What is a Gold Certificate?

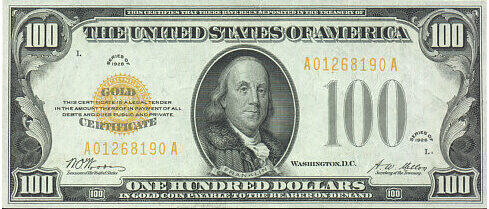

A gold certificate is a piece of paper that entitles the bearer to a certain amount of actual gold.

How Does a Gold Certificate Work?

From 1863 to 1933, the U.S. Treasury issued gold certificates that were redeemable for gold. They were generally for interbank transfers rather than consumer use. In 1933, the U.S. Treasury requested the return of all gold certificates. Not everyone obeyed, and today these documents are rare collectibles. These gold certificates are no longer redeemable for gold.

For example, let's assume that in 1929, John wanted to buy $500,000 of gold. Rather than try to store $500,000 of gold in his house or a storage unit, John bought gold certificates. On paper, the certificates made him the owner of $500,000 of gold held in a bank's secure vault. John could sell the certificates, if he chose to, without having to physically deliver heavy gold to the buyer.

Though the U.S. government no longer issues gold certificates, many other countries do. Gold certificates come from banks that keep stores of gold to sell to investors. The certificates usually trade on a gold exchange.

Why Does a Gold Certificate Matter?

Gold is heavy and hard to move securely. Gold certificates make it easier and faster to transfer ownership of gold without having to remove the gold from a secured facility.

It is important to note that the value of gold certificates changes in accordance with changes in the value of gold. Furthermore, given the possibilities of forgeries and administrative mistakes, there is no way to be certain that any gold certificate corresponds to a dedicated underlying quantity of gold (i.e., that the number of claims on the gold equals the amount of actual gold). Computer records have largely replaced the paper system, though it has not replaced the fact that most investors now invest in unallocated gold.