Question: Does being an investing contrarian actually work? Will I make money going against the market?

-- Jim S., Chicago, IL

Answer: Contrarian investing carries a special attraction for many investors. Not only does being a contrarian frequently present an opportunity to produce outsized gains, it can also be a thrill and big boost to the ego to bet against the masses and go against the grain.

Adding greater allure to the attraction of being a contrarian are the escapades of legendary hedge-fund billionaires scoring huge gains executing contrarian strategies. That includes John Paulson's $12 billion profit in 2007 after bucking popular opinion and making huge bets against housing. Fellow hedge-fund billionaire David Einhorn of Greenlight Capital Management also dazzled Wall Street in 2011 after shorting Green Mountain Coffee Roasters (NASDAQ: GMCR) before the stock's epic implosion, netting Einhorn and his firm hundreds of millions in profits.

But the reality behind these glamorous headlines is that being a contrarian is extremely risky and carries a low probability of success. And there are a few very good reasons for that.

The Risk Of Shorting Stocks

One of the most popular contrarian strategies is shorting a high P/E stock or industry. But the problem with shorting stocks is that the stock market spends a lot more time going up than going down. Since 1950, the S&P 500 is up an eye-popping 9,458%.

That rising equity tide tends to lift all stocks, making it difficult to profit on a short even with an industry laggard or struggling company. Take a look at the huge gains the S&P 500 has produced in the last 63 years.

The Risk Of Timing The Market

The second challenge of being a contrarian is timing the market. A successful contrarian investment requires perfectly timing a turn in sentiment, but even the most successful investors in the industry acknowledge that market timing is the toughest game in town.

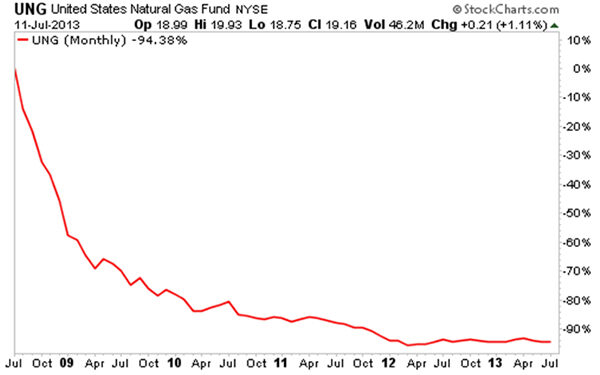

That played out with United States Natural Gas (NYSE: UNG) ETF (exchange-traded fund) in the last five years. With the natural gas market crashing from its record high in the summer of 2008, many contrarian investors were quick to buy on the big drop anticipating a reversal. But four years later, prices are still deeply depressed, equating to huge losses for any contrarian investors calling a bottom in the last few years.

Remember, even if the logic behind a contrarian investment is rock solid, that doesn't mean it will be profitable, thus the saying: “The market can stay irrational longer than most investors can stay solvent.” Take a look below at the huge decline in natural gas that wreaked havoc on contrarian investors looking to go against the grain in the last few years.

The Risk Of Not Having Enough Time, Expertise, And Resources

The third reason being an effective contrarian is so challenging is a matter of time, expertise, and resources. It's important to understand that effective contrarian investing requires identifying an opportunity that the rest of the market is completely missing. And between the largest institutional players on the Street -- including banks and hedge funds -- there are tens of thousands of forensic financial analysts and high-frequency computer models pouring over every single piece of market data in the world. If this group of highly trained professionals with the best resources and incentives is missing a big contrarian opportunity, it is highly unlikely that a one-person operation with limited experience and resources is going to beat the Street and capitalize on a short-term anomaly.

Generally speaking, the best strategy for most investors is to work with an adviser and keep it relatively simple. Investors don't need to score 1,000% gains to be extremely profitable and successful in the market. Great investing is built upon patience and disciple

Bottom Line

Contrarian investing sounds glamorous, but the reality is that going against the grain is extremely risky and carries a low probability of success. Most investors should focus on keeping it simple, with the core of their portfolios invested in low-cost index funds. That will keep your portfolio in tune with the market's bullish trend while limiting fees and expenses to a minimum.