Our financial experts provide you with everything you need about finding the best auto insurance rates, quotes, and coverage.

Get the Best Rate on Your Auto Insurance

For many, auto insurance is something they think about - but do nothing about. You may have had the same insurance coverage for years, but as your wealth and family grows, are you fully protected from what could go wrong?

Auto insurance protects your car and your assets if you're involved in a motor vehicle accident, and it's required to drive in every US state. How much insurance you need is based on several factors, including your budget, what type of car you drive, and your personal habits.

Before you get an auto insurance quote, here's everything you need to know about getting the most from your insurance company.

How Auto Insurance Quotes Work

Not all auto insurance quotes are the same. While you may get a high price from one company, another might provide the same coverage for less. It's important to get multiple quotes to find both the best possible price and coverage for your cars.

In today's world, most auto insurance quotes begin with an online search. While you can get most quotes online, you may have to call independent insurance agents to get quotes from smaller or specialized insurance companies.

What Information is Required For an Auto Insurance Quote?

When you ask for a new auto insurance quote, the insurance company requires information about the cars that will be insured, as well as the drivers in your household. You will need to provide your driver's license number, social security number, and the approximate number of miles you drive to work each day.

From there, the insurance company will put together your auto insurance quote based on several factors. The primary factors include your car's year, make, and model, as well as where it's parked every night. The type of car you drive and your neighborhood play large roles.

In addition to pulling up your driving record, the insurance company will likely run a soft credit check to determine your consumer profile. The insurer may also pull a special credit score (called an insurance score) to determine how much risk you present to the company.

What Coverage Limits Do You Need?

If you get in an accident or severe weather damages your car, you will need to file a claim to take advantage of your benefits. However, your insurance will only pay up to a certain amount.

Coverage limits refer to the maximum amount that the insurance company will pay for a covered incident (which falls within the bounds of your policy).

According to the Insurance Information Institute (III), most insurance plans cover collision damage, property damage, bodily injury liability, and medical payments for yourself and others involved in the accident. Conversely, auto insurance policies won't cover maintenance costs nor will they cover the difference between the loan amount and appraised value if your car is totaled in an accident. In addition, auto insurance policies may not cover your car if someone borrows it with permission.

For example: In the rare - but not unheard of - event that you hit a cow that escaped from a nearby farm, you may only be covered if you have comprehensive insurance. If you don't, you may have to track down the owner and negotiate directly for damages to the vehicle (and the cow).

How to Find the Best Car Insurance For You

When it comes to auto insurance quotes, there is no “one-size-fits-all” approach. Everyone's needs are very different and quotes are based on your driving history, the car you drive, and your personal driving habits.

Be Ready to Discuss Your Driving History

When putting together your auto insurance quote, the two biggest factors in your control are the vehicle you drive and your prior driving record. If you have a clean record without accidents, zero traffic tickets over the past seven years, and/or no insurance claims from other incidents, you may qualify for excellent rates. If you have a couple of tickets or even an accident, however, you'll likely see a higher insurance premium.

The Car You Drive Matters

Insurers will also look closely at the car you drive. When putting together an auto insurance quote, they will look at the car's safety ratings and how much it would cost to repair (or replace) the vehicle after an accident.

For example, a 2019 Ford Escape will likely be cheaper to insure than a 1970 Pontiac GTO, because of easier-to-find parts and experienced mechanics.

Understand Vehicle Features That Influence Insurance Costs

Insurance relies heavily on statistical information to make judgments about the risk of insuring against loss. Vehicles with a lower safety rating may be more expensive to insure because they present more risk of injury to the driver and the passengers inside. Vehicles with key safety features (like side curtain airbags and blind spot warnings) may cost less to insure because they present less of a risk to drivers and passengers.

Another issue that could drive up your insurance is theft frequency. The National Insurance Crime Bureau collects two sets of data about theft: the most frequently stolen vehicles every year and cities that report the most stolen vehicles.

According to the 2019 NICB “Hot Wheels” report, the Honda Civic and Honda Accord were the most commonly stolen vehicles. Rounding out the top five were Ford pick-up trucks, Chevrolet pick-up trucks, and the Toyota Camry. Owning one of these vehicles may carry higher insurance premiums, simply because the risk of theft is higher.

How Driving Habits Affect Insurance Costs

Even if you have a perfect driving record and a car that's unlikely to be stolen, your driving habits could affect how much you pay for your auto insurance policy. Every time you get behind the wheel, insurance companies consider that a risk — not necessarily from the way you drive, but from how everyone else drives around you.

For example: Someone who has a long daily commute to work will usually pay a higher premium than those who have a shorter commute. This is because more hours on the road puts them at a higher risk of getting in an accident from their drive time, fatigue, and even distraction.

Your premium can also increase based on where you live and the driving habits of those around you. According to the Allstate America's Best Driver Report, the worst cities to drive in are Baltimore, Washington DC, Boston, Worcester (MA), and Glendale (CA). Drivers in these cities file twice the auto insurance claims than the national average and are forced to hard-brake more often than other drivers. The result? Higher premiums for everyone calling those cities home.

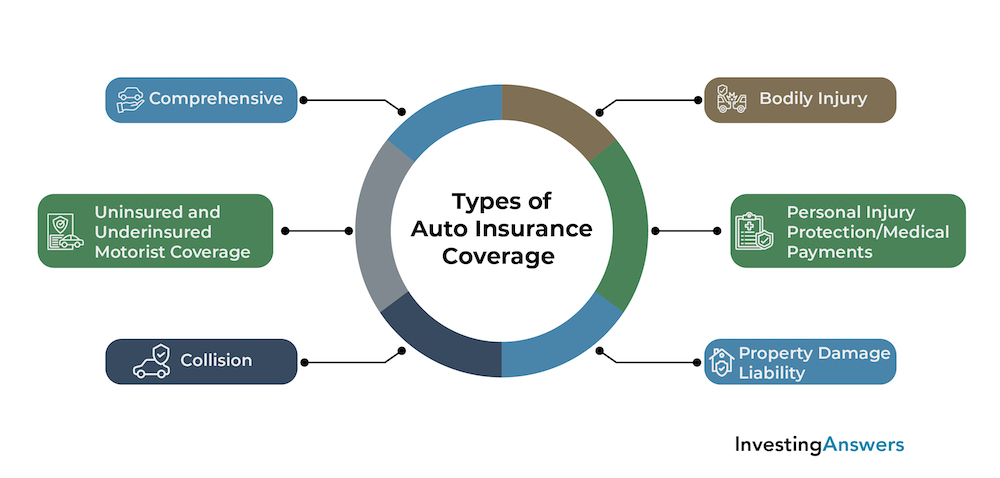

Review the Types of Auto Insurance Coverage

Car insurance doesn't just cover your car if you get into an accident. Rather, it can also cover medical bills for yourself and passengers - and even damage to property caused by your car. Depending on where you live, most insurance policies will offer six areas of coverage.

1. Bodily Injury

Bodily injury coverage provides financial protection for you and other covered members of your household who may be involved in an accident while driving. This coverage usually extends to the vehicles you own and are on your policy. It also pays for medical care and injuries sustained by people in the other vehicle(s) involved in the accident.

2. Personal Injury Protection/Medical Payments

Personal injury protection (also known as PIP or “no fault”) covers the cost of medical treatment, lost wages, and sometimes funeral costs for the driver and passengers in the policy holder's vehicle. Policy limits for PIP are set by state law and some states require that all drivers maintain a minimum amount of PIP coverage.

In most cases, if you're in an accident, your auto insurance policy's PIP coverage is first initiated to cover your medical treatment. Once exhausted, your health insurance policy will cover the remainder of your care and treatment.

3. Property Damage Liability

Property damage liability covers the cost of damage that drivers cause to someone else's property. If you hit a fence or mailbox, property damage liability provides reimbursement to the owner of the fence or mailbox. Likewise, it also covers the cost to replace powerlines, telephone poles, or street signs damaged in an accident.

4. Collision

Collision insurance covers any damage done to your vehicle in an accident. All policies have a deductible on the collision amount (which is the amount that the policyholder is required to pay before the insurance company pays anything). Deductibles range from $250 to $1,000. The higher the deductible, the lower the insurance premium.

Collision insurance covers the vehicle no matter who is at fault for the accident. If you're at fault, you'll pay the deductible before the insurance coverage pays for the repairs. If you're not, the insurance company may request that the other driver's insurance company pay for your vehicle's repairs.

5. Comprehensive

While comprehensive coverage is optional in all states, it is required by the bank or lender financing your car. It covers damage to a vehicle from sources other than an accident with another vehicle (e.g. a tree falling on your parked car, hitting a deer on the highway). Deductibles are usually between $0 and $500.

If you have an older car or are no longer paying down a car loan, you may wish to forgo comprehensive coverage.

6. Uninsured and Underinsured Motorist Coverage

This coverage protects the policyholder, driver, or a family member if they are involved in either a hit-and-run accident or an accident with an uninsured vehicle. Uninsured motorist coverage also provides assistance if you're a pedestrian involved in a hit-and-run accident.

If you're involved in an accident with another vehicle - and the other driver has insufficient coverage to pay for damages - your policy's underinsured motorist coverage may make up the difference.

Coverage Limits

The amount of coverage you should carry is set by several factors. These include state law (which may include minimum amounts as well as the type of coverage required to own and operate a motor vehicle), your personal assets, and your budget. The more coverage you have for your car, the bigger your annual auto insurance premium.

While your insurance company may offer the minimum coverage required by your state to meet the basic minimums, it's always wise to carry more than the minimum. Holding more insurance can protect you from paying for a wide range of expenses should you get into an accident, including the medical bills of others involved and the replacement cost of your car.

Maximum coverage limits also vary by state, with some setting a cap on liability coverage between $300,000 and $500,000.

How Much Insurance Do I Need?

The price of auto insurance is a delicate balance between how much coverage you want and how much you can afford to pay out of pocket.

First, consider the minimum insurance your state requires you to carry. Although minimum coverage will keep you “legal” while on the road, it may not be enough to cover all your expenses in the event of an accident.

Second, take stock of your cars. If they are older - and you aren't paying a loan on them - you may be able to save money by not paying for comprehensive coverage. If you get in an accident without comprehensive coverage, however, your insurance won't pay out the value of your car to replace it with a new one.

Finally, consider the out-of-pocket costs you could afford after an accident. If you're building your savings and can't afford to pay medical bills and damages after an auto collision, you may want to carry more insurance. If you're financially stable and aren't worried about replacing a vehicle, paying for medical bills, or covering property damage, you may be able to save money by reducing your level of coverage.

Auto Insurance and Umbrella Policies

For most drivers, state maximum coverage limits are sufficient to protect assets in the event of an accident. But for those who own a home, multiple vehicles, vacation properties, or other significant financial assets, adding an umbrella policy to their insurance coverage may be a smart move.

An umbrella policy offers additional protection if you're in a complex accident with multiple vehicles or an expensive accident involving multiple drivers and/or destroyed property. These incidents can quickly exceed auto insurance coverage limits.

In one of these situations, an umbrella policy could help you pay the additional amount owed beyond your coverage limits. Once your car insurance policy pays to its limit, the umbrella policy pays the rest. According to the Insurance Information Institute, a $1 million umbrella policy costs on average between $150 and $300 per year.

How to Shop for Auto Insurance

Before you start shopping for auto insurance, consider the following information:

Your Location Affects Pricing

Because different states have different minimum insurance requirements, the average insurance rates where you live may vary.

According to a recent analysis by Business Insider, New Hampshire was the state with the highest average car insurance rates ($1,534). On the opposite side of the spectrum, Missouri residents had the lowest average annual premium ($1,193).

Across the country, annual insurance premiums can range from a low of $775 to over $3,000. By researching how much the annual average car insurance premium is in your state, you can ensure the best possible price.

Balance Cheap Auto Insurance with Necessary Coverage

As you look at the numbers above, it's tempting to go to the cheapest company and get the least expensive policy. But the lowest possible cost can result in the lowest possible coverage, and that can come back to haunt you should you get into an accident.

Consider Who You Purchase From

It's a great concept to pay minimal amounts on car insurance. That said, regardless of how you drive, you're still taking a significant risk if you opt for the minimum required coverage from the cheapest companies. A company's reputation, history, and customer service should weigh in on your decision along with price.

Many companies who offer low premiums are able to do so because they avoid paying policy holders' claims at all costs. They may have a high record of denying claims or poor customer service. Before choosing a cut-rate insurance policy, check Better Business Bureau ratings and online reviews to see what others are saying about these companies.

Another consideration is a low introductory premium that may hide high costs later on. Companies that offer low premiums may do so for new policy holders, then increase their premiums dramatically in subsequent years. Some companies will utilize this tactic because they know policy holders are reluctant to change companies. Again, check online ratings and customer comments to spot any potential pricing red flags.

Top Auto Insurance Companies

Best Overall: Allstate

Allstate is a large insurance company, known for its auto insurance policies and top-rated customer service. Allstate offers a wide range of auto policies, as well as perks like accident forgiveness and a safe driving bonus. Allstate offers a variety of discounts for auto policies, including multi-policy, auto-pay, new car, and good student discounts.

Pros

-

Wide range of policy discounts available

-

Accident forgiveness and cash back bonuses available

-

Rideshare insurance offered

Cons

-

Premiums may be slightly higher than competition

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

-

Mechanical breakdown insurance

Customer Satisfaction

Allstate ranks as one of the top auto insurance companies for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, and receives very few complaints according to the NAIC.

Best for Claims Service: Amica

Amica is a large U.S. insurer that offers a wide range of auto insurance coverages, as well as optional coverage enhancements, such as rental car coverage and glass replacement. Amica offers a huge lineup of potential policy discounts, and it takes our top spot for handling auto insurance claims.

Pros

-

Wide range of policy options

-

Many discounts offered

-

Top-rated for claims satisfaction by J.D. Power

-

Many coverage extras available

-

Policyholders may earn annual dividends

Cons

-

Coverage depends on risk assessment and driving record

-

No rideshare coverage available

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

Customer Satisfaction

Amica ranks as one of the top auto insurance companies for claims satisfaction in J.D. Power's 2020 Auto Claims Satisfaction Study, and receives very few complaints according to the NAIC.

Best for Customer Service: Auto-Owners Insurance

Auto-Owners offers a full suite of auto insurance policy options, as well as add-on coverage such as gap coverage, rental car coverage, and even coverage for lost or stolen keys.

Auto-Owners also offers a wide range of additional insurance options, including homeowners and life insurance, so customers can bundle coverage and save. With high ranking for customer satisfaction and very few customer complaints, Auto-Owners is our top pick for stellar customer service.

Pros

-

High-quality customer service

-

Multiple discounts and perks on all policies

-

Rental car coverage includes added expenses (food, lodging) if main car broken down

-

Usage-based discounts available (select states only)

-

Products sold through independent agents

Cons

-

Only available in 26 states

-

Quotes only available through independent agents

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rental car coverage

Customer Satisfaction

Auto-Owners Insurance ranks as one of the top auto insurance companies for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, and receives very few complaints according to the NAIC.

Best for Discounts: American Family

American Family is a large insurer that offers quite a few discounts for its auto policies, including multi-policy discounts, low-mileage discounts, defensive driving course completion discounts, and even a discount for having a student away at school.

American Family offers a suite of other insurance products, including life and homeowners policies, so it is a decent choice for bundling insurance policies under one roof.

Pros

-

Huge selection of discounts available

-

Wide range of auto policies

-

Other insurance available for bundling (home, life)

-

Offers rideshare insurance (in select states)

Cons

-

Premiums may be higher than competition

-

Higher than average customer complaints

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

-

Mechanical breakdown insurance

Customer Satisfaction

American Family ranks about average when comparing insurance companies for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, and receives more complaints than competitors its size, according to the NAIC.

Best for Low Rates: Geico

Geico has become one of the most famous auto insurers in the U.S., with its huge marketing campaigns on television, radio, and billboards.

Geico offers very competitive rates for auto insurance coverage, along with a host of discounts to keep rates low. Geico also offers 24/7 phone support for customer service, and a slick mobile app for handling policy and claims services.

Pros

-

Competitive rates for auto insurance

-

Long list of discounts available

-

High customer satisfaction ratings

-

Full-featured mobile app

Cons

-

No gap insurance

-

Other types of insurance offered through partners (not direct)

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

-

Mechanical breakdown insurance

Customer Satisfaction

Geico ranks as one of the top auto insurance companies for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, but receives far more complaints than other insurers on average, according to the NAIC.

Best for Young Adults: Erie Insurance

Erie Insurance is a smaller insurance company that is only available in 12 states (mostly in the northeast), but offers great rates for younger drivers, and the ability to lock in insurance rates.

Erie Insurance also offers homeowners and life insurance coverage, and has a wide range of extra perks available for auto policyholders.

Pros

-

Accident forgiveness included

-

Rate lock, even if claims made

-

Discounts for driver improvement class

-

Discounts for drivers under age 21 (that live at home)

-

Products sold through independent agents

Cons

-

Only available in 12 states

-

Updating policy coverage requires speaking to an agent

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

Customer Satisfaction

Erie Insurance ranks as the seventh-best out of 21 auto insurance companies for claims satisfaction in J.D. Power's 2020 Auto Claims Satisfaction Study. It receives an average number of complaints for a company its size, according to the NAIC.

Best for Custom Policies: Farmers

Farmers insurance is a long-standing insurance company that offers a wide range of insurance policies, including auto, homeowners, business, and life insurance, as well as financial services.

Its auto policies include a variety of customization options, including new car replacement, accident forgiveness, custom equipment coverage (think: new stereo or wheels). There is even an option to ensure all replacement parts are OEM in the event of a wreck (original car parts, not aftermarket), which are typically more expensive parts.

Pros

-

Wide range of policy customization options

-

Large list of discounts available

-

Many other insurance products offered, great for bundling

-

Fewer customer complaints than other companies its size

Cons

-

Higher rates than some providers

-

Below-average customer satisfaction ratings (J.D. Power)

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

Customer Satisfaction

Farmers ranks below average for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, but receives very few complaints according to the NAIC.

Best for Work Association Discounts: MetLife

Metlife is a large insurer that offers many types of insurance direct to individuals, as well as through workplace benefits.

Metlife offers a variety of discounts, including auto insurance policy discounts based on your workplace association. Metlife was recently acquired by Farmers Insurance, but still offers individual auto policies.

Pros

-

Workplace association and location discounts to policyholders

-

Major parts replacement coverage available

-

Deductible annual bonus

Cons

-

Policies don't offer as many discounts as other large insurers

-

As part of Farmers, there are more customer complaints than average

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

Customer Satisfaction

MetLife ranks about average for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, but its parent company, Farmers, receives more complaints than average, according to the NAIC.

Best for Bad Driving Record: Progressive

Progressive is famous for comparing quotes of other insurers, but they also offer low rates themselves, even for drivers with a record of accidents or DUI. They also offer forgiveness to drivers that don't have a perfect record, including small and large accident forgiveness, and low rates for those who have a DUI on their record.

In addition to low rates, Progressive has a simple-to-use mobile app for managing your policies, and a long list of discounts available.

Pros

-

Low rates, even for drivers with a DUI

-

Multiple types of accident forgiveness

-

Name Your Price tool for budget-conscious customers

-

Tool to compare rates with other insurers

-

Coverage for pets in a car accident

-

Products sold through independent agents

Cons

-

Poor ratings for claims handling (according to J.D. Power)

-

Rates not as low as competitors for good drivers

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

Customer Satisfaction

Progressive ranks about average for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, and receives an average number of complaints according to the NAIC.

Best for Good Drivers: State Farm

State Farm is the largest auto insurer in the U.S., offering a wide selection of policy options and coverage in all 50 states.

In addition to standard insurance offerings, State Farm has rental car insurance, as well as rideshare insurance coverage available.

Good drivers will benefit from multiple State Farm discount programs, including the Drive Safe and Steer Clear Drive programs. The Drive Safe app measures acceleration and braking for “safe driving”, and the Steer Clear program is an online driving safety course, offering savings to drivers under age 25 who completed the course.

Pros

-

Large discounts for safe drivers

-

Low rates for most policies

-

Policy bundling available for other insurance products

-

High customer satisfaction ratings from J.D. Power

Cons

-

No gap insurance

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

-

Rental car insurance

Customer Satisfaction

State Farm ranks as the top auto insurance company for customer satisfaction in J.D. Power's 2020 Auto Insurance Study in multiple regions, but receives more complaints than other companies its size, according to the NAIC.

Best for Coverage Options: Travelers

Travelers is a large national insurer that offers a large selection of auto insurance options.

In addition to standard offerings, Travelers has optional insurance coverage, including gap insurance, rideshare insurance, responsible driver programs, as well as its Intellidrive app for massive discounts. Travelers also offers almost every other type of insurance, including homeowners, life, umbrella, “travelers”, boat, commercial, business, and even landlord insurance.

Pros

-

Wide range of policy options available

-

Huge selection of other insurance products, great for bundling

-

Available nationwide

Cons

-

Customer satisfaction ratings below industry average

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

Customer Satisfaction

Travelers ranks lower than industry average for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, but receives very few complaints according to the NAIC.

Best for Military Members: USAA

USAA is a large national financial institution that offers discounted insurance products to active military, veterans, and their families. Its auto insurance rates are some of the lowest available, and customer satisfaction ratings received top marks all around.

USAA offers all the standard coverage options, as well as a list of discounts for members. In addition to auto insurance, USAA offers a wide range of insurance and financial services, great for those looking to bundle policies under one roof.

Pros

-

Low rates for military members and their families

-

High customer satisfaction ratings

-

Discounts for younger drivers available

-

Great for bundling insurance products (auto, home, life, etc.)

-

As a mutual company, policyholders are owners, and are eligible for annual dividends

Cons

-

Only available to active military, veterans, and their families

Coverage Options

-

Bodily injury and property damage liability

-

Uninsured or underinsured motorist coverage

-

Collision coverage

-

Comprehensive coverage

-

Rideshare insurance

Customer Satisfaction

USAA ranks as one of the top auto insurance companies for customer satisfaction in J.D. Power's 2020 Auto Insurance Study, but receives more complaints than other insurance companies its size, according to the NAIC.

Who Has the Best Home and Auto Insurance Bundle?

When it comes to home and auto insurance, many factors affect the prices and discounts offered by insurance bundles. These can include your home's location and value, your credit history, driving record, and the make, model, and year of the car(s) you are insuring. Taking all of these into account, the best discounts from bunding your insurance may be obtained from Allstate, Progressive, and State Farm.

Allstate leads the list of discounts for bundled insurance with a long list of potential discounts that can add up to a substantial amount off of your policies. Progressive rewards customers with 10% off of their policies when they bundle them together. State Farm offers a flat discount with the amount depending on the premium costs.

Who Has the Cheapest Auto Insurance?

According to U.S. News, USAA offers the cheapest auto insurance. Their rates are, on average, $300 cheaper than other companies for comparable policies. To receive insurance through USAA, you have to either be an active military, military reservist, veteran, or in the National Guard or Air National Guard.

For insurance policies open to everyone, GEICO was rated the cheapest. On average, the company offers rates are approximately 17% less when compared to similar policies.