What is Cash-Flow Matching?

Cash-flow matching is an investing strategy for investors who need to fund a series of future cash needs.

How Does Cash-Flow Matching Work?

Buy-and-hold and indexing strategies are about generating steady rates of return in a portfolio. But a structured portfolio strategy (also called a dedicated portfolio strategy) is for investors who want to make sure their portfolios are worth a specific amount at a certain point in the future, usually because they need to fund future expenses like tuition or retirement.

Cash-flow matching is one of two kinds of structured portfolio strategies (the other is immunization), and it is intended for investors who need to fund a series of future expenses. The immunization strategy is generally for investors who need to fund one lump-sum future liability or expense.

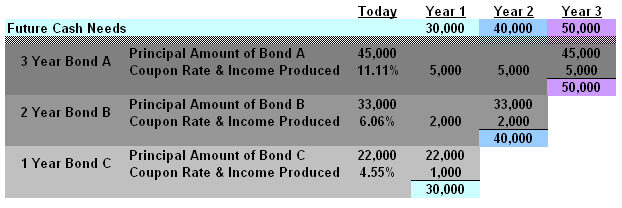

To implement the cash-flow matching strategy, you first need to project your future cash needs. In the example below, we need $30,000 in year 1, $40,000 in Year 2 and $50,000 in Year 3.

Next, we buy a 3-year bond (Bond A) that will return enough principal and interest to cover our expenses in Year 3. Assuming that rates are 11.11% for a 3-year bond, we need to invest $45,000 today to cover our cash needs in Year 3.

Most bonds throw off bonds every year, and assuming Bond A is no exception, we can expect to receive interest payments in Years 1 and 2. These interest payments will offset a portion of our cash needs for those years.

After accounting for the interest from Bond A, we're still $35,000 short in Year 2. So now we need to figure out how much to invest in a 2-year bond (Bond B) to reach our $35,000 goal. Following the same steps we used above, we can figure out the interest payments and principal amounts needed to meet our cash needs for Years 1 & 2.

Why Does Cash-Flow Matching Matter?

When executed well, cash-flow matching can provide terrific returns (and tremendous peace of mind) to investors. After all, the intended result is an income portfolio that has an assured return for a specific time horizon. But there are risks as well.

For example, cash-flow matching requires the investor to calculate and time his or her future liabilities, which isn't always easy or accurate, and it often requires overfunding in order to ensure that the future liabilities are covered.

Another vulnerability in this strategy is that it assumes there are no defaults. But as is almost always the case, the lower the quality of securities the investor purchases, the higher the risk those securities carry and the higher the possible return (or loss). Further, using callable bonds may add return potential, but if these securities are called before they mature, this can eliminate some of the expected coupon payments.