What is a Primary Downtrend?

When financial assets and markets -- as with the broader economy -- fall steadily for an extended period of time, it is known as a primary downtrend, or 'bear market.'

How Does a Primary Downtrend Work?

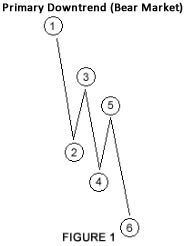

A primary downtrend is when each successive decline of the primary trend carries the market to lower lows and lower highs, lasting from several months to several years. This is illustrated in Figure 1 below.

As you can see in the Figure 1, High 5 is lower than the previous high and Low 4 is lower than the previous low.

Within a primary downtrend, several secondary reactions may occur against the trend, lasting for a few days, weeks or even months, but they don't necessarily change the definition of the overall trend. These movements are considered micro trends, such as daily movements and other short-term price fluctuations.

In the stock market, for example, prices may rise precipitously, even during a powerful downtrend, for several weeks at a time. This is known as a 'rally.'

If a rally doesn’t succeed in breaking through the previous high and the market subsequently declines to fall below a previous low, the price movement is still considered a primary downtrend.

Why Does a Primary Downtrend Matter?

It is difficult for investors to precisely time primary downtrends. That's because markets often rise higher than most investors and analysts anticipate -- and sometimes fall lower than they could possibly fathom.

In nearly every case, investing in assets or markets that are in a primary downtrend is not something you want to do. It is wise to wait until a primary uptrend emerges in the asset or market before you consider buying shares.