What is a High-Yield Bond Spread?

A high-yield bond spread is simply the difference in yield between two high-yield debt securities or, more commonly, two classes of high-yield debt securities.

How Does a High-Yield Bond Spread Work?

Let's assume that junk bond X is yielding 5%, and junk bond Y is yielding 7%. The yield spread is 2%.

Why Does a High-Yield Bond Spread Matter?

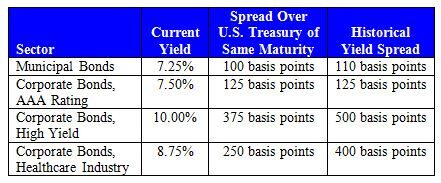

High-yield bond spreads help investors identify opportunities. The goal is to take advantage of expected changes in yield spreads between certain sectors of the bond market. The concept applies to the entire bond market. To illustrate, consider the following table, which compares bond yields of various sectors to U.S. Treasuries.

There could be several reasons for the difference in yields among these sectors. During economic slowdowns, for instance, yield spreads often widen between risk-free securities and the securities of other issuers because non-Treasury issuers must work harder to generate cash flow to service their debts, making their default risk a bit higher. The opposite is true during periods of economic expansion. The task is to determine how prices and yields on securities in a specific sector move together.

Ultimately, when an investor using this strategy believes the yield spread between two high-yield bonds is out of line, he or she either buys or sells securities in those sectors (depending on whether the spread is too narrow or too wide) as a way to earn extra returns when the sectors eventually realign. In the example above, income investors might notice that the spreads on high-yield bonds and bonds from the health care industry are especially high (a 375-point spread for high yield bonds versus the usual 500-point spread and the 250-point spread for health care bonds versus the usual 400-point spread) and might take advantage of these narrow spreads by buying bonds in sectors where spreads are expected to widen.