Pacific Life Insurance Co., better known to investors as PIMCO, is perhaps the most well-respected bond fund in the world. As of the end of March, it has nearly $1.3 trillion in assets under management (AUM), and its billionaire co-founder, Bill Gross, is known far and wide as an investing genius.

Last year, investment research firm Morningstar even named Gross 'Fixed Income Manager of the Decade,' citing his timely and accurate calls on interest rate changes and currency fluctuations from 2000 to 2010. Furthermore, Morningstar said Gross 'nailed the housing bubble,' which allowed investors in PIMCO's mutual funds to avoid serious losses during the credit crisis.

So you may be surprised that the world's smartest bond expert says he prefers stocks right now. How can that be?

Why A Bond Expert Prefers Stocks

Lately, Gross has been highly critical of the low interest rate environment being promoted by the U.S. Federal Reserve. Short-term interest rates are almost zero, and they don't provide enough income for savers. Gross is particularly negative on Treasuries issued by the U.S. government. In fact, he thinks they're overvalued based on his analysis of historical yields and his opinion that yields should start ticking up in the near future.

For all these reasons, PIMCO is avoiding Treasury bonds, though it's recommending higher yielding foreign fixed income securities issued by countries like Brazil, Canada and Mexico.

But Gross has his eye on another asset class that he thinks is even more appealing. The largest bond fund manager in the world really surprised market watchers by suggesting investors consider buying dividend-paying, blue-chip stocks.

Compared to Treasuries, Gross thinks certain blue-chip stocks are much more attractive alternatives, and at a Morningstar investment conference in June, he specifically mentioned two consumer giants he liked: Procter & Gamble (NYSE: PG) and Johnson & Johnson (NYSE: JNJ). He also mentioned two utilities he found appealing: Southern Co. (NYSE: SO) and Duke Energy (NYSE: DUK).

P&G and J&J fit his criteria of global companies with stable operations that should be able to offer steady income for investors. Currently, both offer an above-average dividend yield of 3.4% and forward price-to-earnings ratios (P/E) of about 16 and 13.5, respectively. I would characterize these two stocks as a solid combination of appealing dividend income and reasonable valuations, with J&J looking more appealing because of its lower earnings multiple.

Southern Company's 4.7% yield should be appealing to those investors focused on income, and Duke's is even higher at 5.3%. Southern Co. and Duke's forward P/E multiples are about 16 and 14, respectively. These valuations are quite reasonable, but keep in mind utility companies tend to grow more slowly than those in other industries.

All About The Dividends

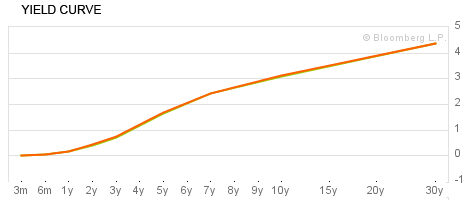

The dividend yields on these four firms are far superior to the income generated by investing in U.S. Treasuries. Below is a recent yield curve detailing Treasury yields...

As you can see, short term rates are next to nothing, with the 3-month yield on Treasuries literally at zero. The 3-year rate is marginally better at 0.83%, but investors would need to invest in a 10-year bond to get a rate above 3%. (The 10-year rate is currently 3.2%.) If you're interested in locking your money up for three decades, the 30-year rate looks decent at 4.4%, but by historical standards even this is a very low yield.

From a risk perspective, there are obviously major differences between U.S. government bonds and blue-chip stocks. Short-term U.S. Treasury securities are by definition risk-free, so in theory there is no safer investment out there. Stocks, on the other hand, are much more volatile and trade on the underlying fundamentals of the issuing firm. In other words, if P&G's business does poorly, that bad performance will be reflected in a declining stock price.

The Investing Answer: Given the extremely low interest rate environment, it makes sense to look for safe alternatives to U.S. Treasuries. Given Gross's stellar investment track record, it's difficult to disagree with his view that allocating some of your portfolio to dividend-paying blue-chip stocks makes great sense right now.

Income-minded investors may also be interested in the higher dividend yields of Southern Company and Duke. Barring another meltdown in the global financial system, blue-chip stocks should offer superior returns over Treasuries for investors willing to accept the volatility.