What is a Notice of Seizure?

A notice of seizure is a bad thing. During this time, the IRS takes physical custody of the taxpayer's assets, which could range from cash accounts to homes, cars and other assets.

How Does a Notice of Seizure Work?

Let's say John Doe falls behind on his taxes and now owes the IRS $25,000 for his income taxes from 2011. After protracted discussions with the government agency, the IRS sends him a notice of seizure, informing him that it has seized his checking account and several investment accounts in order to obtain the $25,000 it is owed.

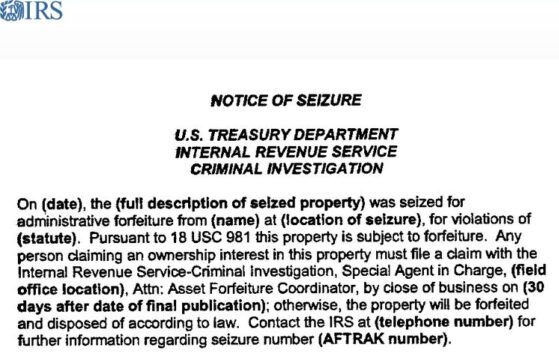

Below is a notice of seizure template from the IRS.

Why Does a Notice of Seizure Matter?

A notice of seizure is a letter from the IRS informing the recipient that it is liquidating the recipient's assets.