Between real estate, groceries, and any other consumer goods, the cost of living has been steadily rising for years. Inflation is an unfortunate reality, and while the current inflation rate isn’t particularly high, there’s always the possibility of a significant increase.

Whether you’re a homeowner, investor, or are simply concerned about rising prices, learning to hedge against inflation can’t hurt. In this article, we’ll explain three inflation hedging strategies that could help you protect yourself.

Why You Should Plan to Hedge Against Inflation

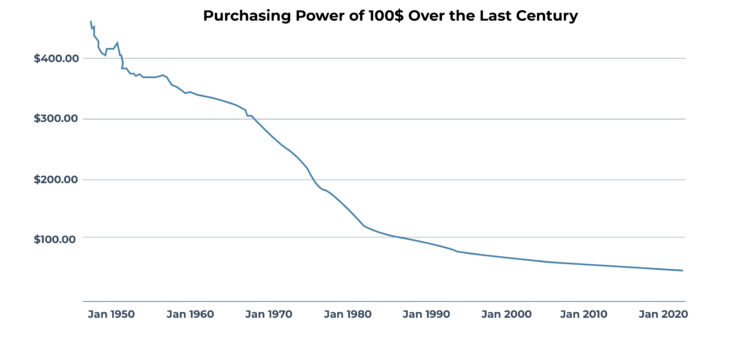

An increase in inflation represents an increase in prices and/or money supply (which decreases the purchasing power of the dollar).

For example, something that cost $1 in 1970 would cost $6.68 in 2020 – while the average inflation rate for this period is 3.87% per year, it amounts to a price increase of nearly 570% when compounded! Since it costs more money to purchase the same item, it’s easy to conclude that the value of money has decreased over this 50-year period.

Why Investors Should Hedge Against Inflation

Inflation doesn’t just affect consumers: It also has negative implications for investors. As inflation rises, the value of the dollar falls, so any money held by investors effectively loses purchasing power.

For example, say an investor holds $10,000 in their portfolio and inflation is 2% per year and they didn’t make any gains or losses on their investments. At the end of the year, the nominal value of the portfolio would remain at $10,000, but its real value would only be $9,800 (2% less) due to its loss in purchasing power.

In order to prevent their portfolio from losing value, the investor would need to make a 2% return on investment to offset the effects of inflation. This is called inflation hedging. Any returns beyond 2% would increase the value of the investment enough to exceed the effects of inflation.

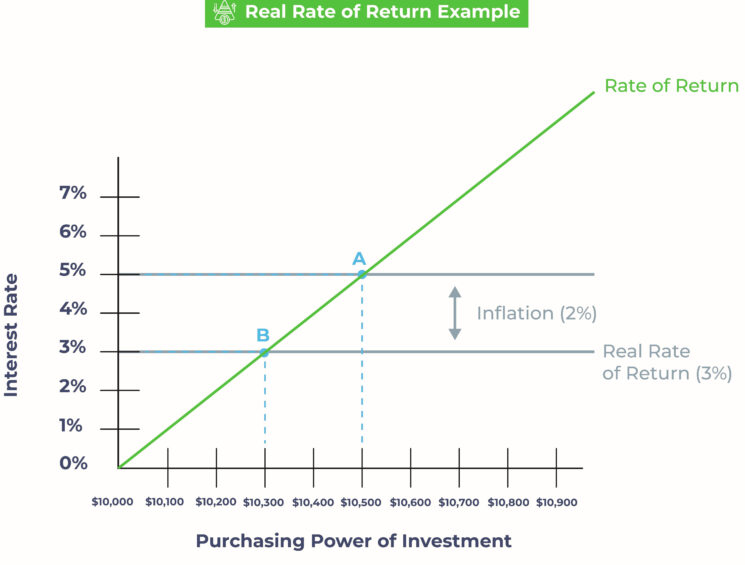

Any returns above the inflation rate are known as the real rate of return, which measures the increase in actual purchasing power of the investment after accounting for inflation.

Real Rate of Return Example

For example, let’s say an investor earns a 5% return on a $10,000 investment over one year, which brings the value of that investment to $10,500 at the end of the year (point A on the graph).

However, if we assume that inflation is 2%, the investor’s real rate of return would be 3% (5% minus 2%). This brings the actual purchasing power of the investment to $10,300 (point B on the graph).

3 Simple Inflation Hedging Strategies

While you can’t avoid inflation, there are ways you can reduce its effects. Regardless of your investing style, the composition of your portfolio and inflation hedging strategies can have a significant effect.

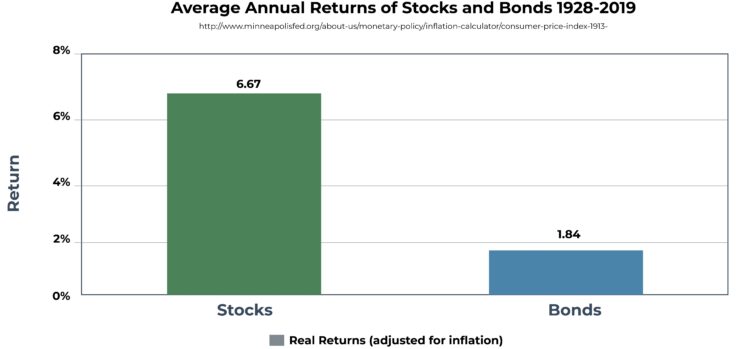

1. Make Sure You’re Investing in Stocks

While bonds are a great way to reduce your exposure to risk, they don’t usually perform well during periods of high inflation. Bonds generally provide a lower rate of return over a long period of time (which increases their exposure to inflation). If the inflation rate exceeds a bond’s rate of return, the bond will retain less value by the time it reaches maturity, leading to an overall loss in purchasing power of the investment.

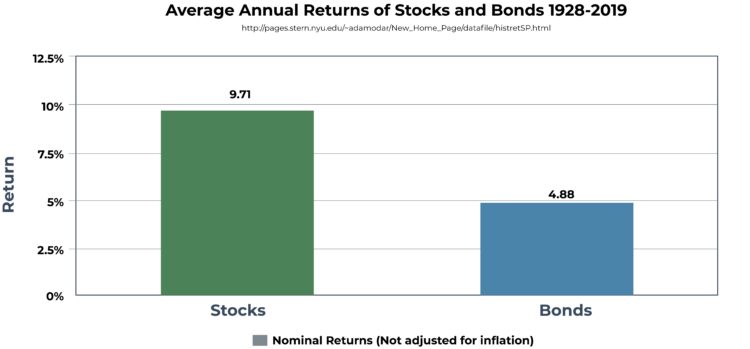

Comparison Between Stock and Bond Returns Over Time

To demonstrate how stocks are a better hedge against inflation than bonds, we compare historical returns between the two. The first example shows average annual returns from 1928 to 2019 without adjusting for inflation (nominal returns).

The second example shows average annual returns of stocks and bonds from 1928 to 2019 after adjusting for average inflation over the same period, which was 3.04% (real returns).

How Commodities Help Hedge Against Inflation

As the price of goods rises, the value of their production inputs (e.g. commodities like metals, grain, and oil) increases in parallel. While most investments lose value as inflation rises, commodities tend to appreciate in value, making them a possible way to hedge against inflation.

Unlike bonds, stocks, and other similar investments that correlate to a specific brand or company, commodities are interchangeable. Investors purchase a general type of commodity such as wheat or beef (which don’t differ in quality or utility). As prices for a specific good rise, the prices for their underlying commodities rise with them. For example, if consumer prices for bread increase, prices for wheat (the underlying commodity) will also increase.

However, inflation affects each good differently, making it difficult to predict which (if any) commodities will increase in value. Additionally, commodity prices may decrease as inflation falls, potentially wiping out any gains. Commodity prices are also very sensitive to currency exchange rates, which will naturally vary with inflation.

How Stocks Help Hedge Against Inflation

Stocks usually generate returns faster than bonds, making them more likely to beat inflation. However, there are two main types of stocks which react to inflation differently: growth stocks and value stocks.

1. Growth Stocks

Growth stocks are shares of companies that aim to accelerate growth by reinvesting profits instead of paying dividends. Since the companies generate revenue and earnings growth more rapidly than other companies in their industry, their stocks often have higher expected returns.

2. Value Stocks

Value stocks are shares of companies that are generally well-established and have steady cash flows. That means they’re less risky than growth stocks. These stocks are considered undervalued in relation to company fundamentals and are purchased for their potential to increase in price (once the market reflects the company’s true value).

Since these companies have steady cash flows – and are less reliant on business loans – value stocks generally perform better than growth stocks during times of high inflation. Because they’re generally larger and more stable than growth stocks, they’re usually slower to react to positive market conditions and often take longer to generate returns.

Growth vs. Value Stock Performance 1982-2020

The following chart compares performance of growth and value stocks with respect to inflation. Generally speaking, value stocks tend to outperform growth stocks in times of high inflation, whereas growth stocks tend to outperform value stocks in times of low inflation.

.jpg)

Growth and value stocks are two effective investment options that can help hedge against inflation. While they are completely different strategies, many investors diversify their portfolios by purchasing both types in order to further reduce exposure to risk and inflation.

2. Consider Inflation-Protected Bonds

Fixed-rate bonds are some of the poorest-performing investments during times of high inflation. However, Treasury Inflation Protected Securities (TIPS) are a similar alternative but with returns that are guaranteed to beat inflation – with a fraction of the risk.

TIPS are inflation-indexed treasury bonds that are designed to hedge against inflation risk and are issued by the US government. Unlike regular bonds (which have fixed interest and principal amounts), TIPS principal amounts and interest payments adjust with inflation and deflation.

As inflation rises, the principal amount increases to reflect the real value of the security. Since interest payments are based on the adjusted principal amount, they increase as well. However, if deflation occurs, the principal amount decreases to reflect the real value of the security (reducing the amount of the interest payments). Once the bond reaches maturity, the holder will receive the inflation-adjusted principal or the original principal amount (whichever amount is higher).

3. Look Into REITs

Property values and rental incomes generally rise during times of high inflation, allowing owners to increase their return on investment. While this makes real estate a great way to hedge against inflation, not everyone has the capital or time required.

Real estate investment trusts (REITs) lower the barriers to entry by pooling together capital from multiple investors and investing it in real estate assets. This structure allows all investors (regardless of their portfolio size) to access the benefits of real estate investments without the upfront capital requirements, maintenance costs, or responsibilities of direct ownership. Using REITs to invest in real estate indirectly, you can effectively hedge against inflation and diversify your portfolio.

Much like traditional stocks, individual shares of publicly-traded REITs – along with REIT mutual funds and REIT ETFs – can be purchased through a broker or online trading platform.

Note: Shares of non-traded and private REITs must be purchased directly through dedicated brokers and online platforms, but they may only be open to accredited investors due to their increased risk.

Close to Retirement? Hedge Against Inflation with This Tip

If you’re close to retirement, consider purchasing short terms bonds instead of (or alongside) long-term bonds. You might receive less interest, but you’ll be better protected against the effects of inflation.

Why Short Term Bonds Make Sense When You’re Close to Retirement

The reason that bonds tend to perform poorly during periods of high inflation is because their value is derived from future interest payments. When you invest in a bond, you receive interest payments at regular intervals until the bond reaches maturity. But as inflation rises, the real value of those future interest payments falls (since that money has less purchasing power).

The length of the bond determines the number of interest payments the holder will receive, and consequently, the amount of inflationary risk they are exposed to.

Additionally, if the Fed increases interest rates to combat inflation, newer bonds will pay more interest than existing ones (thus reducing the value of existing bonds). If the bond holder wants to sell their bond before maturity, they’ll need to sell it below market value because buyers would rather purchase new bonds with higher interest rates. This is called interest rate risk.

The amount of time before the bond reaches maturity affects both the potential changes in interest rate and the change in value caused by inflation. Since long-term bonds have more time until maturity, they are exposed to more inflationary and interest rate risk than short-term bonds.