If used strategically, a balance transfer credit card can help you pay off credit card debt. You’ll want to pay special attention to the introductory 0% APR, annual fees, and other perks the credit card may offer. We cover these essential topics below so you can select the best balance transfer credit card.

What Is a Balance Transfer Card?

A balance transfer credit card allows you to move existing debt onto it when you open your account. Ideally, you’ll move your debt to the balance transfer credit card while taking advantage of a zero-interest period to pay down your balance.

What Is a Balance Transfer?

The act of moving your debt from one card to another is a balance transfer. When you transfer the full balance from one credit card to the other, it doesn’t literally slide over to the new card. The debt on your original credit card is paid off by your balance transfer credit card issuer either online or via check.

Card issuers often have limits to how much you can transfer onto the new card, so be sure to read the fine print to make sure your full balance is eligible.

Balance Transfers to Existing Cards

Balance transfers can occur from a cardholder’s existing credit card to another existing credit card. This might be an option if the credit card issuer is running a special promotion. However, it is more common for a cardholder to do a balance transfer from an existing card to a new credit card to take advantage of a 0% APR introductory offer.

0% APR on Balance Transfers

The introductory offer of 0% APR for balance transfers is great but it’s not a guarantee. If you have excellent credit, you’re more likely to qualify for the offer. However, if you don’t have an excellent credit history, you may see a different interest rate for balance transfers upon approval.

Pay attention to when this promotional APR expires. Generally, the regular APR will begin to accrue interest as soon as the 0% period ends.

You should also know that the 0% APR might be contingent on the good standing of your account. If you do any of the following, the regular APR may kick in and you’ll lose the 0% promotion:

- Fail to transfer a balance within a specific period of time (typically 2-4 months).

- Miss a payment.

- Make a late payment.

- Exceed the credit limit.

Balance Transfer Card Fees

Transferring your balance is rarely free and the new credit card issuer will often charge a fee. Fees are typically a minimum of $5 or 2-3% of the balance transfer (whichever is greater).

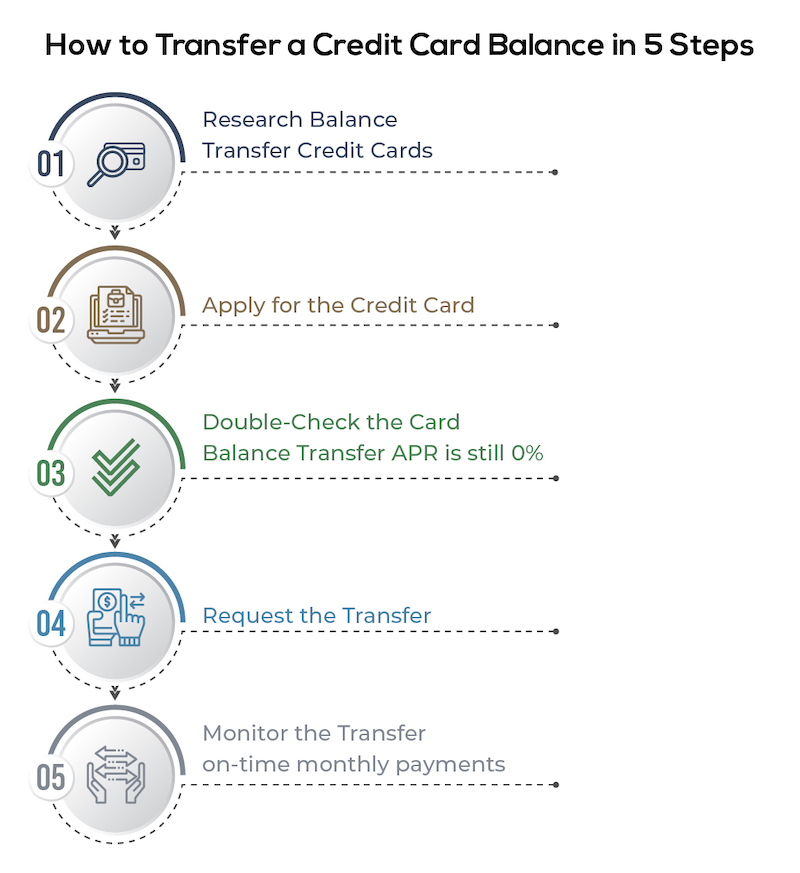

How to Transfer a Credit Card Balance

How to Evaluate a Balance Transfer Card

When you evaluate a balance transfer credit card, review the following:

- Promotional 0% APR period

- Regular APR after the promotional period expires

- Balance transfer fee

- Balance transfer limit

- Annual Fee

- Other credit card benefits like cash back or travel rewards (and whether they apply to balance transfer)

You’ll then have to compare these numbers with the credit card balance you want to transfer. You should have a payment plan and know the:

- Amount you want to transfer

- Monthly payment you can afford to make during the 0% period

- The total balance transfer fee you will need to pay

Overall Benefits of Balance Transfer Cards

- Low-0% APR for a period of time

- The chance to reduce debt while not accruing interest

- Earn rewards for future purchases made on the credit card.

- Possibly qualify for an additional introductory perk like a statement credit

Downsides of Balance Transfer Cards

- You often need good to excellent credit to qualify for the 0% APR.

- Credit card issuers have balance transfer limits.

- Balance transfer fees will need to be paid.

- Balance transfers can take time to process, so you will need to pay your minimum on your cards until it is complete.

How to Use a Balance Transfer Card Wisely

Before transferring a balance, make sure you can make progress in paying off debt. Avoid getting into a costly credit card that doesn’t help you pay down debt by calculating how much you’ll need to pay each month.

Balance Transfer Example:

Let’s look at a scenario and how you might take advantage of a balance transfer. Say you carry a balance of $5,000 on a credit card with 22% APR. You apply for a balance transfer credit card with 0% APR for 12 months and a 2% balance transfer fee. You’re approved, and because you have excellent credit, you qualify for the 0% APR.

You’ll need to issue the balance transfer within the first two months. This takes time to process, so you pay the minimum on your old card while you wait. The balance transfer fee is $100. You pay this and the balance transfers. You’ll pay about $417 per month for 12 months to pay off your balance (assuming you don’t put anything more on the card).

Your Takeaway

When you transfer a balance, do so with the intention of paying it off within a specific period of time. Find a balance transfer credit card that offers a 0% APR and minimal fees for the transfer itself.