To build a foundation that will carry you through the best and worst of times, avoid these six ways you can ruin your financial plan.

1. Not Living Within Your Means

Continuously going over budget and relying on savings or (gasp!) credit cards to make ends meet will make it difficult to create any headway toward financial freedom.

Financial health begins with a realistic household budget that takes into account after-tax income and actual expenses. Once you know how much is coming in and how much is going out, you can begin to make decisions on where to cut costs and save money.

2. Not Paying Off Bad Debt

Many people think putting their extra cash in a savings account is a smart move, but if they have high-interest credit card debt or loans, they're hurting their financial future.

Most credit cards have interest rates higher than the average return of most savings accounts or investments, so the size of your debt will grow faster than your earnings. If you choose to save rather than pay off your debt, you'll actually end up losing money. A good rule of thumb is to pay the highest-interest debt first, then any other consumer loans, then student loans, then start saving.

3. Not Creating a Savings Safety Net

Avoid using credit to pay for life's unexpected events and start building an emergency fund. Your financial plan should include keeping an emergency fund that holds between three months to a full year's worth of living expenses. It should be kept in cash or in a stable, liquid investment like a money-market account, not in some investment vehicle where it could be losing value.

If saving is difficult for you, jumpstart your effort by waiting for your next tax refund, cutting your electricity bill or spending less money on gas. The most important part is to get going -- you'll be glad you did. Nothing helps you sleep better than money in the bank.

4. Not Building a Secondary Source of Income

A secondary income source will help you pay off debt, pad your emergency savings, and serve as a lifeboat if you're forced to look for a new job.

Finding something that stems from your day job can be an easy way to earn extra money. Are you a nurse? Maybe you could pick up extra shifts or home health-related jobs on your days off. Are you a professional in your industry? Teach at a community college to help share your wisdom. Have a passion for knitting? Sell your home-made scarves online at Etsy.com.

5. Not Planning for Retirement

If your workplace offers a contribution-matching 401(k) plan, take advantage of it. At the minimum, contribute the amount that your workplace will match for an instant 100% return on your money, even before you make a single investment!

If a 401(k) isn't offered at your workplace, contribute to an Individual Retirement Account (IRA) or a Roth IRA. No matter how you do it, make sure you start contributing to a retirement plan ASAP. Investing in your future financial health is one of the most important steps you can take, and the tax advantages and possibility of free money make it too good to pass up.

6. Not Investing for the Long Term

People tend to focus on the here and now, leaving long-term investing out of their financial plan. Once you've paid off your bad debt, topped off your emergency fund and maxed out your retirement plan contributions, it's time to go the extra mile and start investing.

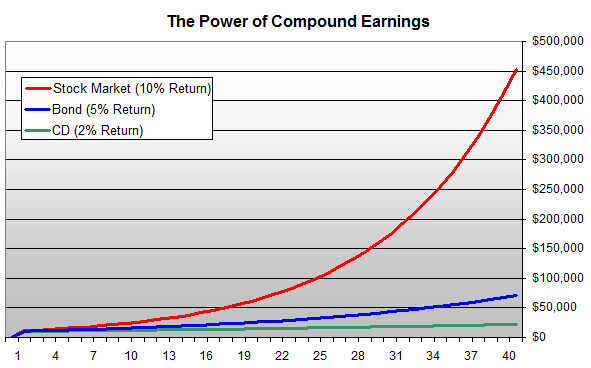

Certificates of deposit (CDs) and savings bonds offer reliable returns of 2% - 5%, but it's not even enough to keep up with inflation. If you have a large financial goal that's more than five years away, investing in the stock market can give you the extra earning power you need using the magic of compounding returns.

For example, if you invested $10,000 in the stock market and receive an annual return of 10%, at the end of year one, your investment would return $1,000. If you leave that $11,000 in the market and earn 10% for a second year, you would earn a return of $1,100, $100 more than the year before. Let the $1,100 sit for 38 more years and...

Your $10,000 has turned into $452,593!

[InvestingAnswers Feature: Beginner's Guide to Investing in Stocks]

It's tempting to relax once you've made a little progress, but it's important to stay focused on your long-term financial plan. Need some inspiration? Set short-term goals for yourself ('This month, I will pay more than the minimum balance on my credit card!'). When you meet these goals, treat yourself for all your hard work. A little splurge (within reason) can help keep you motivated and remind you of all the good things you're working toward.