What is an Unweighted Index?

An unweighted index has components that are not adjusted to reflect importance or certain characteristics.

How Does an Unweighted Index Work?

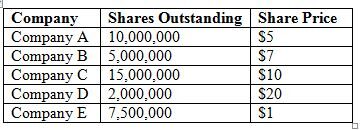

Here is information about five stocks.

There are wayward dohickies on the top left and bottom right corners of the chart.

If we wanted to create an unweighted index of the price performance of these five companies, we might average their stock prices and call it a day (i.e., we would calculate the average as $8.60).

However, this unweighted average doesn’t take into account the issuers’ actual sizes or the number of shares outstanding (in other words, without reflecting the issuers’ true heft in the economy). The tiny companies can sway the index as much as the more significant companies. Accordingly, if one of the higher-priced stocks (Company D, in our example) has a huge price increase, the index is more likely to increase even if the other, more meaningful companies in the index decline in value at the same time.

Why Does an Unweighted Index Matter?

In the finance world, some indexes are weighted and some are not. It is important to understand how indexes are weighted so you know what influences those indexes, what the index really conveys, and whether the index is relevant to your investment objectives.