What is a Bond Ladder?

A bond ladder is an investment strategy whereby an investor staggers the maturity of the bonds in his/her portfolio so that the bond proceeds mature and can be reinvested at regular intervals.

How Does a Bond Ladder Work?

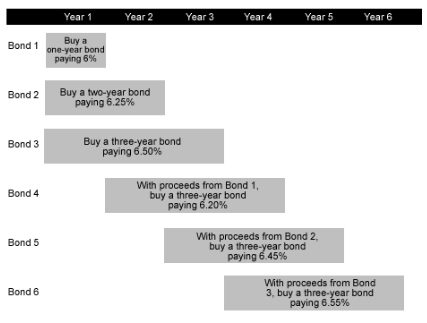

For example, say you have $75,000 to invest. To create a bond ladder, you could invest $25,000 in a one-year bond at 6%, $25,000 in a two-year bond at 6.25%, and $25,000 in a three-year bond at 6.50%. Each year is considered a 'rung' on the ladder.

Now, when the one-year bond matures, you would reinvest the proceeds in a three-year bond. At the end of the second year, you would put the proceeds from the matured two-year bond into a three-year bond, and so on. Here is how the strategy, using sample data, looks visually:

Let's look at the difference between simply rolling a $75,000 one-year bond over every year and using the laddering method.

.png)

Because the laddered portfolio was able to take advantage of the higher yields offered by longer-term bonds, the laddered portfolio earns 4.49% more income ($19,999 vs. $20,898) during a four-year period even though much of the investor's capital was never more than one year from maturity.

Why Does a Bond Ladder Matter?

There are several advantages to bond laddering, and many bond fund managers use this strategy. The first advantage is that bond laddering can allow investors to benefit from increases in interest rates because the investor is able to reinvest the maturing portion of his or her capital at market rates. Second, the diversification inherent in laddering can help stabilize the investor's income stream. Third, laddering gives the investor liquidity because a portion of the portfolio is never more than a year away from maturity.

There are some drawbacks to laddering, however. First, the transaction costs of purchasing several bonds may be higher than purchasing one large bond. Second, the constant maturing does present some reinvestment risk to the investor if interest rates are falling instead of rising.