What are Upthrusts?

Upthrusts are false breakouts that can trap the unsuspecting trader. Upthrust patterns quickly reverse, with the stock or index then often testing the opposite end of the trading range.

How Do Upthrusts Work?

Upthrusts are a type of technical pattern named by legendary technician Richard Wycoff. The quality of upthrust can be judged by an examination of the degree of penetration of support or resistance, as well as the volume on the day or period this penetration occurred. These four scenarios are possible:

-- Large penetration on large volume

-- Large penetration on small volume

-- Small penetration on large volume

-- Small penetration on small volume

Upthrusts provide the swing trader with good opportunities. First, they can provide a stop loss, which should be placed just above the extreme of the day the upthrust occurred. They can also create a target, since the stock is likely to test the opposite end of the trading range.

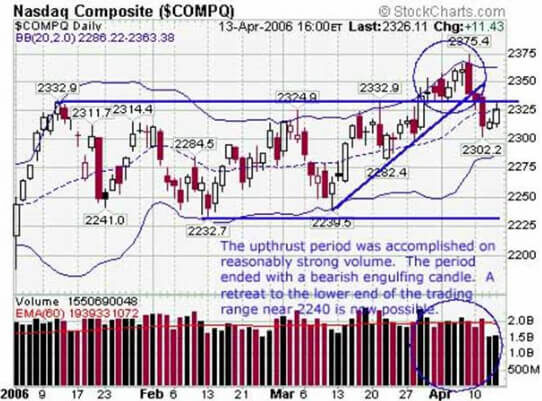

The recent upthrust in the Nasdaq Composite is shown below. The duration of the upthrust lasted for approximately one week. For most days during this period, the Nasdaq traded roughly two billion shares -- a bit higher than normal daily volume. Observe on the chart that the bearish engulfing candle signaled a key reversal. Also, note that the Composite was about to fall back into the consolidation pattern.

Why Do Upthrusts Matter?

Being able to accurately recognize an upthrust can turn a potential threat from a false breakout into an opportunity. Swing traders should always watch the activity following a breakout to confirm whether a stock is behaving as it should. If not, then it might still provide an excellent trading situation -- if you spot an upthrust in the making.