What is a Qualifying Investment?

A qualifying investment is a contribution to a retirement plan made with pre-tax income.

How Does a Qualifying Investment Work?

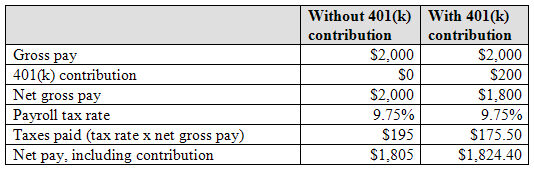

For example, let's assume that John participates in his company's 401(k) plan. He socks away $200 per month, and the company automatically deducts the amount from his paycheck. John earns $2,000 every two weeks.

Because the contribution is a qualifying investment, no payroll taxes are withheld from the amount. In other words, if John earns $2,000 every two weeks, his 401(k) contribution of $200 is deducted 'off the top' and then the remainder is taxed. This is in contrast to having the whole $2,000 taxed, which would be the case if John were not making contributions to his 401(k) plan.

As you can see, John is saving money simply by making a qualifying investment because he is taxed on less of his paycheck. Additionally, any money that John makes in his 401(k) plan (from capital gains or dividends, for example) is tax-deferred, meaning that he doesn't have to pay taxes on it in the year in which he earns it. Rather, he pays taxes when he withdraws the money in a few decades. This means that more of his money stays working for him (rather than going to pay taxes), and these savings compound over the years.

Why Does a Qualifying Investment Matter?

Qualifying investments can be made in IRAs, trusts, 529 plans, and many other retirement and savings plans. As the example shows, their tax-deferred status has huge advantages, especially for long-term investors.