Homes are most people’s greatest financial asset, so making wise financial decisions is crucial to protect these investments. Home equity loans and a home equity line of credit (HELOC) are two types of loans that use the value of a home (or its equity) as collateral against the loan.

Get a Home Equity Quote

Get a quick and easy home equity loan quote now.

What Is a Home Equity Loan?

A home equity loan is a fixed-rate loan that’s based upon the equity (or value) of a home. They’re often called ‘second mortgages’ because they work similarly to a mortgage, using your home as collateral against the loan. Like a mortgage, home equity loans are repaid in installments.

Many homeowners take out a home equity loan to make major improvements to their home. Home equity loans, however, can be used for anything the borrower needs. This includes paying off higher interest loans.

How Does a Home Equity Loan Work?

Home equity loans enable homeowners to borrow up to 85% of the home’s equity. Equity is estimated by taking the appraised value of your home and deducting the outstanding balance on the mortgage (or any other liens against the house).

If your loan application is approved, you’ll receive the amount as a lump sum. The lender expects repayment of the loan on a fixed schedule. Each payment amount includes principal plus interest.

What Is a Home Equity Line of Credit (HELOC)?

A home equity line of credit (HELOC) is another form of a home equity loan. Instead of paying out the loan’s value in a lump sum, it offers a line of credit you can borrow against, repay, and continue to borrow from if needed. Payments are then made on the amount borrowed.

Like a home equity loan, if you are late with payments or fail to pay off a HELOC, the lender can foreclose on the home itself. It is also a loan with an adjustable rate, which means that the rate can change over time.

How Does a Home Equity Line of Credit Work?

Homeowners apply for a HELOC with the lender of their choice. After the lender reviews the home owner’s credit history and the value of the home, it will assess the amount of equity available. Equity is used to determine the loan-to-value ratio. This is the amount that the lender is willing to lend based on how much is owed on your current home.

To access an HELOC, you’ll write a check against the HELOC account or use a debit card linked to the account. It works similarly to a credit card, enabling you to take out as much as you need and repay it as you go.

The amount available to use is the total credit line amount minus any outstanding payments. For example, if your HELOC is $10,000 and you’ve used $2,000 (but haven’t repaid it yet), you still have $8,000 left in the line of credit. Once you repay the $2,000, the full $10,000 is available again.

Home Equity Loan vs HELOC: Which Is Better

Which is better: a home equity loan or a HELOC? Compare these features to determine which is best for you:

| When is the money available? | Money available as lump sum | Money available as revolving line of credit |

|---|---|---|

| How are payments made? | Fixed payments | Payments vary according to what has been borrowed |

| Can you lose your home if you fail to repay it? | Yes, your home is the collateral | Yes, your home is the collateral |

| Are there any tax benefits? | Yes, you may be able to deduct interest if the loan is used for home improvements | No, you cannot deduct the interest or amount of HELOC payments |

| Are there costs besides interest? | No | Yes, there may be transaction fees, annual fees, or early termination fees |

| Are the closing costs different? | Closing costs are 2 to 5% of the loan amount | Closing costs are 2 to 5% of the total line of credit |

Can You Have a HELOC and a Home Equity Loan?

There’s no limit to the number of HELOC or home equity loans you can have, provided the lender believes you have enough equity in your home to repay the loan. If you own multiple properties, such as a main residence and a vacation home, you may also take out a HELOC, home equity loan, or both on these properties.

Lenders may be reluctant to agree to a HELOC or home equity loan if they believe a property is overleveraged (meaning there is too much borrowed against its value). They may also turn down what they consider are excessive credit requests if they believe the borrower won’t be able to repay the loan.

Calculate Your Home Equity

First, determine the appraised value of your home. You can estimate your house’s value by looking at real estate ads for houses with similar features in your neighborhood (e.g. the same number of bathrooms, bedrooms).

Take the value of your home and subtract any outstanding loans against it, including the mortgage. The result is the approximate amount of equity in your home.

Home Equity Formula

To calculate the amount of equity you have in your home, use this simple formula.

Current appraised value of your home - mortgage balance = home equity

Let’s assume your home recently appraised for $260,000. The balance due on your mortgage is $120,000.

$260,000 - $120,000 = $140,000 home equity

Combined Loan to Value

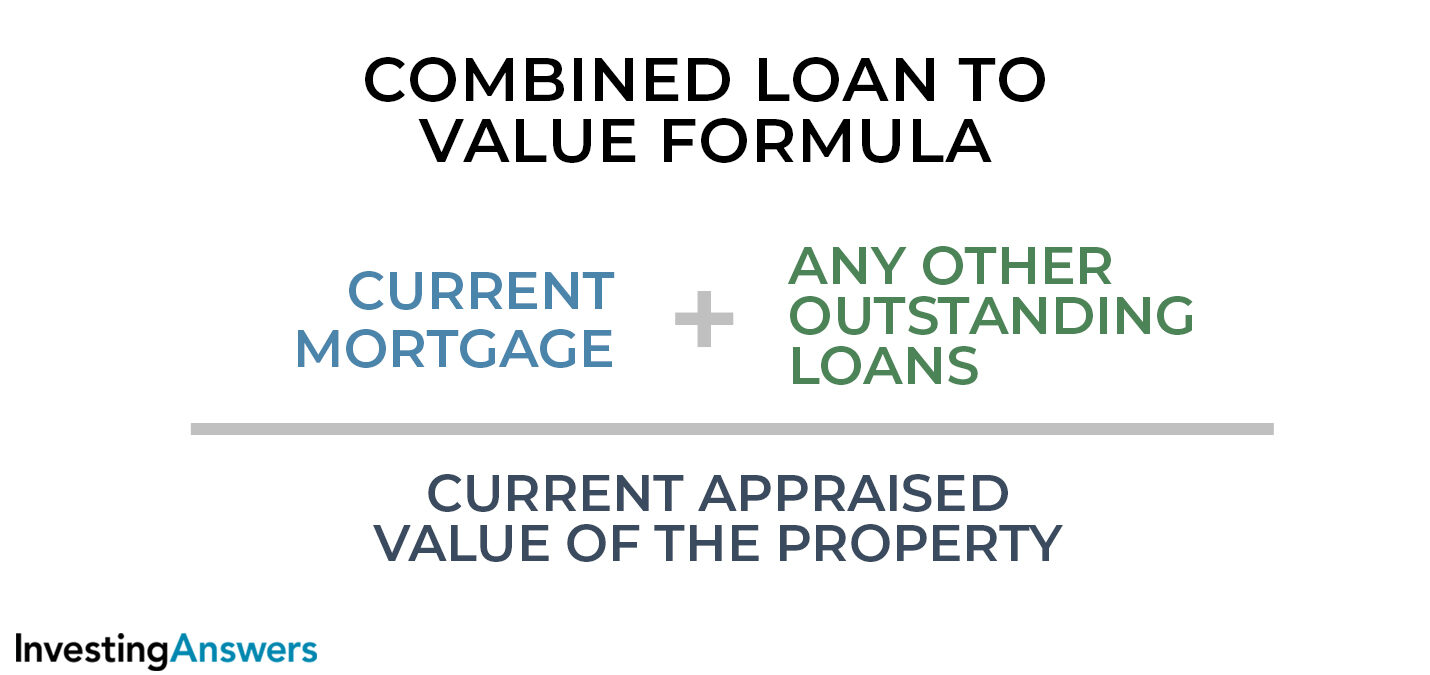

Another calculation you may need is the combined loan-to-value (CLTV). Along with your credit score, your CLTV is what lenders use to determine the final amount of a potential home equity loan. Most lenders require a CLTV of 85% or less to grant a home equity loan.

To find CLTV:

To find a current estimated appraisal value, use a real estate site (e.g., Zillow) or look through real estate ads for your area. Find properties comparable to yours and use the prices as a rough estimate of what your home may be worth.

How Much Home Equity Can You Afford?

To determine how much you can afford, use a home equity loan or HELOC calculator, below, to determine the loan repayment schedule.

Home Equity Loan Payment Calculator

The following home equity loan payment calculator uses today’s rates to help you determine how much of a loan you can afford, as well as the payment schedule.

Home Equity Line of Credit Payment Calculator

This home equity line of credit payment calculator helps you compare credit offers and find the right one for your needs.

How To Find a Home Equity Loan

Like other loans, you must apply for a home equity loan from a financial institution such as a bank or a credit union, or a non-depository financing company. It’s a smart idea to shop around and compare various lenders’ rates and offers before finalizing a home equity loan.

Read your loan papers carefully and ask questions before signing the contract. If you don’t approve of the terms offered to you, you can try negotiating with the lender to request changes. You are free to take your business elsewhere.

Note: Just because you’ve gone through the appraisal process and have the paperwork in hand does not mean you are obligated to sign it.

To find a home equity loan, follow these steps.

1.Gather Your Financial Documents

You’ll need the following information to apply for a home equity loan:

- Identification (including your social security number)

- Current income (e.g. pay stubs) and proof of income (e.g. W2s

- Two years’ worth of employment history and contact information for each employer

- Proof of home ownership (e.g. deed, mortgage document, sales papers)

- Home insurance declaration which can be obtained from your insurance company

- Debts or support obligations (e.g. alimony, child support)

- Current mortgage statement

- Paperwork for any other debts or liens on your home

- An appraised value of your home

2. Take a Financial Inventory

Examine your current financial state. A financial inventory should include your total income, total debts, and credit score. A credit score of 620 or higher is required for a home equity loan. To find your credit score, visit Experian, TransUnion, or any company that calculates credit scores. A HELOC application shows up on a credit score like a credit card application, so be careful with how many times you apply for credit. It may negatively impact your score if you apply for too much credit at once or have too many credit lines and cards open.

3. Calculate Home Equity

Go into the loan negotiation process with a clear idea of your home’s value and equity so you have a better idea of what your loan might be. Use the formulas above or InvestingAnswers’ calculators to determine this number.

4. Estimate Loan Needs

The amount you need depends on the reason for the loan. If you know that a planned kitchen remodel will cost $20,000, you can estimate your loan needs as $20,000 and up (including a cushion for project cost overruns). Your credit score and combined loan-to-value (CLTV) typically determine the final amount that lenders are willing to give you.

5. Shop for a Loan

Shop around for loan rates and offers. Discuss your loan needs and complete your application paperwork with several lenders so you can compare offers and rates. Remember: Just because you have applied for a loan does not mean you are obligated to work with that lender.

6. Complete and Sign Paperwork

Once you’ve found the lowest rate and the most favorable terms for your situation, complete the loan paperwork and sign the required documents.

Remember the “Three-Day Rule”

What if you change your mind after signing the home equity loan payments? The FTC states there’s a Three-Day Rule which gives you three days to cancel a loan (or any other sales) without penalty.

Find the Best Rates for a Home Equity Loan in 2021

Choose from among these lenders to begin your search for a home equity loan.

How to Find a HELOC

Shopping for a HELOC can be daunting. To find the best HELOC for your needs, follow these steps.

1. Gather Documents

As with a home equity loan, you’ll need to gather a list of documents including income statements, debt amounts, proof of home ownership and insurance, the home appraisal amount, employment history, and credit score.

2. Find Lenders

Start with your personal bank, local banks, credit unions, and other lenders. You can also search online for specific HELOC lenders.

3. Read the Fine Print

Some lenders offer a low introductory rate but raise it considerably after the introductory period is over. Understand what rates are being charged and when the introductory period ends.

4. Understand Rates and Markups

Most lenders advertise that their rates are based on the prime rate, but there’s a catch: They often increase the prime rate. Again, read the fine print and see how much of a markup each lender adds onto the prime rate.

5. Note Potential Rate Increases

Don’t assume that the initial interest rate you’ll be charged on a HELOC is the rate it will always be. In addition to markups over prime, HELOC rates may include a limited-time discount.

6. Check Lifetime Rate Caps

If rates rise over the lifetime of the loan, a lifetime rate cap may be beneficial in limiting the amount of interest that can be charged.

7. Compare Rates

Examine and compare all of the loan variables, including the base rate (ie. prime or index), the margin and markup of the loan, introductory period, any initial discounts offered by the lender, and lifetime rate caps.

8. Avoid Excess Fees

Some lenders offer low introductory rates followed by higher rates and fees at a later date. Others charge inactivity fees if you choose not to use your HELOC. Others actually charge penalties for repaying the HELOC early. For example, you may be fined if you take out a HELOC to make significant improvements to your home in order to sell it, then repay the HELOC early after a quick sale. Negotiate these fees or choose another offer to avoid them.

| Common HELOC Questions | |

|---|---|

| What is the base rate for the loan? Is the lender using prime or index? | This tells you what interest rates are based on. |

| What is the lender's markup on the loan? | Lenders may markup or increase the base rate to make an added profit on the loan. |

| How much is the lender willing to offer me? | Although it is likely that you'll see similar credit offers, some may be much higher or lower than others. Take careful note of the credit lines lenders are willing to extend to you. |

| Is there an introductory period? | Some HELOCs offer discounts, lower interest, or lower payments during a special introductory period. When the period ends, rates can increase or other changes may occur that aren't as favorable. It's important to note whether this is in your loan agreement. |

| Is there a maximum interest rate cap? | Helps limit interest amount during times of rising interest rates. |

| When does the draw period end? | The draw period is the time when you can take money out of a HELOC. When it ends, you have to repay the loan. |

| Is there a balloon payment? | A balloon payment HELOC offers lower initial payments with one large payment due at the end of the draw period. |

| Are there prepayment penalties? | Some HELOCs have penalties if you pay before the end of the draw period. |

| Are there inactivity fees? | An inactivity fee is a fee charged for not using the HELOC. Avoid this fee - why pay for what you aren't using? |

9. Sign the Paperwork

Once you’ve found the best HELOC opportunity for your needs, complete and sign the loan application to finish the process.

Find the Best Rates for a Home Equity Loan in 2021

We’ve made it easy to find the best rates for a home equity loan. Use the handy table, below.