What is an Ascending Triangle?

The ascending triangle is marked by two significant technical features. At its top, there is a line of resistance. This is a supply line, or a price at which sellers step into the market and unload their shares. The second aspect of the ascending triangle is the rising trendline, which communicates the fact that bullish investors are willing to pay higher and higher prices over time.

How Does an Ascending Triangle Work?

Eventually either the bulls or bears must triumph. The more times a stock or index tests its upper resistance line, the more likely it will eventually break out to the upside (because the supply held by sellers is consumed over time). If a stock tests resistance in an ascending triangle three or four times, then it is likely that the fifth try will be successful.

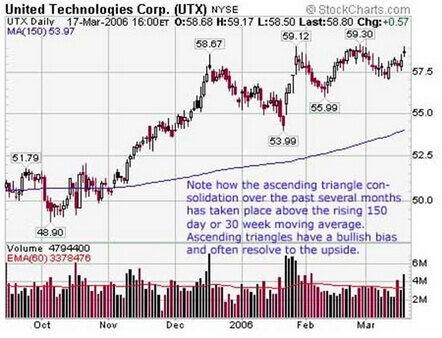

The ascending triangle is typically thought of as a consolidation or continuation pattern. That means that prices are likely to exit the pattern in the same direction they entered; therefore, a bullish breakout is likely. In assessing the ascending triangle, I also check to see whether the consolidation is occurring above a rising 30-week moving average. If so, then the consolidation is part of an ongoing stage II advance, increasing the probability of a bullish resolution.

When the breakout comes, it should be accompanied by stronger than normal volume. The higher the volume is in relation to normal volume, the more power the breakout has -- and the more trustworthy it is.

The measuring principle can be applied to the ascending triangle. To do so, simply take the height from the bottom of the triangle formation. Add that number to the breakout level, and you have the eventual target.

On the chart below, I have shown the ascending triangle in UTX. note that the stock has consolidated above the rising 30-week moving average, increasing the probability of a bullish resolution.

Why Does an Ascending Triangle Matter?

Many technical analysis trading strategies require the trader to buy on the breakout. Recognizing the bullish bias of the ascending triangle gives traders a valuable head start, alerting them to a potential trading opportunity before the price action takes place. Therefore, being able to spot the ascending triangle is yet another tool that swing traders can use to identify profitable opportunities.