What Is a Warranty Deed?

A warranty deed is a real estate document which states that the owner owns the purchased property free and clear of any outstanding mortgages, liens, or other types of encumbrances against it.

A general warranty deed legally transfers property from one individual or business to another (in most cases for real estate). They’re usually put in place when a grantee is looking to secure financing for mortgage or title insurance.

Grantor vs. Grantee

A grantor is an entity or individual who transfers the interest or ownership rights to a property to another. This person or entity is called the grantee (ie. the person who receives the property).

How Does a Warranty Deed Work?

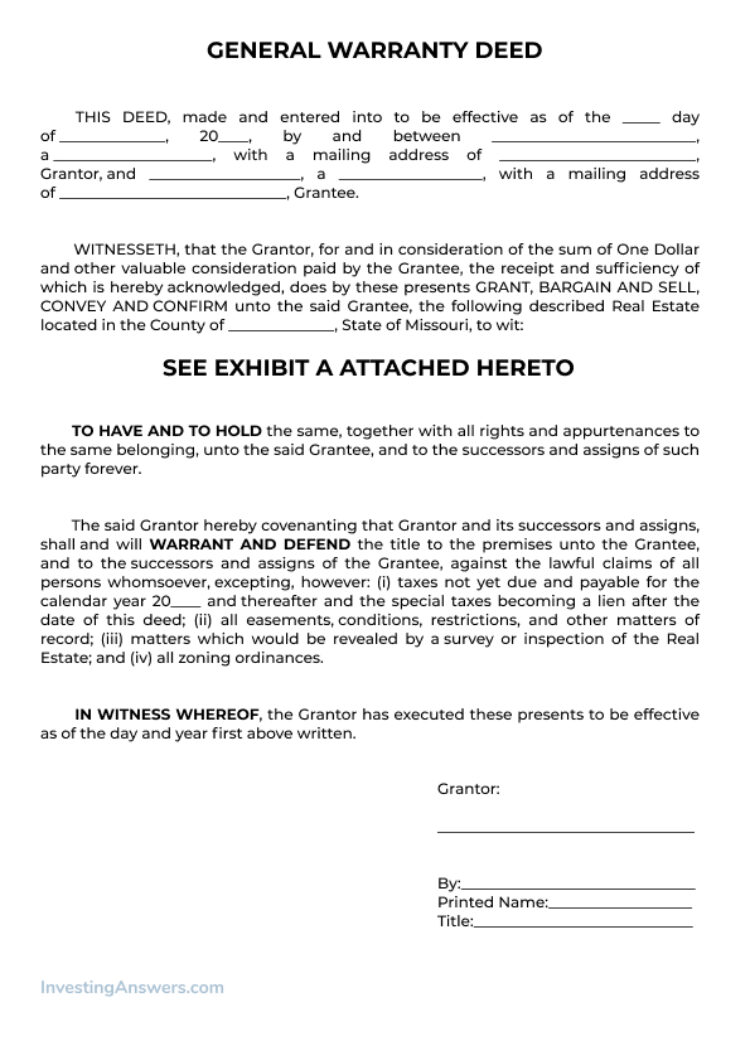

Warranty deeds document the names of involved parties, the transaction date, a description of the transferred property, and the signature of the grantee or buyer. It also needs to be signed in front of a notary or a witness.

The seller or grantor will then be responsible for any breaches of guarantees/warranties after the buyer owns the property (and even if the breach occurred without their knowledge). That’s why the general warranty deed puts the seller at a high amount of risk since they’re responsible for any encumbrances to the title – even when they didn’t own the property.

Common elements included in a warranty deed include:

The grantor stating they’re the rightful property owner and can legally transfer the title

The grantor guaranteeing that the property doesn’t have any outstanding claims or liens on the property (such as using it as collateral for a loan)

The guarantor affirming that the title of the property does not have any third-party ownership claims

Due to the burden of responsibility on the seller, title insurance is used to protect against any potential claims and liens. Before the property is to be transferred, a title company will do a full title search to determine whether there are any possible breaches.

Warranty Deed Example

Jane buys a single-family home from Tim in 2018 and the property is transferred to her name using a general warranty deed. In 2020, Jane finds out that there has been a lien on the property that was been placed by the IRS in 2016 – and the outstanding debt hasn’t been paid back.

Since Jane wasn’t the owner until 2018 and wasn’t notified of the lien, Tim is now responsible for fixing the lien due to the warranty deed. That means Tim will need to pay back to the debt and obtain a lien release.

How to Obtain a Warranty Deed

Warranty deeds can be obtained by downloading a template online or through your real estate agent. To ensure that it’s legally binding, warranty deeds need to be signed in front of a notary public.

Warranty Deed Template

You can find many low-cost warranty deed templates online. If you’re using a template, ensure that it meets the legal requirements for your specific state (rather than a generic one). All deeds will have space for you to fill out the grantor and grantee’s names, date, property being transferred, grantor’s signature, and signatures of witnesses.

Can Anyone Prepare a Warranty Deed?

Anyone can prepare and execute a warranty deed but it needs to meet the state’s legal regulations. Because of the risks to the seller, the seller (or their listing agent) will hire a real estate attorney to prepare the warranty deed. This ensures that all aspects of the document are valid before the property is transferred.

Once the warranty deed is signed and notarized, the seller or attorney needs to deliver the deed to the buyer who will then accept it.

When to File a Warranty Deed

A warranty deed should be filed when the property is being transferred. The grantor needs to sign off on the document which will then need to be submitted to a government agency (e.g. register of deeds, county clerk’s office).

Are Warranty Deeds Public Record?

Because the deed is submitted to a government agency, the real estate transaction will need to be kept in the county’s official records and filed on public record. Once the government agency puts a filing stamp on the warranty deed, the document will be returned to the buyer.

Can a Warranty Deed Be Changed?

A warranty deed can be changed for multiple reasons, such as the owner legally changing names or the death of a co-owner. In order to change a warranty deed, you’ll need to contact the title company, mortgage lender, and the local property records office to inform them of the change. Each entity will need to follow local and state guidelines when filling out paperwork. There may also be fees involved with this service.

Can I Transfer a Warranty Deed?

A warranty deed can be transferred, like when an individual wants to purchase the property. Transferring the deed requires that the seller ensures a clear title on the property, checks with the title insurance company/attorney to ensure a clean title, creates the new warranty deed, and signs it in front of witnesses to ensure that it’s legally binding.

Can a Warranty Deed Be Contested?

A warranty deed can be contested and revoked, though the complexity of the situation depends on when that happens. If the grantor hasn’t delivered the warranty deed to the buyer, they can destroy the document with no issue (because the property hasn’t been officially transferred yet).

However, if the transfer is complete – and it has already been recorded – then the seller needs to contact the buyer to do so. The best case scenario is one where the seller agrees: All they have to do is return the deed (if it hasn’t been recorded) or sign a document rescinding the warranty deed (if it has).

Should a seller refuse, they can file a lawsuit and ask for the court to rescind the transaction. Typically called a “quiet title action”, these lawsuits can be long and complicated, so if sellers want to proceed, it’s best to hire legal help.

Warranty Deeds and Divorce

Couples who split up can use warranty deeds to remove the name of one spouse and transfer the property to another. Unless it’s required by their divorce decree, spouses don’t need to transfer real estate using a warranty deed, especially those who don’t want to be responsible for the warranty of title. Many homeowners in this situation use quitclaim deeds, a popular deed that doesn't provide a warranty of title. Instead, it releases the spouse from having their name on the deed so they’re no longer the co-owner of the property.

What Is a Special Warranty Deed?

Not as detailed as a general warranty deed, a special warranty deed:

conveys that the grantor has received the title

warrants that the property is free of liens or other encumbrances only while the grantor was in possession of the property.

With a special warranty deed, the grantee can’t hold the grantor responsible for any discrepancies to the title before the grantor owned the property.

When Is a Special Warranty Deed Used?

Special warranty deeds tend to be used in commercial real estate transactions. Most mortgage lenders for residential properties will insist on using a general warranty deed.

Types of Deeds

A warranty deed isn’t the only type deed available in real estate transactions.

Warranty Deed vs. Quit Claim Deed

A quitclaim deed is used to transfer ownership of a property that isn’t due to a traditional sale, like when property is placed in a trust or when it’s used to distribute property due to a divorce settlement.

Unlike a warranty deed (where the grantor is legally responsible for any encumbrances on the title), quitclaim deeds have no such clauses. It’s simply a document that outlines the transfer of property from one party to another.

Warranty Deed vs. Title Insurance

Title insurance is meant to protect the buyer from any unknown encumbrances to a property. Lenders won’t likely approve a loan for a warranty deed without title insurance because they don’t want to take on any risks to the property title. Title insurance is usually purchased by the seller (though buyers can also purchase it as well).

Warranty Deed vs. Grant Deed

A grant deed also transfers the title from one individual or entity to another. This document guarantees that the property hasn’t been sold to anyone else and there aren’t currently any known liens or restrictions to the title. It offers less protection than a warranty deed because the grant deed means that the grantor only needs to provide proof that they can legally sell the property (not be responsible for any other claims).

Warranty Deed vs. Deed of Trust

Both a warranty deed and deed of trust are used for the purposes of transferring, financing, and owning property. However, a warranty deed transfers property between the buyer and seller whereas a deed of trust transfers the title of a property to a third-party (such as a mortgage lender). This third-party entity will hold the property title until the terms of their contract are fulfilled, such as when the borrower pays the mortgage back in full.