Classic Car Loan Calculator

If you've been eyeing that restored muscle car, or watching online cars auctions, and wondering how people buy classic cars, the truth is that many people buy them with classic car financing. While traditional new vehicle loans may offer lower rates than classic car loans, many classic cars are actually appreciating in value, making them an investment rather than a liability.

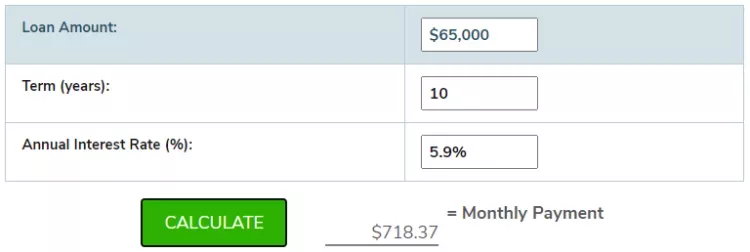

We've put together a classic car loan calculator to help you figure out how much you can afford to spend on your dream car.

What Is a Classic Car?

Classic. Vintage. Antique. Rare, older cars have become a great investment, but what exactly is a classic car? While classic cars don't have a strict definition, a car may be considered "classic" if it is 20 years or older.

For insurance purposes, each state has its own definition of a classic car, but typically it’s a car between 20 and 40 years old. Antique and vintage cars are typically at least 45 years old, and have been restored to their original manufactured specifications.

While the definition may vary, most classic cars need to stay in original condition to truly be considered a "classic." When looking for an auto loan on a classic car, lenders will typically have guidelines for what age and make/model qualifies as a classic car.

How Does the Classic Car Loan Calculator Work?

To use the classic car loan calculator, you will need to input the following information:

Total loan amount. This is the total amount you wish to borrow for the classic car purchase. This does not include the down payment for the car.

Loan term (in years). This is the total length of the loan. Classic car loans can go up to 10 years (or more), depending on your lender.

Annual interest rate (%). This is the annual interest rate percentage you will pay on the loan. This is usually expressed as the annual percentage rate (APR).

The purpose of this calculator is to show you the estimated monthly payment for a classic vehicle loan. The loan term and interest rate can greatly affect your monthly payment, as well as the total amount of interest paid over the life of the loan. When using the calculator, try adjusting the rate to see how it affects your payment and overall loan terms.

Example of Classic Car Loan Calculator

Let's walk through a hypothetical example of how to use this calculator:

Imagine you are looking to buy a 1970 Chevelle SS 454, but don't have $75,000 sitting around. You know the car might appreciate in value, and want to see how much your monthly payment would be if you got an auto loan instead. You have $10,000 to put on a down payment, and a 720 credit score.

Here's what you'll need to input into the calculator:

Total loan amount: $65,000

Loan term (in years): 10

Annual interest rate (%): 5.9%

Note: The interest rate will depend on your credit score and overall credit profile.

As you can see from this example, buying a classic 1970 Chevelle with a $10,000 down payment with a 10-year auto loan would require a $718 monthly payment, assuming that interest rate.

But this doesn't tell the whole story. If you check out the amortization schedule, over the life of your 10-year loan, you will pay over $21,000 interest.

This is an important cost to understand before signing any loan agreement.

How Do I Get a Classic Car Loan?

To get a classic car loan pre-approval, you will need to provide personal and financial information to a lender that specializes in class cars. This includes your name, address, credit score (including a credit check), as well as income and bank statements.

But before you go out shopping for a vintage car, here are a few steps you can take to ensure you find the best loan for you:

Check Your Credit Score

As with any car loan, having a good credit score will help you qualify for a loan with better terms, including a lower interest rate and smaller down payment requirement. Most lenders will require good or excellent credit for credit approval of a classic car loan.

Save a Down Payment

Most lenders will require a downpayment to obtain a vehicle loan, so make sure to have some money set aside for your purchase. This amount can vary per lender.

Shop Around

Don't just go with the first lender you find. Shop around to find the best rates and loan terms that work for your financial situation. Here are a few lenders that offer classic car loans:

Mershon's

Woodside Credit

Lightstream

Suntrust Bank

Premier Financial Services

Contact a few lenders to learn their terms, rates, and vehicle requirements for qualifying. This will help you find the best rate.

Consider a Personal Loan

If you don't want to jump through the hoops of meeting specific lender requirements for obtaining a classic car loan, you may want to consider using a personal loan instead. Not to be confused with a secured loan, which ties your loan to an asset (such as your home), personal loans are based on your creditworthiness (the ability to pay back the loan). Most banks and credit unions offer personal loans, andshopping around to find the best rates can help you find a personal loan that won't break the bank.

What Is the Oldest Vehicle a Bank Will Finance?

While most banks shy away from financing vehicles that are more than 10 years old, classic car lenders may fund some of the oldest cars in existence, considering them antique cars. Classic car loan providers typically consider cars that are 25 years (or older) to be a classic, but usually want those vehicles in original factory condition, and to have some market value.

Who Will Finance an Older Car?

Classic car loan providers are typically the only lenders that will finance older cars. While some banks and credit unions will consider financing cars up to 15 years old, vehicles that are much older will need specialized financing.

Some lenders will have minimum loan amounts, and specific requirements for the types of vehicles they will finance. Always check with a lender first to ensure they cover your desired vehicle before shopping for a specific car.

Summary: Own Your Dream Car at a Dream Rate

If you're ready to fund your dream car, finding a competitive rate on a classic car loan can help make this a reality. Improving your credit score, saving a down payment, and shopping around for lenders will help you get the lowest rate available and affordable monthly payments. And using this calculator can help you set your savings goals and budget for your favorite collector car.