What Is a Forward Contract?

A forward contract is a private agreement between two parties. It simultaneously obligates the buyer to purchase an asset and the seller to sell the asset (at a set price at a future point in time).

Unlike futures – which are regulated and monitored by the Commodities Futures Trading Commission (CFTC) – forward contracts are unregulated. Such unregulated financial instruments are called over-the-counter (OTC) instruments.

A Brief History of Forward Contracts

Forward contracts have existed since at least Greek and Roman times. There’s evidence that they were commonly used during the Middle Ages in Europe, and Europeans continued the tradition of forward contracts in the New World.

Forward contracts were used to stockpile essential goods that could be resold for a profit at a later date. Buyers would take possession of the wheat, corn, or other commodities upon delivery of the contract, pay the forward price (agreed upon in the contract), and hope that the demand for the good would grow so they could raise prices, resell it, and generate profits.

How Do Forward Contracts Work?

Think of farmers who face considerable price uncertainty each year. Their crops fail due to insects, disease, or weather, and the demand for their crops may fluctuate substantially.

To protect against uncertainty, farmers may draw up a forward contract and sell it to a private buyer. For example, large food manufacturers may purchase a farmer's wheat forward contract to lock in the price and control their manufacturing cost. The farmer hopes to benefit from the forward contract by ensuring that he has a buyer for the commodity. If they can meet the forward contract's qualifications (like producing and delivering bushels of wheat, corn, or oats), they also have an agreed-upon price.

The buyer assumes a long position and the seller assumes a short position when the forward contract is executed. The agreed-upon price is called the delivery price. It is equal to the forward price at the time that the two parties enter into a contract.

Hedging vs. Speculation

Forward contracts attract two types of buyers: hedgers and speculators. Typically, more hedgers than speculators participate in forward contracts.

Meaning of Hedging

Hedgers enter into forward contracts to stabilize revenues or costs of their business operations. Instead of seeking profit, gains are used to offset losses in the market for an underlying asset.

Meaning of Speculation

Speculators try to maximize their profits by 'betting' on which way the prices will go. They aren't interested in buying or selling the underlying asset. Instead, they hope to profit on the forward contract itself by 'betting' on the direction the price will go.

Forward Contract Example

Old MacDonald had a farm, and on that farm, he grew corn – a lot of corn. This year, he expects to produce 500 bushels of corn that he can sell at the price-per-bushel that’s available at harvest time – or he can lock in a price now.

The Crunchy Breakfast Cereal Company needs plenty of corn to manufacture their cornflakes. They send a representative around to Old MacDonald’s farm and offer him a fixed price to be paid upon delivery of 500 bushels of corn at harvest.

With the forward contract, Old MacDonald will receive the delivery price if he can deliver 500 bushels of corn by a specific date. Based upon the expected delivery price, if he's able to produce the 500 bushels of corn, he can plan this year’s farm revenues and next year’s expenses.

Because Crunchy Breakfast Cereal Company has a forward contract, they can control variable costs (such as the cost of corn) to make their breakfast cereal. Knowing the cost of corn in advance enables them to keep prices steady for the consumer. They risk overpaying Old MacDonald for his corn, but it's a risk they’re willing to take to hold costs steady and retain market share for their cornflakes.

Why Is a Forward Contract Useful?

Despite being a zero-sum transaction (where one party wins or loses it all), there are major advantages of forward contracts and they offer potential benefits to both buyers and sellers.

For buyers, forwards lock in prices, enabling them to predict and control variable costs of commodities. They can hedge against volatility in the currency exchange rate by locking in the rate using a forward contract.

For sellers, forward contracts enable them to project cash flow by understanding the value of a future asset when the forward contract is struck. Forward contracts obligate buyers to take possession of the commodity upon the delivery date, so sellers also have certainty about who they are delivering their commodities to (and by when). They can use this information for business planning and management purposes, reducing their risk.

Lastly, because forward contracts are unregulated, they are also private. Buyers and sellers have the freedom to strike whatever price they deem is fair and acceptable but have no obligation to disclose that price to anyone else.

Forward Contracts vs. Futures Contracts

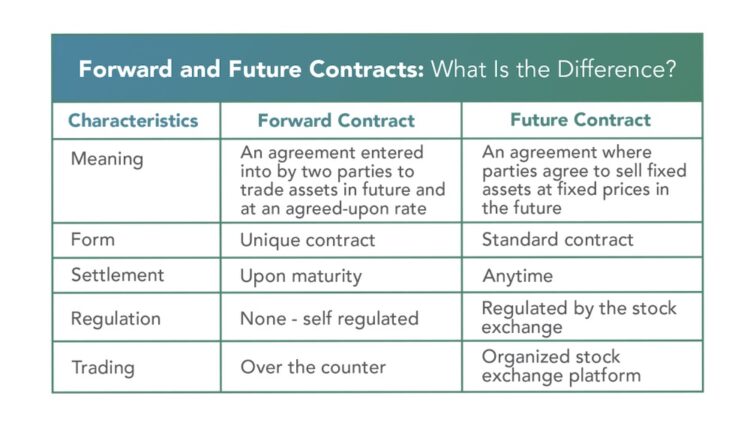

Forward contracts and futures contracts are similar in that both are derivative instruments – and a derivative is a contract that has value based on the value of another underlying asset. They differ, however, in several ways.

Elements of Forward Contracts

Forward contracts are unregulated derivative instruments. Banks often execute forward contracts on behalf of their clients (especially currency forward contracts) but other contracts may be drawn up privately.

Elements of Futures Contracts

The Commodities Futures Trading Commission regulates futures contracts in the United States, and trades must be executed on the floor of a registered commodities exchange. Firms and individuals who provide advice or trade futures must be registered with the National Futures Association. To place an order for futures, clients register with the broker of their choice (who can execute trades on their behalf).

The futures exchange also acts as a clearinghouse and counterparty for both the buyer and the seller. That is, both buyer and seller are actually trading with the exchange, rather than directly with each other (reducing the risk of counterparty default). Because there is no central clearinghouse for forward contracts, there is also a higher default risk.