Knowing how to calculate internal rate of return (IRR) is important for determining whether an investment is a good choice for your company. IRR is the discount rate that results in the investment’s net present value of zero. In other words, the IRR is a “break even” rate of return on the investment.

How to Calculate IRR in Excel

Though it isn’t a straightforward calculation, Excel’s IRR formula makes it simpler to figure out your IRR for instant investment decisions.

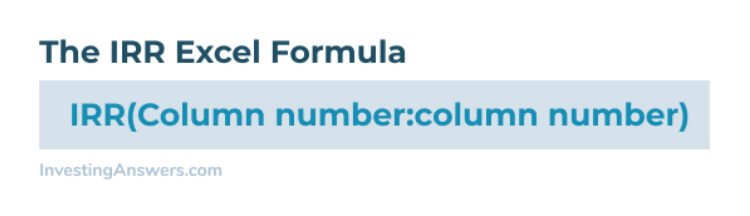

IRR Excel Formula

You can use the IRR function in Excel and you’ll need the following values:

The initial investment (which would be negative cash flow)

The cash flow value for each period

Input each figure into the same column and instruct Excel to compute the IRR by using the following IRR Excel formula:

Input this number into the cell directly below the column with your cash flow numbers.

IRR Calculator in Excel Example

Here’s a simple example of how to find IRR in Excel using the following figures:

Initial investment: $50,000

Subsequent cash flows: $20,000 each year for 5 years; $40,000 in year 6.

.jpg)

How to Find IRR on a Financial Calculator

If you don’t use Excel, you can still calculate IRR using a financial calculator (such as the Texas Instrument BA II Plus). You’ll need the same figures you’d use to find IRR in Excel: the initial investment and subsequent cash flows.

Using a financial calculator, enter the following:

Press the CF (Cash Flow) button to start the Cash Flow register.

Enter the initial investment (negative number).

Hit enter.

Hit the down arrow to move to CF1 or your first year’s cash flow.

Enter the amount for year 1.

Hit the down arrow twice to enter year 2’s cash flow.

Repeat the process until you’ve entered each year of projected cash flow.

Press the IRR key.

Press the CPT key for your IRR.

Calculating IRR with a Financial Calculator Example

Here’s an example of how to find IRR with a financial calculator using the following figures:

Initial investment: $150,000

Subsequent cash flows: $50,000 per year for 5 years.

Step 1: Press the Cash Flow (CF) Button

This starts the Cash Flow Register when you enter your initial investment. Because cash is paid out, it’s a negative number. In this example, enter -$150,000 and hit enter.

Step 2: Press the Down Arrow Once

The calculator should show CF1. This is where you enter the first year’s cash flow. For this example, enter $50,000.

Step 3: Press the Down Arrow Twice

The calculator should show CF2. This is where you'll enter the second year’s cash flow. In this example, enter $50,000.

Step 4: Repeat

Press the down arrow two more times and repeat Step 3 until you’ve entered all five years of $50,000 cash flow.

Step 5: Press the IRR Key

Press the IRR key to start the IRR calculation, followed by the CPT key. This should provide the IRR calculation for your investment.

How to Read Your IRR Results

Compare the IRR to your benchmark rate to determine whether the investment is worth it. If the IRR is higher than your benchmark rate, you’ve likely got a good investment. If it isn’t higher, it may not be worth the investment.