What is a Golden Cross?

In the trading world, a golden cross occurs when a stock's short-term moving average rises above its long-term moving average.

How Does a Golden Cross Work?

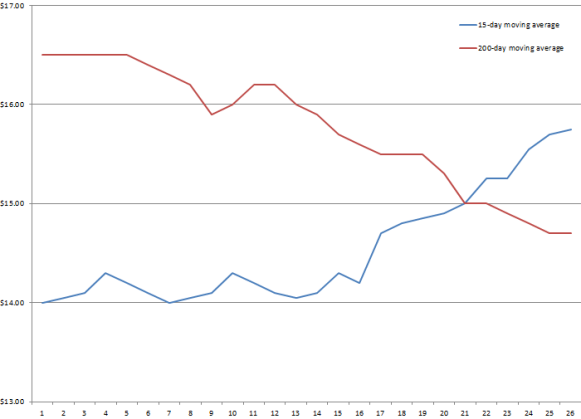

For example, let's assume that Company XYZ’s 15-day moving average has been about $14 per share. But over the last two weeks, the 15-day moving average has been rising. Company XYZ's 200-day moving average is about $16.50 -- higher than the $14 short-term moving average -- but declining.

Because Company XYZ’s 15-day moving average has been increasing, by the end of two weeks, the 15-day moving average is now higher than the 200-day moving average. The point at which the rising 15-day moving average crosses (that is, equals) the 200-day moving average is called the golden cross.

Why Does a Golden Cross Matter?

A golden cross is a telltale sign of bullish sentiment for a stock and sometimes for the economy as a whole. Thus, investors who watch technical trading charts tend to buy a stock when the short-term moving average rises above the long-term moving average, and they tend to sell when the short-term moving average falls below the long-term moving average.