There are few places investors can turn to for a guaranteed return. The very idea of a no-risk return sounds almost mythical in this era of volatility and uncertainty.

Stocks and bonds carry no such distinction. Neither do commodities or currencies. One of the few vehicles that comes to mind is a money-market account, carrying a paltry yield as low as 0.25% that doesn't even keep pace with record-low levels of inflation.

That's why I am such a big fan of tax shelters. Even though most people don't think of tax strategies as an investment, that's what they are. And there is one little-known retirement account that blows the usual tax shelters out of the water.

What is it? I'll tell you in a minute.

Whether discussing an individual, small business or large corporation, taxes are frequently the No. 1 expense.

That means any investment in a tax-deferred entity and advanced tax strategies can have a huge impact on taxable income and the bottom line. And in an age when taxes continue to creep higher while interest rates remain at a record low, maximizing the benefit of tax-deferred accounts has never been more important.

But while the IRA (individual retirements account) and 401(k) are great vehicles for many investors, there is a little-known alternative that blows both of them away.

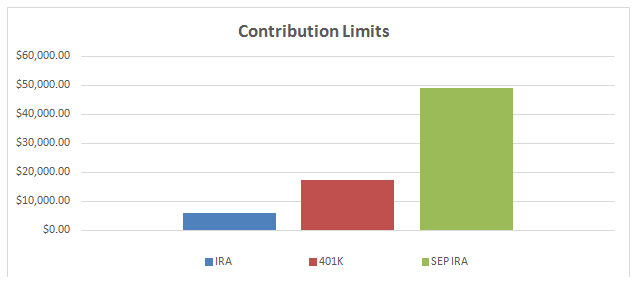

The current-year contribution limit for an IRA is $6,000 while the limit on a 401(k) is $17,500. But this super-charged IRA I am about to reveal leaves both in the dust with a whopping contribution limit of $49,000, or 25% of taxable income. What is it? It's called a SEP IRA.

A SEP IRA is a type of traditional IRA for self-employed individuals and small-business owners. (SEP stands for Simplified Employee Pension.) Any business owner with one or more employees, or anyone with freelance income can open a SEP IRA for themselves or on behalf of their employees.

Tax-deductible contributions from the business on behalf of the participants are deposited into a SEP IRA and held in the employee's name. Employees of the business are not allowed to contribute -- that is the responsibility of the employer. Employees are eligible if they are at least 21 years old, have worked for the company in three of the last five years and received at least $550 in compensation during the year.

As an employer, a company is not required to make a contribution every year. But when an employer does decide to make a contribution, they are required to fund the SEP IRA of every eligible employee. Each individual SEP IRA contribution is then capped at $49,000 annually, or 25% of total annual income.

The value of this super-charged IRA account cannot be overstated.

At the highest level, it is a huge tax shelter and amazing retirement vehicle for the owner of a company and the employees. The robust contribution limits of the SEP IRA far exceed those of the regular IRA and the small-business 401(k), which is usually loaded with hidden fees that make them extremely expensive.

That means the robust contribution limits for the SEP IRA can have a huge impact on taxes at the end of the year. In an environment of record-low interest rates where the 10-year Treasury note is yielding 1.6%, reducing your tax bill is no different than putting huge, no-risk returns in your pocket. And with robust contributions limits, the SEP IRA is an unparalleled vehicle for reducing taxes to put money back into your pocket.

For the standard corporate tax rate of 35%, a company with a $100,000 profit would pay $35,000 in taxes. But with a 25% contribution to a SEP IRA, the company's taxable profit falls to just $75,000, creating a total tax bill of just $26,000 and creating $9,000 in tax savings.

That is an immediate, no-risk return for any company, owner or employees taking advantage of the robust contribution limits of the SEP IRA.

In addition to significantly reducing taxable profits, a contribution to a SEP IRA can provide added savings by pushing companies and participants into lower tax brackets. Although regular C corporations pay a flat 35% federal tax, flow-through entities like an S-Corp and LLC have business owners paying corporate taxes at the personal-income level, creating an opportunity for small-business owners to fall into a lower tax bracket with a robust SEP IRA contribution.

Another great benefit of the SEP IRA is its wide offering of investment options. Unlike the 401(k), where plan participants are forced to choose from a narrow list of investment options that usually includes 15-20 mutual and target-date funds, SEP IRA investors can choose from a long list of individual stocks, commodities, currencies and ETFs (exchange traded funds).

Withdrawal limits on the SEP IRA look a lot like a 401(k) and regular IRA. Plan participants become eligible for regular distributions at the age of 59 ½. Minimum required distributions begin at age 70. Qualified distributions from the SEP IRA would be handled the same way as a regular IRA as taxable income.

The Investing Answer: Setting up a SEP IRA could hardly be any easier. After SEP IRA participants have selected a brokerage firm that provides the right mix of support and service, opening a new account usually takes less than 15 minutes and can be done electronically without any in-person meetings. Then the SEP IRA account holder has a huge universe of individual stocks, ETFs, commodities and currencies to choose from while picking up huge tax savings in this little known retirement account.