When Is the Best Time to Buy Bonds?

If you’re looking closely at your investments, you’ve probably wondered two very important questions: When is the best time to buy bonds? Do they still have a place in an investment portfolio?

The best time to invest in bonds depends on:

how close to retirement you are

how comfortable you are with the variability of certain investments

when you’ll need to access the invested cash

To make a better-informed decision, let's dive in.

Bonds vs. Stocks

Both bonds and stocks are important elements of a diversified investment portfolio. Stocks carry greater risk and higher possibility of return, while bonds carry less risk and less return. Bonds have become more popular in recent years, thanks to the past volatility of the market and ensuing apprehension about investing.

Market Crashes Have Made Investors Nervous

When the stock market crashed in late 2008, many investors saw their portfolio value drop – again.

They’d already suffered through a second brutal market meltdown after the dot-com implosion of 2001. This was an “all pain, no gain” situation for their current stock market investments. Add a series of scandals (e.g. Bernard Madoff) and over 85% of consumers viewed the stock market as a rigged game.

For these reasons, investors started turning to bonds instead of stocks since they carry less risk and provide a steady (small) return.

Bonds Have Offered More Stability Since 2009

Since 2009, individual investors have started to return to the stock market with renewed optimism. Billions of dollars started flowing back into mutual funds and index funds. Once again, it was seen as the path to wealth and – eventually – a stable retirement plan.

Are Stocks Better Investments Than Bonds?

Both stocks and bonds have their advantages, but you should be investing according to your overall long-term strategy – not the up and down of the market.

Despite market fluctuations, one thing remains true: Investments in stocks tend to have a higher return than bonds over time. On average, large stocks have returned 10% per year over time, with bonds returning about 6-7%.

Stocks: Greater Opportunity, Greater Risk

For people who are decades away from retirement, this makes investing in stocks – even with such volatility – a better choice than bonds: Stocks simply offer the opportunity for greater returns than bonds, but also greater risk.

Does that mean that you should shift your assets out of bonds and into stocks? Yes – but not all of your assets.

3 Rules for Deciding When to Buy Bonds vs. Stocks

To help you determine the best time to invest in bonds – and how much of your portfolio should be allocated to both bonds or stocks – read the following investing rules.

Rule #1: For High Returns, Choose Stocks Over Bonds

There’s a simple but powerful reason that most investors favor stocks over bonds: Every asset class delivers a long-term return that corresponds with the risk it carries. In other words, risk is tied to return (and they’re often relative to each other).

For example, holding cash in a high-yield savings account carries little-to-no risk, but it also earns very little (about 1%). Low-risk bonds offer fairly tepid returns as well. Stocks – which carry short-term risk because they move up and down with the market – tend to deliver better longer-term returns. Risk is tied to returns, and often they are relative to each other.

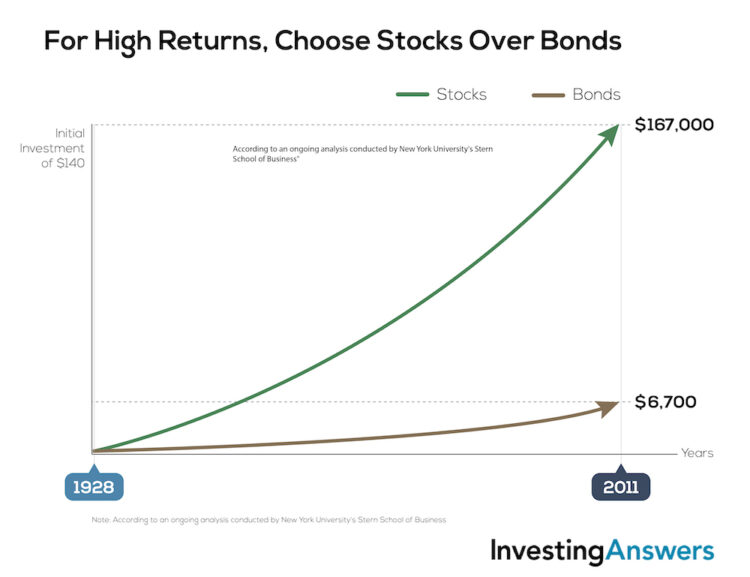

In an ongoing analysis conducted by New York University's Stern School of Business, $140 invested in stocks in 1928 would be worth $167,000 by the end of 2011. About $100 invested in Treasury Bonds would be worth just $6,700.

Of course, there are rare instances where stocks lagged bond returns at various intervals (for example, in the 1930s and 1970s). For the most part, however, stocks have been the highest returning asset class.

Although we don't know how stocks will fare over the next few years, we have a pretty good idea about bonds: With interest rates already at stunningly low levels, there isn't much room for rates to fall much lower. Bonds will have a predictable return – making them less risky – but stocks will have a higher return over time.

Rule #2: Buy Bonds According to Your Age

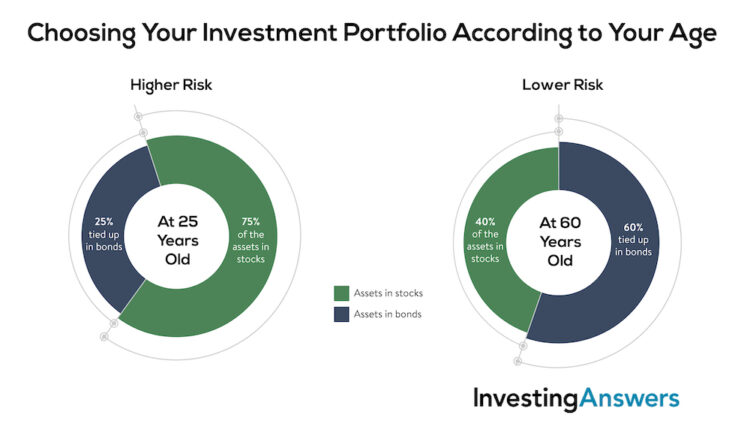

You shouldn't shun bonds all together. Instead, use the 'Method of 100,' to determine how much of your portfolio should be composed of bonds.

Your base of assets (including stocks, bonds, and home equity) should represent a lower risk as you age. To determine the best time to buy bonds, simply subtract your age from 100 to figure out how much exposure you should have to the riskiest asset class: stocks.

For example, if you're 25 years old, you should have 75% of your assets in stocks. If you're 60 years old, then the percentage devoted to stocks should fall to 40%. The remainder should be tied up in bonds, along with your homeowner's equity.

Rule #3: Consider Buying Bonds to Store Excess Cash

The stock market is always capable of faltering in any given year, and many retirees saw their nest eggs shrink dramatically in 2008.

Determine how much money you’d need to live on for 1-2 years if you lost your other sources of income. Keep that money out of stocks. Bonds could be a good alternative to store cash, especially because they can be accessed quickly at various financial institutions.

In a Nutshell: Is Now a Good Time to Buy Bonds?

Due to their lower risk, bonds are a good investment choice for investors nearing retirement age. Bonds are also a good place to keep an emergency fund if you don’t need immediate access (unless you experience a loss of income).