What is a CD Ladder?

A CD ladder is an investing strategy whereby the investor staggers the maturity of ('ladders') the certificates of deposit in his portfolio so that the proceeds can be reinvested at regular intervals.

How Does a CD Ladder Work?

For example, say you have $75,000 to invest. To create a laddered portfolio, you could invest $25,000 in a one-year CD at 6%, $25,000 in a two-year CD at 6.25%, and $25,000 in a three-year CD at 6.50%. Each year is considered a 'rung' on the ladder.

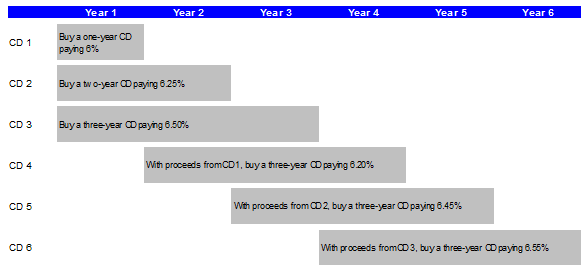

In this example, as each CD matures, you would reinvest the proceeds into another three-year CD. When the one-year CD matures, you would reinvest the proceeds in a three-year CD. At the end of the second year, you would put the proceeds from the matured two-year CD into a three-year CD, and so on. Here is how the strategy, using sample data, looks visually:

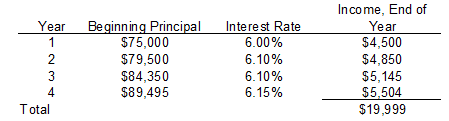

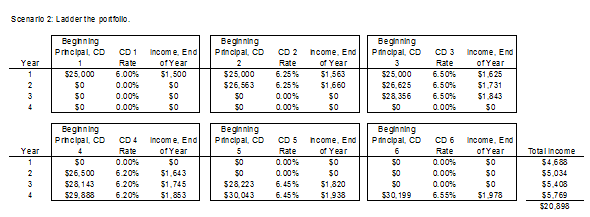

Let's look at the difference between simply rolling a $75,000 one-year CD over every year and using the laddering method.

Because the laddered portfolio was able to take advantage of the higher yields offered by longer-term CD, the laddered portfolio earns 4.49% more income ($19,999 vs. $20,898) during a four-year period even though much of the investor's capital was never more than one year from maturity.

Why Does a CD Ladder Matter?

There are several advantages to laddering, and CD investors should take care to read their fund prospectuses as many fund managers use this strategy. The first advantage of laddering is that it can minimize the investor's exposure to interest-rate fluctuations because the investor is able to reinvest a portion of his or her capital each year at market rates. Second, the diversification inherent in laddering can help stabilize the investor's income stream. Third, laddering gives the investor constant liquidity because a portion of the portfolio is never more than a year away from maturity. It enables the investor to enjoy liquidity while taking advantage of the higher yields offered by longer-term CDs.

There are some drawbacks to CD laddering, however. First, the transaction costs of purchasing several CDs may be higher than purchasing one large CD. Second, the constant maturing does present some reinvestment risk to the investor in a falling interest rate environment.