverage – and they have a number of applications.

How Does a Call Option Work?

A call option is a contract between two parties: a buyer and a seller. While the underlying concept is the same, it works differently for each party.

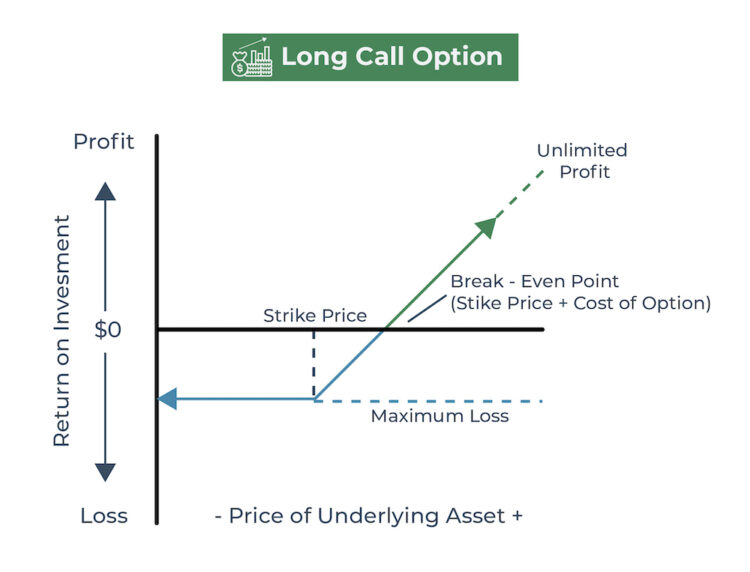

Long Call Option

The buyer has the “long position.” A long call option gives the buyer the right, but not the obligation to buy an underlying asset, such as shares of stock, at a predetermined price (strike price), on or before a predetermined date (the expiration date). In this situation, the buyer pays a premium to purchase the call option, betting that the price of the underlying asset will increase.

If, at expiration, the price of the underlying asset is greater than the strike price, the buyer makes money by exercising the option and effectively buying the shares at a discount (or by selling the contract to another investor). On the other hand, the buyer is not obligated to buy the shares. So if the price of the underlying asset is less than the strike price, the option holder can simply choose to not exercise the option.

Since there is no cap on how much the underlying asset can increase, the potential profit is unlimited, while the risk is limited to the cost of the call option (the premium).

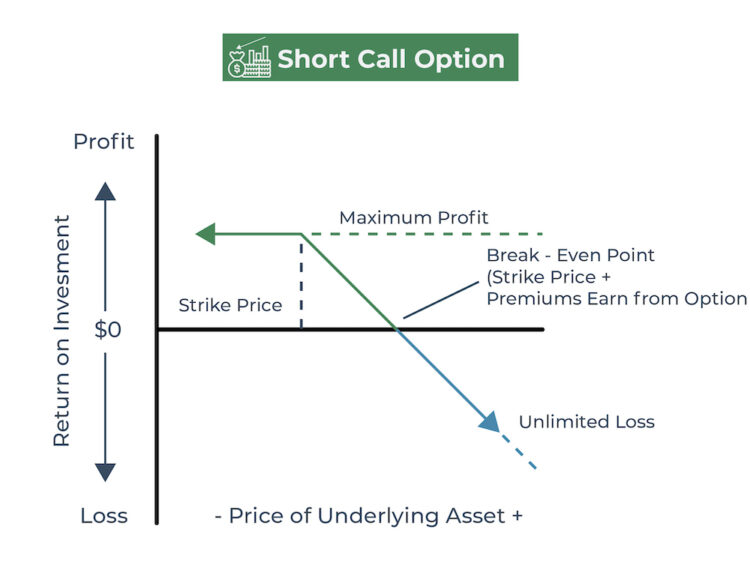

Short Call Option

The seller has the “short position.” A short call option (also called a naked call option) occurs when the option is exercised and the option seller is obligated to sell the asset at a predetermined price, on or before a predetermined date. In this situation, the seller receives a premium for selling the call option, betting that the price of the underlying asset will decrease.

At expiration, if the price of the underlying asset is less than the strike price, the buyer is not likely to exercise the option and the seller will profit from the premiums already received. However, if the price of the underlying asset is greater than the strike and the buyer chooses to exercise the option, the seller is obligated to sell the shares at the strike price. If the seller does not own the underlying shares, they must be purchased at the higher market price and sold to the buyer at the lower strike price.

Since the price of the underlying asset can increase indefinitely, the seller is exposed to an unlimited amount of risk. On the other hand, the maximum profit is limited to the price of the call option. That’s because the buyer won’t exercise the call option if the strike price is above the market price.

Why Call Options Are Used

Once thought of as an advanced strategy exclusive to experienced investors, call options are increasingly popular, powerful investment tools that can be used for various purposes:

Speculation

Call options allow investors to speculate on price movements without actually purchasing the underlying shares. Depending on the type of call option, they can also help investors limit their downside risk.

If an investor thinks the market price of an asset is going to increase, the investor can purchase a call option. If the market price increases beyond the strike price of that option, the investor profits by exercising the option or reselling it to another investor. In this situation, the downside is limited to the amount spent on premiums, while the upside potential is unlimited.

If an investor thinks the market price of a share is going to decrease, s/he can sell a call option. If the market price is equal to or less than the strike price at expiration, the contract is worthless to the buyer and the seller will earn a profit from the premiums. However, if the market price exceeds the strike price and the call option is exercised, the investor is obligated to sell at the strike price, even if s/he has to pay market price to obtain them. And since the price can increase indefinitely, the seller has unlimited downside potential.

Hedging

A covered call option can reduce losses by hedging against movements in the price of the underlying asset. In a covered call, the seller also owns the underlying shares of the call option. This can help provide protection in two ways:

- If the price of the underlying shares decreases, the shares are worth less and the investor therefore has a loss. However, by selling a covered call option on those shares, the premiums offset some of the loss.

- If the price of the underlying shares increases, the investment is worth more and the investor therefore gains. The investor is still obligated to sell the shares to the buyer, but since s/he already owns them, s/he won’t be forced to pay above the strike price to obtain them. This limits the risk and increases the potential profits.

Earning More

Relatively speaking, call options require a smaller investment than purchasing shares outright. Instead of paying the share price multiplied by the amount of shares you would like to buy, you simply pay the option price. This unlocks the potential to earn income with a much smaller investment. Investors can buy call options that earn money when the price of the underlying shares increases or sell call options that earn money from premiums collected.

Key Terms to Note for Understanding Call Options

You may hear the following terms used in association with call options:

- Premium/option price

- Strike price

- Expiration date

- In the money

- Out of the money

- At the money

- Intrinsic value

- Time value

How to Buy a Call Option

Buying a call option is similar to buying stocks and other securities:

- Open an options trading account

- Select the call option you would like to buy

- Purchase the option

- Choose what you would like to do with the call option:

- Exercise it and purchase the underlying shares

- Sell it to another investor

- Hold it until it expires

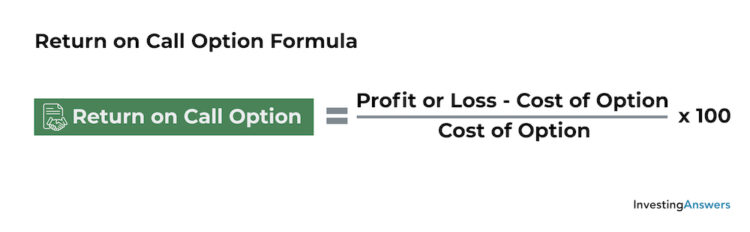

Return on Call Option Formula

Call Option Examples

Let's assume a company’s shares have a current market price of $100. An investor wants to purchase a call option with a strike price of $110 and an option price of $5 (since call option contracts include 100 shares, the total cost of the call option would be $500).

There are three outcomes when buying a call option: taking a loss, breaking even, and making a profit. In order to explain the potential outcomes, we will explore four different scenarios using the return on call option formula.

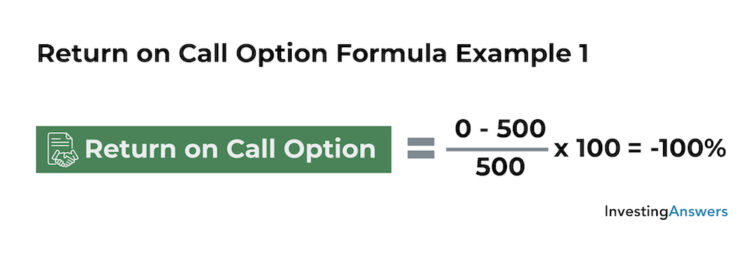

Scenario #1 - The Investor Takes a Loss

The underlying asset is trading at $105 at expiration. In this example, the buyer would not exercise the right to purchase the underlying shares because the strike price is higher than the market price (meaning that they would be overpaying for the shares). Therefore, the option is worth nothing when it expires – and the buyer would lose their entire $500 investment.

The percentage return would be calculated as follows:

The buyer of the call option will lose 100% on their investment.

.jpg)

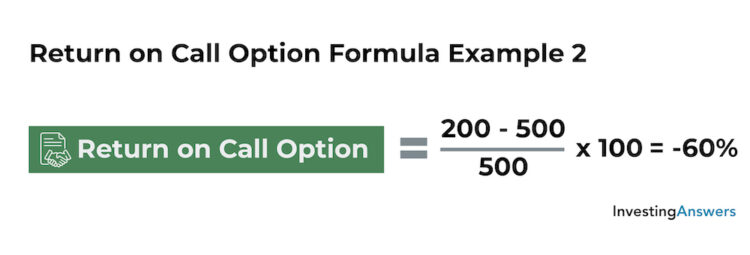

Scenario #2 - The Investor Takes a Loss

The underlying asset is trading at $112 at expiration. In this example, the buyer would exercise the option to purchase the shares for $110 and immediately sell them for $112. In this case, they would earn $200 in profit ($2 increase in price x 100 shares), but since they paid $500 to buy the option in the first place, they will take a loss of $300.

The percentage return would be calculated as follows:

The buyer of the call option will lose 60% on their investment.

.jpg)

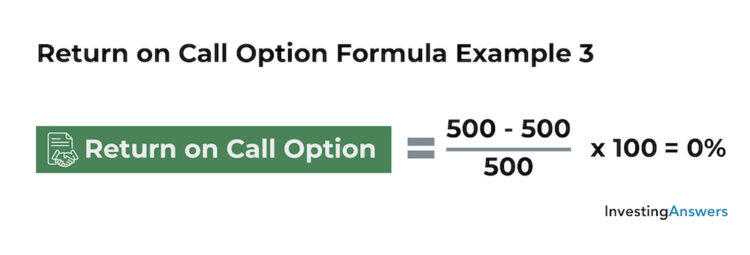

Scenario #3 - The Investor Breaks Even

The underlying asset is trading at $115 at expiration. In this example, the buyer would exercise the option to purchase the shares for $110 and immediately sell them for $115. In this case, they would earn $500 ($5 increase in price x 100 shares) and since they paid $500 to buy the option in the first place, they would break even.

The percentage return would be calculated as follows:

The buyer of the call option will neither lose or gain money on their investment.

.jpg)

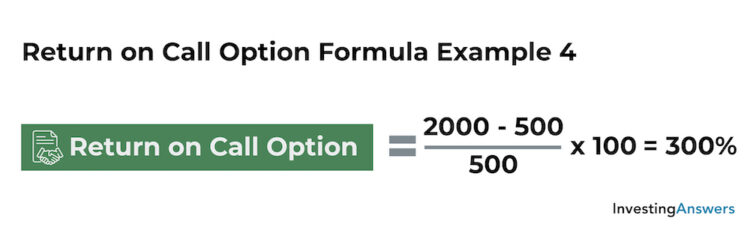

Scenario #4 - The Buyer Makes a Profit

The underlying asset is trading at $130 at expiration. In this example, the buyer would exercise the option and purchase the shares for $110 and immediately sells them for $130. In this case, they would earn $2,000 ($20 increase in price x 100 shares). Since they paid $500 to buy the option in the first place, they would earn $1,500 ($2,000 - $500).

The percentage return would be calculated as follows:

The buyer of the call option will earn 300% on the investment.

.jpg)

Selling a Call Option

Instead of buying a call option, an investor can choose to sell or write a call option. The seller is obligated to sell a set number of shares to the buyer at a set price (the strike price) on or before a predetermined date – if the buyer of the call option chooses to exercise the option. In exchange, they receive a premium from the buyer. The seller is hoping that the price of the underlying asset falls below the strike price so that the option is not exercised and can earn a profit from the premiums.

There are two ways this can be done: naked call options and covered call options.

1. Naked Call Option

A naked call option is a strategy that involves selling a call option without owning the underlying shares. In this situation, the seller receives premiums from the buyer in exchange for the right to buy a fixed amount of the underlying shares at a set price on a specific date. If the buyer decides to exercise the option, the seller must purchase the underlying shares at market price, then sell them to the buyer at the strike price.

The maximum profit in this situation is the amount earned from the premiums, but the maximum loss is unlimited because the market price of the underlying shares could increase indefinitely. If the market price is higher than the strike price, the seller must buy the shares at the higher price and sell them to the buyer for the lower price.

How to Sell a Naked Call Option

A naked call option does not require the seller to own the underlying shares, so the process is as follows:

- Open an options trading account.

- Select the call option to sell.

- Choose a strike price, premium amount, and expiration date.

- Sell the naked call option.

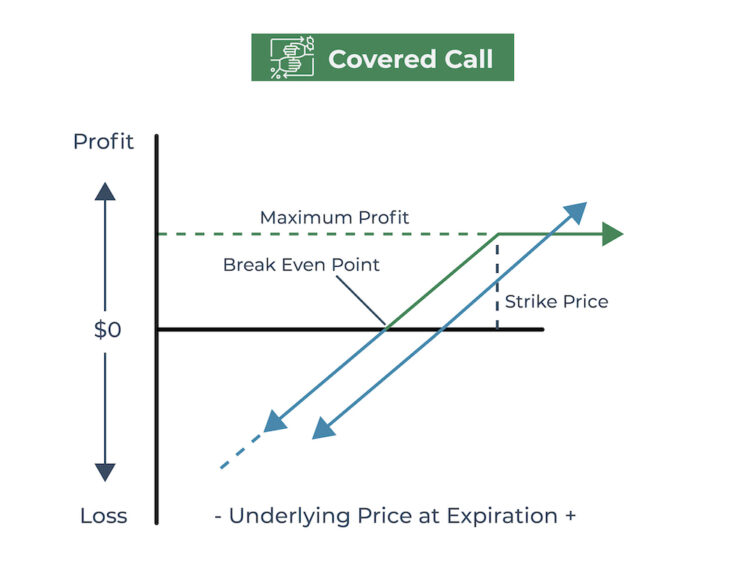

2. Covered Call Option

A covered call option is an options strategy in which the seller of a call option owns the underlying shares of the contract. In this situation, the seller is able to limit their exposure to risk by selling their shares if the buyer exercises the option, as opposed to buying them at market price and taking a loss on the sale (a naked call). There are three main reasons why an investor might sell covered call options:

- To make additional income: Sellers earn premiums on each covered call they sell.

- To hedge against their investment: If the price of their shares decrease, they can earn some of the money back from the premiums.

- To sell their shares: If the price of the underlying asset increases and the buyer exercises their option, the seller can immediately sell their shares, potentially at a profit.

How to Sell a Covered Call Option

A covered call option requires the seller to own the underlying shares of the call option. Here’s how it works:

- Open a trading account.

- Purchase shares of a company.

- Instruct the broker to sell a covered call option on those shares.

- Choose the strike price, premium amount, and expiration date.

- Sell the covered call option.

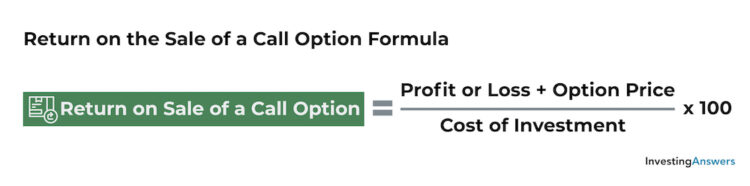

Return on the Sale of a Call Option Formula

Examples of Selling a Call Option

From the seller’s perspective, there are three outcomes when selling a call option: taking a loss, breaking even, and making a profit. In order to explain these outcomes, we will evaluate five different scenarios using the return on the sale of a call option formula.

Let’s assume that an investor purchases 100 shares of an underlying asset at a market price of $100 per share (for a portfolio value of $10,000). The investor decides to sell a call option at a strike price of $110 and an option price of $5. Since call option contracts include 100 shares, the total price of the call option is $500 ($5 x 100). If we assume that there is always a buyer, the seller will earn $500 in premiums when they sell the call option contract.

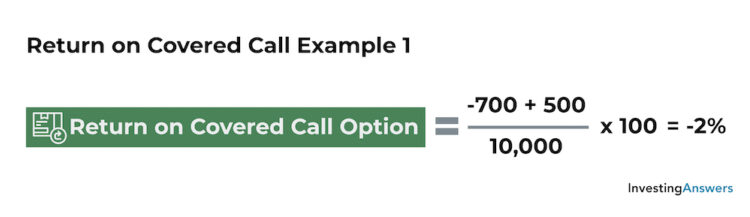

Scenario #1 - Seller Makes a Loss (Selling a Covered Call Option)

The price of the underlying asset decreases to $93 per share. The buyer decides not to exercise the call option because the value of the underlying asset is below the strike price. In this case, the seller would lose $700 due to the decrease in the price of the asset ($7 decrease x 100 shares), but since they earned $500 from the sale of the call option, they would take a net loss of $200 ($700 - $500).

The value of the portfolio would decrease to $9,800 and the percentage return would be calculated as follows:

The seller of the call option will lose 2% on their investment.

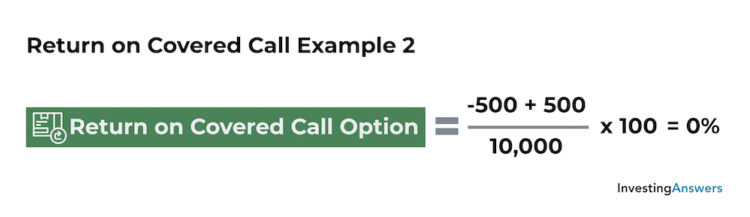

Scenario #2 - Seller Breaks Even (Selling a Covered Call Option)

The price of the underlying asset decreases to $95 per share. The buyer decides not to exercise the call option because the value of the underlying asset is below the strike price. In this case, the seller would lose $500 due to the decrease in the price of the asset ($5 decrease x 100 shares), but since they earned $500 from the sale of the call option, they would break even.

Since they neither gained nor lost money, the value of the portfolio would remain at $10,000 and the percentage return would be calculated as follows:

The seller of the call option will neither gain nor lose money on their investment.

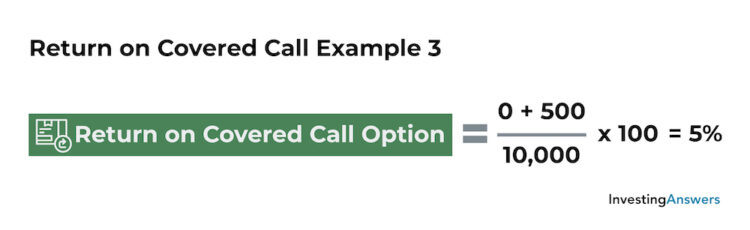

Scenario #3 - Seller Makes a Small profit (Selling a Covered Call Option)

The price of the underlying asset remains at $100 per share. The buyer decides not to exercise the call option because the value of the underlying asset is below the strike price. In this case, the value of the underlying investment would not change, and since they earned $500 from the sale of the call option, they would make a profit.

The value of the portfolio would increase to $10,500 and the percentage return would be calculated as follows:

The seller of the call option will earn 5% on their investment.

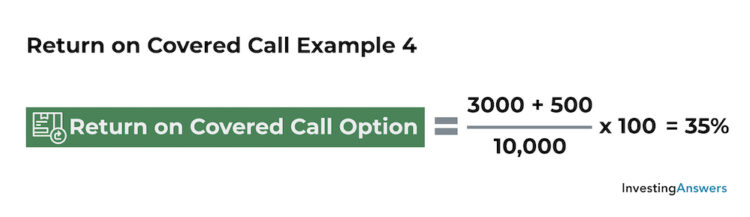

Scenario #4 - Seller Makes a Large Profit (Selling a Covered Call Option)

The price of the underlying asset increases to $130 per share. The buyer decides to exercise the call option and purchase the seller’s shares. In this case, the seller would earn $1,000 ($10 increase in price x 100 shares), and an additional $500 from the sale of the call option, they would make a profit of $1,500.

The value of the portfolio would increase to $11,500 and the percentage return would be calculated as follows:

The seller of the call option will earn 15% on their investment.

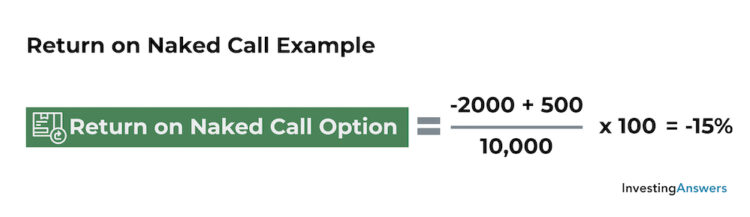

Scenario #5 - Seller Doesn’t Own the Underlying Asset (Selling a Naked Call Option)

In this situation, let’s assume that the buyer did not originally purchase the underlying asset for $100, so they are now selling a naked call option. Using the same numbers as the previous situation, the price of the underlying asset increases to $130. The buyer decides to exercise the call option to purchase 100 shares of the underlying asset.

Since the seller does not own any of the underlying shares, they must now purchase 100 shares at $130 (for a total of $13,000), then sell them to the buyer at $110 (a total of $11,000), generating a loss of $2,000.

The value of the investors portfolio would be -$1,500 ($2,000 loss on investment plus $500 from the sale of the call option) and the percentage return would be calculated as follows:

The seller of the call option will lose 15% on their investment.

Can a Casual Investor Make Money with Call Options?

Yes. While call options can be intimidating to new investors and rely on tricky market timing, it is possible for a casual investor to make money with call options. The ability to choose between buying and selling options gives investors flexibility in their investment strategies and offers multiple ways to earn money.

Advanced Options Strategies Involving Call Options

Beyond the standard buying and selling of call options, there are advanced call options strategies that experienced investors often employ:

What Happens When a Call Option Expires?

There are three things that can happen when a call option expires, and the outcome often depends on the market price of the underlying asset:

Out of the Money

This occurs when the market price of the underlying asset is less than the strike price. In this situation, the contract is worthless and will automatically expire on its expiration date unless it is sold to another investor.

At the Money

This situation occurs when the market price of the underlying asset is the same as the strike price. The contract is worthless and will automatically expire on its expiration date unless it is sold to another investor.

In the Money

This happens when the market price of the underlying asset is greater than the strike price. In this situation, the contract is valuable because it gives the holder the right to buy the underlying asset at a discount. If a call option is in the money at its expiration date, it is automatically exercised.

Can Call Options Be Exercised Early?

Yes. American call options can be exercised any time up between the moment they are purchased and the expiration date. However, this is not common. Most investors who consider exercising early end up selling the contract to another investor for a profit. European options cannot be exercised early.

What Is a Put Option?

A put option is the opposite of a call option. A put option is a contract that gives the holder the right – but not the obligation – to sell an underlying asset at a predetermined price at/within a specific period of time.

Call and Put Options Explained

The main difference between calls and puts is the underlying transaction. While a call option gives the holder the right – but not the obligation – to buy an underlying asset from the seller, a put option gives the holder the right – but not the obligation – to sell an underlying asset to the buyer.