What is a Doji Candlestick?

A doji candlestick is a significant signal in the technical analysis of financially traded assets. If prices finish very close to the same level (so that no body or a very small real body is visible), then that candle can also be read as a doji.

How a Doji Candlestick Works

There are four types of doji candlesticks -- common, long-legged, dragonfly and gravestone. All dojis are marked by the fact that prices open and close at the same level.

A doji represents a supply/demand equilibrium -- a tug-of-war where neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have recently moved higher. Now, the outcome of the latest skirmish is in doubt. Meanwhile, after a long downtrend, the opposite is true. The bears have been victorious in previous battles, forcing prices down. In this case, the bulls have found courage to buy and the tide may be ready to turn.

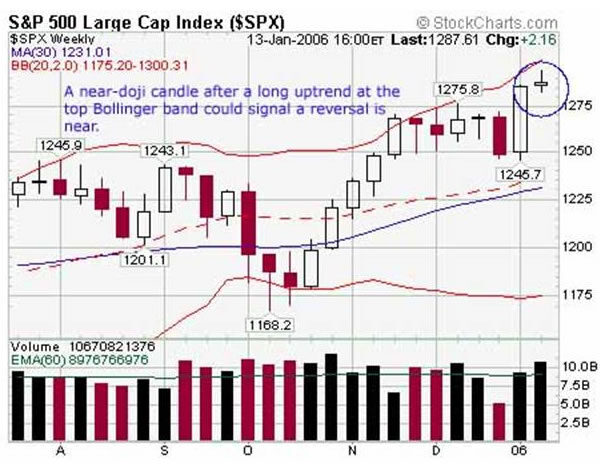

When assessing a doji candlestick, always take careful notice of when it occurs. If the security you're examining is still in the early stages of an uptrend or downtrend, then it is unlikely that the doji will mark a top. Similarly, if the doji occurs in the middle of a Bollinger Band, then it is likely to signify a pause rather than an outright trend reversal.

As significant as the pattern is, one should not trade on the doji alone. Always wait for the next candlestick to confirm your suspicions before taking action. That does not necessarily mean, however, that you need to wait the entire next period. If a doji is seen after a sustained uptrend, then a large gap down immediately following the doji should normally provide a safe shorting opportunity. The best entry time for a short trade would be early in the following session. Similarly, if a strong downdraft occurs at the beginning of a week after a weekly doji, trading action should be taken.

In the sample chart below, the S&P has formed a prime example of a common doji. Note that this doji candle is significant, as it comes after a prolonged uptrend and is near the top Bollinger Band.

Why Doji Candlesticks Matter

After a long uptrend, the appearance of a doji candlestick can be an ominous warning sign that the trend has peaked or is close to peaking. Dojis should not be assessed mechanically. However, after a strong trend in either direction, they can often mark major turning points. Always recognize the doji when it occurs and be prepared to take appropriate action.