What Is the Acid Test Ratio?

Also referred to as the quick ratio, the acid-test ratio is a measure of how well a company can meet its short-term financial liabilities. In addition to providing fast results, an acid test quickly reveals how a company’s short-term assets can be converted in order to pay its short-term liabilities.

Acid Test Ratio vs Current Ratio

The acid-test ratio is a more conservative version of the current ratio (another well-known liquidity metric). Although similar, the acid test ratio provides a more rigorous assessment of a company's ability to pay its current liabilities.

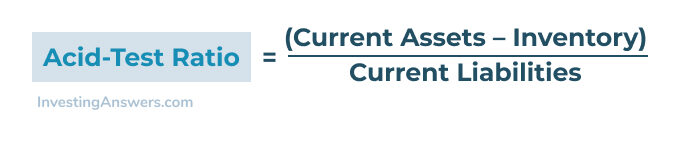

Acid-Test Ratio Formula

The acid-test ratio can be calculated as follows:

Another common acid test ratio formula is:

Note: The acid-test ratio eliminates all but the most liquid current assets from consideration. Inventory is the most notable exclusion since it isn’t as rapidly convertible to cash and is often sold on credit. However, some analysts include inventory in the ratio if it is more liquid than certain receivables.

Acid Test Ratio Interpretation

High and/or increasing acid-test ratios generally indicate that a company is:

- experiencing solid top-line growth

- quickly converting receivables into cash, and

- easily able to cover its financial obligations.

A common rule of thumb for acid test ratio is that companies with 1.0 or more are sufficiently able to meet their short-term liabilities. Such companies often have faster inventory turnover and cash conversion cycles.

In general, a low and/or decrease in acid test ratio can suggest that a company is:

- over-leveraged

- struggling to maintain or grow sales

- paying bills too quickly, or

- collecting receivables too slowly.

Acid Test Ratio Example

Let's assume the following information was pulled from Company XYZ’s balance sheet:

.jpg)

Using the primary quick ratio formula, we can calculate Company XYZ's acid-test ratio as follows:

($60,000 + $10,000 + $40,000) / $65,000 = 1.7

This means that for every dollar of Company XYZ's current liabilities, the firm has $1.70 of very liquid assets to cover its immediate obligations.

Disadvantages of Acid Test Ratio

Like most other measures, the biggest potential drawbacks of the acid-test ratio are that it:

- provides no information about the level and timing of cash flows (which are what really determine a company's ability to pay its liabilities when due).

- assumes that accounts receivable are readily available for collection, which may not be the case for many companies.

- also assumes that a company would liquidate its current assets to pay current liabilities. This isn’t always realistic, considering some level of working capital is needed to maintain operations.

Capital requirements that vary from industry to industry can also have an effect on acid-test ratios. The timing of asset purchases, payment and collection policies, allowances for bad debt, and even capital-raising efforts can all impact the calculation and result in different acid-test ratios for similar companies. This means that liquidity comparisons are generally most meaningful among companies within the same industry.