Investors use the Dividend Discount Model, or DDM, as a way to find the value of a stock that pays dividends. Those dividends are valuable but since they are in the future it's not as simple as adding them up.

The calculation isn't perfect but it can work as a guide to let investors know if a stock is under or overvalued.

What Is The Dividend Discount Model (DDM)?

DDM, or dividend discount model, is used to value a stock, based on the premise that it should be equal to the sum of its current and future cash flows (but after taking the 'time value of money' into account).

In other words, DDM is calculating what the stock “should” cost considering its current value and future dividend payments.

What Is the Purpose of the Dividend Discount Model?

The dividend discount model can be used to determine the current price of a stock, as well as whether it’s under- or over-valued. Understanding the stock’s fair value will help investors determine whether to purchase it based on their goals.

For instance, if the DDM results in a value that is more than a stock’s current trading price, investors may choose to purchase the stock since it’s potentially undervalued. That is, they expect the stock price to rise to the DDM result.

Estimating Dividends & Stock Value

Estimating dividends – or even the stock value of a company – is often relatively simple. To estimate potential changes, investors can make assumptions or attempt to seek trends based on past dividend payments. However, this isn’t a guarantee.

What Is the Time Value of Money?

The time value of money (TVM) is the concept that money you currently have will be worth more in the future. More specifically, money an investor holds now can potentially earn more money in the form of interest or investment returns.

This relates to the DDM because a dividend payment that will be paid in the future is worth less today. You wouldn’t pay $100 to receive a $100 payment in two years.

But if you would pay $80 today to receive $100 in the future then the present value of that $100 is $80.

How Is the Dividend Discount Model Calculated?

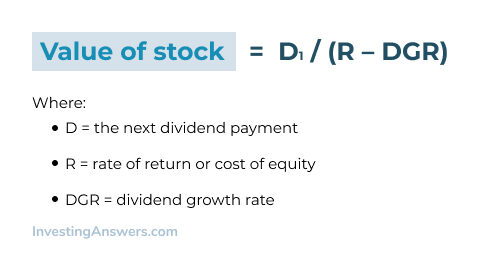

The dividend discount model is calculated using a basic valuation model that is the foundation for many other investing techniques. It combines expected future cash flows and the time value of money into one formula.

The Formula for Calculating Stock Price Using the Dividend Discount Model

There are several variations of the dividend discount model, but the most common is the Gordon Growth Model (GGM). The GGM model is as follows:

How to Find Stock Prices with the Dividend Discount Model?

The dividend discount model assumes that a stock price reflects the present value of all future dividend payments. In essence, the dividend discount model is a simple method to calculate stock prices, and it uses a formula that doesn’t require a lot of input variables compared to other formulas.

Example of The Dividend Discount Model

Let’s say the stock for Company ABC is trading at $50 per share. The company has a 10% rate of return and pays a $5 dividend per share in a year, expected to increase by 5% each year.

Using the formula, we can now calculate the stock’s value:

Value of stock = $5 / (0.10 - 0.05)

= $100

What this means is that the stock has a current price of $50 but an intrinsic value of $100, so currently the stock is undervalued. Based on this information, an investor may decide to purchase the stock, hoping that the price goes up to $100.

Is the Dividend Discount Model Reliable?

The dividend discount model can be extremely useful when determining the value of a stock based on the present value of dividends. However, there are several flaws that can make it unreliable (or even unusable) for investors.

Based on a Constant-Growth Model

The DDM model assumes that dividend payments will go up at a consistent rate for the foreseeable future. Unfortunately, most – if not all – stocks won’t have dividend payouts that increase at a constant rate.

Sensitive to Changes

Changing any of the input values in the DDM formula by even a fraction of a percent can result in huge differences in the resulting stock value.

Doesn’t Apply to All Stocks

Investors can’t use DDM to value growth stocks that pay small dividends, as well as stocks that don’t pay dividends.

Alternative Dividend Formulas to Find Stock Price

There are several types of dividend formulas that investors can use to determine stock prices, including the discounted cash flow model and the dividend growth model.

Discounted Cash Flow Model vs Dividend Discount Model

Both the discounted cash flow and dividend discount models determine a stock’s value. The main difference is that the discounted cash flow model focuses on cash flow whereas the dividend discount model looks at a stock’s dividends.

Dividend Discount Model vs Dividend Growth Model

There are essentially no differences between the dividend growth model and the dividend discount model. Both look at a stock’s fair value and are based on current and future dividend payments. These terms tend to be used interchangeably.

Dividend Discount Model vs Gordon Growth Model

The Gordon growth model is the most commonly used formula for the dividend discount model. Named after Myron J. Gordon, an American economist, this model is based on looking at a stock's value based on the constant rate of growth of its dividends.

Should Investors Use the Dividend Discount Model?

Like any valuation method used to determine the value of a stock, the best way to use a dividend discount model is as one piece of the puzzle. In other words, don't buy a stock just because the dividend discount model tells you that it's cheap. Conversely, don't avoid a stock just because the model makes it look expensive.

To determine whether an asset is worth investing in, investors should use metrics like return on equity, price-to-earnings, and other key financial ratios.