How Do Auto Loans Work?

Auto loans are secured installment loans offered by banks and credit unions. In order to finance the purchase of a new or used automobile, financial institutions will step in to cover the balance beyond your down payment. In turn, the bank or credit union will put a lien on the car, as guarantee of payment. If the borrower falls behind or goes delinquent, the lender can repossess the car.

There are two main ways auto loans are written and originated. If a consumer gets a loan from an auto dealer, they are shopping through the indirect market. When borrowers get their car loan pre-approval directly through their bank or credit union, however, they are shopping on the direct loan market.

What Is a Good Interest Rate for an Auto Loan?

No matter where you get your auto loan, the rate is based on several factors: Your credit history and the current prime rate all play into your final interest rate.

According to the most recent quarterly report by Experian, the average auto loan interest rate for new cars is 4.12%, while the average interest rate for used cars is 8.70%. However, your best car loan interest rate will be based on your credit score.

For example, if you have a prime credit score between 661 and 780, a good interest rate is around 3.54% on a new car (or 5.54% on a used car). If you have less-than-great credit, you could face anywhere between 6.64% and 10.81% interest (or between 10.43% and 17.26% on a used car).

Average Interest Rates for Auto Loans

| New Cars | Used Cars | |

| Super Prime Credit (781 - 850) | 2.41% | 3.71% |

| Prime Credit (661 - 780) | 3.54% | 5.54% |

| NonPrime Credit (601 - 660) | 6.64% | 10.43% |

| SubPrime Credit (501 - 600) | 10.81% | 17.26% |

| Deep SubPrime Credit (300 - 500) | 14.66% | 21.07% |

Best Auto Loans in 2021

Best Overall: Bank of America Auto Loan

Bank of America offers great rates for auto loans, with multiple loan lengths and options available. Bank of America provides loan options for new and used vehicles, as well as lease buyout, private party loans, and auto refinancing. With an A+ rating from the BBB, and only one formal complaint to the CFPB in the past three years about auto loans, Bank of America offers quality servicing of auto loans.

Pros

-

Auto loans for most every type of purchase

-

Competitive rates for qualified borrowers

-

Quick application decisions and funding

-

Transparent pricing

-

A+ rating from BBB

Cons

-

Higher minimum loan amounts

-

Won’t finance a car over 10 years old

Loan Rates

Bank of America provides low rates on new and used vehicles. Here are the current loan rates for as of 2021:

-

Dealer New: 2.39%

-

Dealer Used: 2.59%

-

Refinance: 3.39%

-

Lease Buyout: 3.39%

Private party purchase rates will vary. Rates listed above are for highly-qualified borrowers with excellent credit. Bank of America also offers up to a 0.50% rate reduction for Preferred Rewards Members as well.

Loan Qualifications

Bank of America offers loans to credit-worthy applicants on new, used, and private party purchases. To qualify for a loan, the vehicle being purchased must be 10-year-old (or newer), have less than 125,000 miles, and worth at least $6,000. Bank of America will not approve an auto loan for less than $7,500.

Best for Online Applications: Capital One Auto Loan

Capital One auto loans are a great choice for a full online experience, including pre-approval, application, and funding for new and used vehicle purchases. Capital One is great for those who don’t want a hard credit pull to see if they may qualify for a loan, offering a quick pre-approval process all online.

Capital One also has a built-in auto navigator tool that shows pre-qualified rates and terms on vehicles at nearby dealerships. This gives consumers an easy way to shop for nearby cars online, and then they can present the pre-approval offer at the dealership when going to purchase the vehicle.

Pros

-

Instant online pre-approval available

-

Online car shopping portal with rate details

-

Quick decision and funding on applications through dealerships

-

A rating from BBB

Cons

-

Strict vehicle standards (no private party)

-

Won’t finance a private party car purchase

Loan Rates

Capital One rates may vary depending on the applicant’s credit-worthiness and the vehicle being purchased. Rates for new car purchases are typically lower than used cars. Refinance rates will vary. Private party purchases are not available.

Once you submit a pre-qualification application, rates will be listed next to the vehicle you are looking at on the Auto Navigator tool.

Loan Qualifications

Capital One offers loans to credit-worthy applicants on new and used purchases. To qualify for a loan, the vehicle being purchased must be 12-years-old or newer, have less than 120,000 miles, and worth at least $4,000. Capital One does not finance lease buyouts or private party purchases.

Best for Buying from a Dealership: Wells Fargo Auto Loan

Wells Fargo works directly with over 12,000 dealerships in the United States to offer auto loans. Although those who bank with Wells Fargo can apply for a car loan in their local branch, they do not offer car loan pre-approval online.

When looking to finance your car purchase through a dealership, you can ask them for a Wells Fargo loan. Wells Fargo customers can also apply in-branch. Wells Fargo offers financing on both new and used vehicle purchases, with terms up to 72 months available.

Pros

-

Available at over 12,000 dealerships nationwide

-

Online car shopping portal with rate details

-

Quick decision and funding on applications through dealerships

-

A rating from BBB

Cons

-

Pre-approval not available, even for Wells Fargo customers

-

No private party car purchase loans

Loan Rates

Wells Fargo rates may vary depending on the applicant’s credit-worthiness and the vehicle being purchased. Rates for new car purchases are typically lower than used cars. Loans are issued through a partner dealership or at Wells Fargo branch for current customers. Private party purchases are not available.

Loan Qualifications

Wells Fargo auto loan qualifications will vary based on location and dealership. Since Wells Fargo partners directly with the dealer, there are no stated minimum qualifications for age and mileage of vehicles being financed. Ask your dealer for more details.

Best for Military Members: USAA Auto Loan

While membership into USAA is limited to active-duty military, honorably-discharged veterans, and their immediate families, their banking products are highly-rated. USAA Bank offers auto loan pre-approval that’s good for 45 days, which applicants can take to a dealership for financing.

Rates are competitive, and loan terms are available up to 84 months. USAA has an A rating with the BBB, and the CFPB has received 82 vehicle loan complaints about the bank over the past three years.

Pros

-

Pre-approval good for 45 days

-

Competitive rates for qualified borrowers

-

Rate discount for auto-pay

-

A rating from BBB

Cons

-

Must be a member of USAA to apply

-

Rates not available online for refinance or private party loans

Loan Rates

USAA offers low rates on new and used vehicles. They also can refinance your car (if not a current USAA auto loan), or help you finance a lease buyout. Here are the current loan rates for as of 2021:

-

New car: Starting at 1.89%

-

Used car: Starting at 2.79%

-

Older car (8 years or older): Starting at 5.99%

Refinance and lease buyout rates will vary. Private party purchase loans are also available. Rates listed above are for highly-qualified borrowers with excellent credit. USAA also offers a 0.25% rate reduction for customers who pay their loan with auto-pay.

Loan Qualifications

To qualify for a loan, there are no vehicle minimum qualifications. USAA loans are classified as new, used, or “older”, with a minimum financing amount of $5,000. The best rates are reserved for newer vehicles, while older cars come with a higher interest rate.

Best for Used Cars: Chase Auto Loan

Chase offers auto loans both direct to consumers and through a network of dealerships across the United States. The bank offers a pre-qualification process on their website that’s based on users’ income and credit. Pre-qualification lets you walk into any dealership with a letter stating what you are qualified to purchase, making used car shopping a breeze.

After answering a few quick questions, Chase will use a soft credit check to determine how much you may qualify for. Chase has an A+ rating with the BBB, and the CFPB has received 664 complaints about auto loans over the past three years.

Pros

-

Pre-qualification available online

-

Chase can finance vehicle online, or direct through a dealership

-

Competitive rates on new and used car loans

-

Online shopping portal with local partner dealers available

Cons

-

Pre-qualification not available on cars under $10k

-

Private purchase financing not available

-

Must purchase at Chase network dealership

Loan Rates

Chase loan rates will vary based on your credit-worthiness, location, and the year, make, and model of the vehicle you want to purchase. New and used car rates are competitive with other national brands, but you will need to use the Chase loan calculator for exact rates estimates. Chase also offers a 0.25% discount to Chase Private Client customers.

Loan Qualifications

Chase will finance new and used cars, with a few minimum qualifications. The vehicle must be 10 years old or newer, have less than 120,000 miles, and you must finance a minimum of $4,000. The vehicle must also be at a Chase network dealership, no private party loans are available. Both pre-qualification and full loan applications can be done online.

Best Credit Union: Consumers Credit Union Auto Loan

Consumers Credit Union is a national credit union that offers membership to any U.S. citizen, and has some of the best auto loan rates available. New car loan rates start at just 2.24%. With online applications and no hidden fees, Consumers is our top pick for credit union auto loans.

Consumer Credit Union also has an A+ rating with the BBB, and the CFPB has received 189 complaints about auto loans over the past three years.

Pros

-

Low rates for both new and used car loans

-

No loan minimums

-

No down payments required

-

Up to 0.50% rate reduction available

Cons

-

Membership required to qualify

-

No private party loans available

Loan Rates

Consumers Credit Union offers low rates on new and used vehicles. Here are the current loan rates for as of 2021:

-

New car: Starting at 2.24%

-

Used car: Starting at 2.49%

-

Older car (7 years or older): Varies

Rates listed above are for highly-qualified borrowers with excellent credit. Consumers Credit Union also offers a 0.50% rate reduction for customers who pay their loan with auto-pay, or a 0.25% rate reduction for payments from another financial institution.

Loan Qualifications

No vehicle age or mileage maximums are enforced for an auto loan, though the best rates are available for cars that are 6 years old (or newer). There is also no minimum or maximum loan amount, so borrowers can borrow as little or as much as they qualify for. Approval and rates are based on credit score, vehicle being purchased, and income.

What to Consider When Shopping for an Auto Loan

When shopping for an auto loan, there are multiple factors you need to keep in mind. Probably most important is your credit score, as it could have a significant impact on your rates and monthly payment.

According to Experian, Borrowers with a credit score of 781 or above had an average new-car interest rate of 2.41%, while borrowers with much lower credit scores (501 - 600) had an average rate of 10.81% on new car purchases. This is more than three-times the interest rate of those with excellent credit.

You will also need to consider the loan term, as shorter terms typically have lower rates, and a lower overall cost over the life of the loan. With 72- and 84-month loans becoming popular, it’s a good idea to calculate the total interest you will pay over the life of the loan before borrowing.

Finally, you need to give yourself a set budget for your car purchase, to ensure you can continue to afford the payments, as well as have a plan to pay off the loan eventually.

Historical Auto Loan Rates

According to the Federal Reserve, auto loan interest rates have been dropping for over 10 years. The historical data on the FRED Economic Data site shows that average auto loan interest rates on new car loans were about 8.0% in 2007, and dropped all the way down to around 4.0% in 2014. Over the past few years, there has been an uptick in rates, with current new car auto loans hovering around 5.0% on average.

Why Get Pre-Approved for an Auto Loan?

Every year, thousands of Americans go auto shopping without realizing they can get an auto loan without the help of their car dealer. According to the Federal Deposit Insurance Corporation (FDIC), just over 40% of loans originate at auto dealers, but these often come with hidden fees, increased rates, and other dealership incentives that cost the consumer.

Getting an auto loan pre-approval gives you the ability to get direct financing from a financial institution without additional changes and add-ons that most car dealers profit from. This gives you more negotiating power and protects you from needless charges. You may also be able to secure a lower interest rate, better loan terms, and lower monthly payments.

Set a Realistic Purchase Price

By getting your loan term and interest rate up front, you’ll be able to control your monthly payments long before setting foot in any auto showroom. This cuts through much of the negotiations and lets you find the right auto for your budget and lifestyle.

Avoid Dealer Add-Ons

Although car dealerships make money by selling cars, they make even more on all the additional options – which get added to your final loan. Everything from extended warranties to clear-coat applications add a premium to car prices, which go straight into the dealership’s pockets.

Walking in with a car loan pre-approval means that you’ll have your monthly payment and loan term in advance. This will help ensure that you get only what you pay for (without hidden add-ons).

Secure a Lower Interest Rate

A car dealership has the ability to work with many different lenders. What they won’t tell you, however, is that for every loan they originate, they receive a commission. In many situations, that commission is passed on to you in the form of a higher interest rate.

Having an auto loan pre-approval letter allows you to skip the drama of waiting on bank approvals. You may be able to secure a better interest rate by working directly through a bank or credit union, instead of waiting on a dealer to find the best opportunity for their bottom line.

Strengthen Your Negotiating Power

If you rely on a loan from your auto dealership, the sales team has the power to determine the final sales price. Because they have to determine whether you qualify for a loan – and which terms are best for them – they can lock you into a payment which may be higher than you are comfortable with.

If you walk into a car dealership with a car loan pre-approval letter in hand, you’re already a qualified buyer with money to spend. This gives you leverage during price negotiations. In certain situations, car sales teams may actually be willing to reduce an auto’s price if you are prepared to make a purchase.

What You Need to Get Pre-Approved for an Auto Loan

Once you’ve decided to get your auto loan pre-approval, it’s time to go through the application process. Before a bank or credit union will give you a car loan pre-approval letter, you will need to prove your identity, your monthly income, and know your credit score.

Proof of Identity

When applying for a car loan pre-approval online, you will be required to prove your identity. In many cases, your potential lender will pull personal questions from your credit report in order to verify your identity.

This process isn’t always a failsafe option. If you get an answer wrong, you may be asked to submit additional documentation. This may include a copy of your state-issued photo ID, social security card, and proof of residence. In most situations, you can submit these documents online through a secure portal provided by the lender.

Income Requirements

In order to qualify for an auto loan pre-approval, you may also be asked to prove your ability to pay. If a lender cannot verify employment during your application process, you’ll need to submit supporting documents.

In order to prove that you have a steady source of income, requested documents from a lender may include your most recent W-2 Form, pay stubs, or tax returns from the past two years. Again, these documents can often be sent online through a secure portal.

Minimum Credit Score

Finally, your interest rate and the amount you are allowed to borrow will ultimately depend on your credit history and credit score. According to Experian, the minimum credit score varies by auto loan lender, making it difficult to know the exact minimum credit score required. In the most basic terms, the better your credit score is, the better your loan terms may be.

Before you apply for auto loan pre-approval, you’ll want to do everything you can to maximize your credit score. This includes paying down debt, reducing your debt-to-income ratio, and minimizing your credit applications.

Auto Loans for Bad Credit Are Available

During the shopping process, many shoppers wonder: “If my credit isn’t great, can I get a car loan?” Even if you have subprime credit, auto loans are available. Certain banks specialize in working with individuals rebuilding their credit after a bankruptcy or period of bad credit.

Even though you can still get an auto loan with bad credit, your interest rate will almost certainly be higher than those who have good credit. Before starting the process, take a close look at your budget to determine how much you can afford. Use an auto loan calculator (below) to determine how much you may be forced to pay based on car price, loan term, and interest rate.

Avoid Self-Financing Car Dealerships

If you have bad credit, never go to a “buy here, pay here” auto dealer. Self-financing car dealerships often charge “excessively high interest rates,” which increase the chances of a borrower going into default.

In one such case, the CFPB took action against a car dealer that advertised loans with a 9.99% average interest rate, but forced buyers into paying for extras with their loan. Self-financing dealers often spell bad news for car buyers. Avoid them at all costs and try to get a car loan pre-approval instead.

How Much Car Can I Afford?

As you start narrowing down what kind of car you are looking for, it’s important to determine how much you can afford. While your auto loan payment is the biggest part of the equation, auto insurance premiums will add on to the monthly price tag.

During the shopping process, it’s important to get an idea of how much your monthly insurance premium may be. Because you will be relying on car financing, your insurance company will require you to carry comprehensive coverage on your car.

You may be able to work with your insurance agent or auto insurance company to determine how much your car insurance premium would be on your next vehicle, and work together to find the right vehicle, the right price, and the right insurance payment.

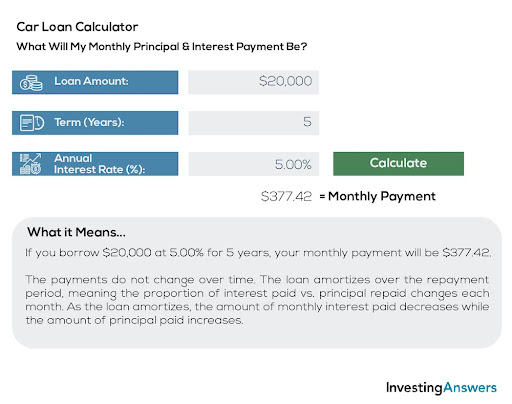

Auto Loan Calculator

If you aren’t sure where to start, use a car loan calculator to determine just how much you can afford. An auto loan calculator will help you simulate your monthly budget based on your total loan amount, interest rate, and loan term.

If you use Excel to manage your personal finances, you can use the spreadsheet program to calculate your monthly auto loan payment.

How to Buy a Car with Pre-approved Loan

Once you have the auto loan pre-approval letter from your bank – and have picked out the car you’d like – start the process by contacting the dealer to ensure it is still available. You can inform the dealer up-front that you’ll be working with a lender and will bring along your pre-approval information.

Work with the sales team to negotiate a fair price that’s not only within your budget, but also fits within the terms of your loan. After settling on the price, the dealership’s finance team will work directly with your lender to originate the loan, get the car registered with your state’s motor vehicle authority, and send the original vehicle title to the lender.

At this point, you will “own” your car, and can start making payments to your lender. Unless you have a special promotion, your first payment will usually be due within 45 days of the purchase date.