High unemployment is affecting almost everyone in one way or another. Recent college graduates saw their average starting salary fall by 1.3 percent vs. the previous graduating class according to the National Association of Colleges and Employers (NACE). Fortunately, college graduates remain in demand as their unemployment status remains positive.

College Graduates Salaries Dip

The NACE's Summer Salary Survey indicates recent bachelor degree graduates received an average starting salary of $48,661, down from $49,307 received by the previous graduating class. Those who have jobs probably do not mind the slightly lower starting pay. At least they have a job, when some of their peers do not.

The table below provides starting salaries and changes over the past year for some of the more popular undergraduate majors.

Employment Better for College Graduates

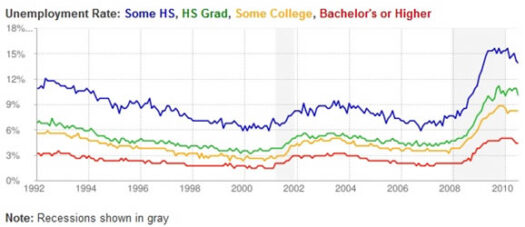

Those with a college education or higher tend to experience lower unemployment. Since 1992, the Bureau of Labor Statistics has tracked the rate of unemployment by education level. Not surprisingly, the degree of unemployment aligns with an individual's education level. The chart below from Department of Numbers shows the affect more education has on your prospects for unemployment. The high unemployment problem concentrates on those without the education and training employers need.

As you expect, higher education pays better when you have a job. The chart below is from the Bureau of Labor Statistics showing the median weekly earnings for various education levels in 2009.

About half of the more than 8 million jobs that have been lost come from construction. These workers find it difficult to develop the skills necessary to find jobs in vibrant areas like healthcare, education, advanced manufacturing, information technology and biotechnology.

It takes time and money to improve your skills. Since many of the unemployed do not have the money to spend on getting a better education, they face a difficult problem trying to balance their job search, caring for their family and gaining the necessary education. Those that own homes may owe more on their mortgage than the home is worth, leaving them trapped and unable to move to a place where a job might be available.

Adding to the problem is the length of unemployment. Those unemployed for long periods find it more difficult to return to the workforce.

The Bottom Line

Employment growth for middle-skilled workers has steadily declined because of automation, but the productivity of high-skilled workers has boomed. To solve the unemployment problem we will need to see education levels rise. More college educated employees will fill in a large and growing gap in the labor force. Besides, as we have seen, college graduates sometimes receive nice starting salaries to get them off in the right direction. It will take some time, but a better education is the best long-term answer.