What is Moving Average Convergence Divergence (MACD)?

Moving Average Convergence Divergence, or MACD (pronounced 'Mack-Dee') is a technical analysis indicator developed by famous market technician Gerald Appel.

How Does Moving Average Convergence Divergence (MACD) Work?

The MACD is used by traders to determine when to buy or sell a security, based on the interaction between a line constructed from two moving averages and a 'trigger line.'

The MACD line is constructed from two moving averages -- a 12-period, or faster moving average, and a 26-period, or slower moving average. The MACD calculation subtracts the 26-period from the 12-period to create a single line. This is known as the main line.

The next step is to compute the nine-period exponential moving average of the main line. This line is then called the trigger line. It is the interaction between the main line and the trigger line that certain types of trading signals are generated.

Also note that the MACD is plotted on a chart with zero as the equilibrium. The amount of divergence between the main line and trigger line is also plotted on this chart.

During a period when there is a strong trend, the two MACD lines will grow further apart (divergence). During sideways consolidation, they come closer together (convergence), often crisscrossing one another several times.

The MACD is best used in a market that is trending either higher or lower. This way there is less criss-crossing between the main line and the trigger line, and the MACD's signals are clearer.

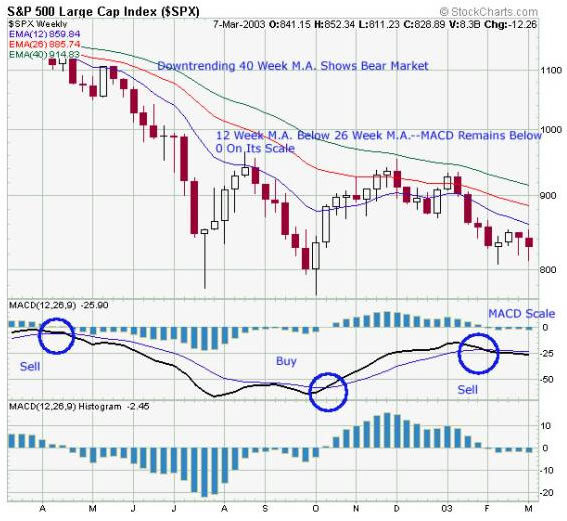

When the main line crosses through the trigger line from below, this is seen as a buy signal for the security. If the main line crosses the trigger line from above, this is a sell signal. Also, moves through the zero line on the chart from above or below is used as a buy or sell signal.

It is also important to take note of divergence between the MACD and the share price. If the shares reach a new high, but the main line fails to do so, this is seen as bearish divergence. Should the stock make a new low, but the main line does not, this is known as bullish divergence.

The chart below shows an example of how the MACD is used to determine when to buy or sell. Since the S&P's 12-week average was always below the 26-week average, the MACD remained below the zero line. Please note that this is not always the case.

Why Does Moving Average Convergence Divergence (MACD) Matter?

While the MACD is difficult to decipher in a sideways market, a trending market allows it to be used effectively. This is yet another tool that technical analysts can use to determine when they should time their entry and exit points for a position. Traders should be aware that the MACD acts as a trend-following signal and as such, it may not foretell large, quick moves in a security.