How Does the Investment Calculator Work?

The investment calculator works based on information about your current expectations of your investments. With that, you’ll need to provide the amount you are starting with, the number of years for your investment to grow, the expected annual return rate, and the amount you plan to contribute to your portfolio monthly.

From there, the investment calculator will show you what your investment will be worth at the end of your specified timeline if you make your regular contributions. Additionally, you’ll see how much your investment will be worth without regular contributions.

Beyond the numbers, you’ll also see a graph to visualize how your investment will grow. The bar graph will break down the growth between the cumulative contributions you make and the total interest you earn on the investments.

Finally, you’ll find a chart that indicates how much you will contribute each year, the annual amount of interest earned, the total amount of interest earned, and the ending balance of your investment for the year.

Example of Investment Calculator

Let’s see how the investment calculator works in practice.

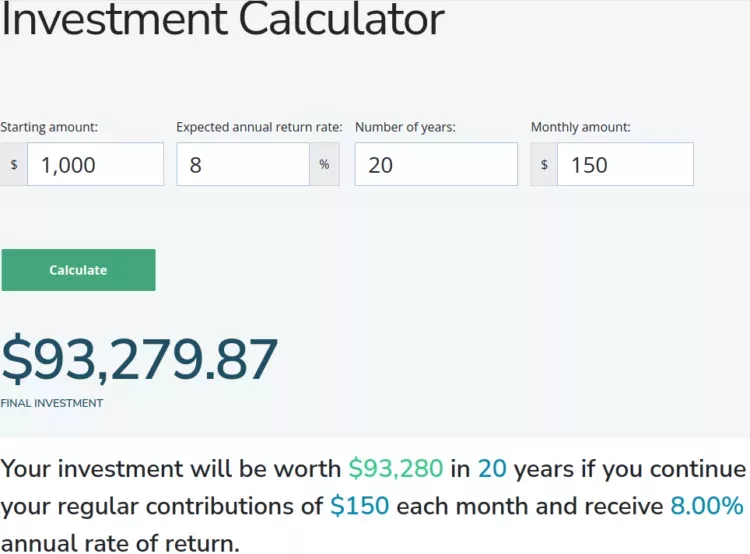

In this example, you have $1,000 to make an initial deposit into your investment. You plan to allow your investment to grow for 20 years with an expected 8% annual rate of return. Additionally, you are planning to make regular deposit contributions of $150 per month.

With that information, the investment calculator will determine that your investment will be worth $93,280 in 20 years if you continue your regular contributions and receive 8%. But without regular contributions, the investment will be worth only $4,927 in 20 years.

In addition to the numbers, you’ll find graphics to help you visualize the growth of your investment.

Factors that Affect Your Investment Returns

Many factors will affect your investment returns. However, one of the most significant factors is time. The longer you are able to leave your funds invested, the more they are likely to grow. As the saying goes: “Time in the market beats timing the market.”

Beyond the time you allow your investment to grow, there are numerous factors outside of your control that affect investment returns. These include interest rates, economic growth, inflation, government policy, and more. Ultimately, you cannot control the return on your investments. But you can control the amount of time you leave your funds invested.

Average Stock Market Return Over Time

It’s no secret the stock market is a volatile investment. Although there are strategies to help mitigate market volatility, annual returns will likely vary dramatically from year to year.

For example, information provided by New York University highlights the unpredictability of annual stock market returns. The S&P 500 provided a yearly return of -4.23% in 2018 but 31.21% in 2019.

However, the average annual return of the S&P 500 was 14.38% between 2010 and 2020. The regular market swings make it difficult to predict how well your stock market investments may perform, especially over a shorter period of time.

Average Bond Returns Over Time

Bonds are another type of investment that can offer more predictable returns. Highly rated bonds can provide lower levels of risk, but that can lead to less lucrative returns.

Since 1926, long-term government bonds have returned between 5% and 6%. However, the rate of return will vary based on the type of bond you choose to invest in, and interest rates on bonds have declined significantly in recent decades.

Average Real Estate Returns Over Time

Real estate is a popular investment choice. The price of real estate has risen over time. But on average, the median home value has increased at an annualized rate of 5.5% since 1940.

Like other investments, different types of real estate will see different levels of return. Additionally, your style of investment in real estate will impact your returns. For example, you may see higher returns in a risky flip. But a buy and hold strategy could lead to more reliable returns, especially if it’s a rental property that produces a steady cash-flow stream.

Risk Vs. Return

In general, the more risk associated with a particular investment, the higher potential returns will be. The concept of higher risk can lead to enticingly high returns. As you build an investment portfolio, you’ll need to decide for yourself what levels of risk you are comfortable accepting.

In some cases, you may be open to more risk that leads to the possibility of bigger returns. But in other situations, you may seek out a low-risk investment with a more reliable return.

Summary

An investment calculator can help you map out the future value of your investment portfolio. Although it can be challenging to determine an exact rate of return, it is still useful to explore the possibilities. Take some time to explore the possibilities of your investment portfolio with the right combination of time, capital, and investment returns.

RELATED: Quick 3-Step Test: How Much Investing Risk Can You Stomach?