What is a Step-Up in Basis?

A step-up in basis refers to an increase in the price at which an investment is considered to have been purchased.

How Does a Step-Up in Basis Work?

Let's assume that your uncle purchased 100 shares of Disney in 1970 for $1 per share. This $1 per share is your uncle's original cost, or basis, in the stock. He hangs on to the shares for the rest of his life. When he dies, he leaves the shares to you, when they are worth $50 per share.

Now, you might think that you have to pay capital gains taxes on the difference between $50 per share and $1 per share, which could be a considerable tax bill. But in this situation, and under current tax law, you actually get a step-up in basis. This means that for tax purposes, the IRS pretends the original cost of the shares is now $50 rather than $1.

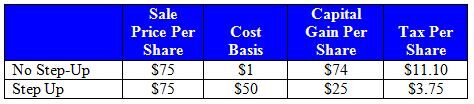

Let's say you hold those Disney shares for another five years and then decide to sell them at $75 per share. Your capital gains tax is based on the difference between $75 and $50, not the difference between $75 and $1. At a 15% capital gains tax rate, here is the savings:

On 100 shares, the difference in the tax bill is $1,110 - $375, or $735!

Why Does a Step-Up in Basis Matter?

Step-ups in basis matter because they reduce tax bills. For people who inherit investments, step-ups often mean they can sell those investments immediately and pay little or no income tax. In our example, this would mean that you would owe the $1,110 tax bill rather than the $375 tax bill.

Understanding and calculating the value of a step-up in basis requires knowing the original basis of an investment. The original tax basis of an investment is often is a matter of good record keeping. In most cases, the investor's financial institution will have records of the original purpose, but if the investor has changed institutions or transferred assets to other accounts, the cost basis may be hard to track down.