What is Accounts Receivable Aging?

Accounts receivable aging is a report showing the various amounts customers owe a company and the length of time the amounts have been outstanding.

How Does Accounts Receivable Aging Work?

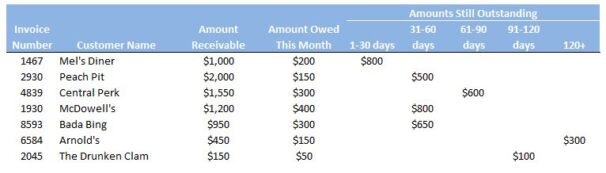

Here is sample of an aging report:

Notice that the report shows how much each customer owes in total ('Amount Receivable'), how much is owed for the current month, and how late any other previous months' payments are.

Why Does Accounts Receivable Aging Matter?

Often nicknamed 'the aging report,' receivables aging is a management tool. It helps companies know which specific customers to send to collections, which ones to target for follow-up invoices, and whether the accounting department is collecting receivables too slowly.

Companies can also use an aging report to determine whether it is taking on too much credit risk. Aging reports also guide company billing policies. If the company requires payment within 30 days, but most customers are blowing that off and paying in 60 days instead, the company might see this in the aging report and consider changing its policy.