What is the Herfindahl Index?

Also known as the Herfindahl-Hirschman Index (HHI), Herfindahl Index measures the market concentration of an industry's 50 largest firms. The purpose is to determine whether the industry is competitive or nearing a monopoly.

Why Does the Herfindahl Index Matter?

It’s important for industry analysts to understand where a particular company's source of growth and competitive advantage comes from (and competition structure is one of the main components of this analysis).

For example, if a company exists in a highly competitive industry, it will be more difficult for it to maintain above-average profit margins in the future – even if it currently has above-average profit margins.

Herfindahl Index Formula

You can calculate Herfindahl Index by squaring the market share for each firm (up to 50 firms) and then adding the squares.

In a perfectly competitive market, HHI should approach zero. Let's say there are thousands of restaurants in your city, but the top 50 each have 0.1% of the market share. The HHI is 0.12 x 50 = 0.5.

HHI Example

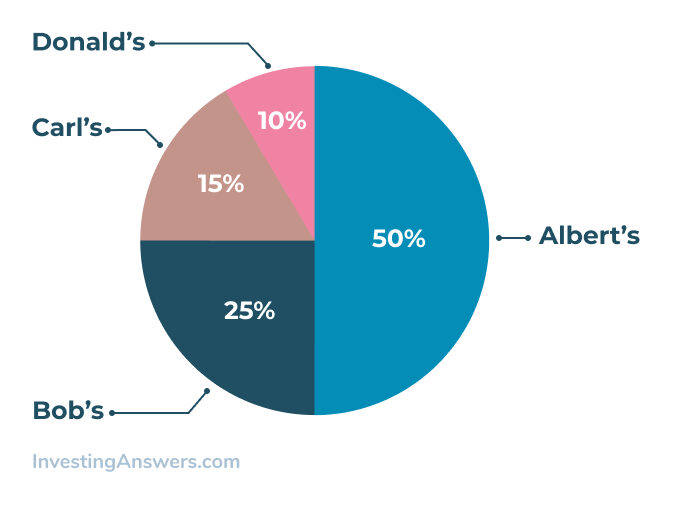

Let's say there are four grocery stores in your town: Albert's, Bob's, Carl's and Donald's. Their market share is broken down as follows:

To calculate the HHI, you would apply the following formula:

HHI = 502 + 252 + 152 + 102 = 3,450

What Is the HHI for a Monopoly?

In a monopoly, HHI approaches 10,000. If the largest firm has 100% of the market share, HHI = 1002 = 10,000.