Student Loan Extra Payment Calculator

With this calculator, see how much faster you could pay off your student loan if you made extra student loan payments each month.

Student Loan Basics: What You Need to Know

After scholarships, grants, and savings, if you still don’t have enough funds for college, you’ll likely need to take out a private or federal student loan.

Because they can affect your finances for decades after graduation, it’s crucial to choose the right student loan for you.

The Difference Between Private and Federal Student Loans

Private student loans are offered by private banks, each with its own programs and requirements. Most banks charge an origination fee and require both immediate principal and interest payments. Some private student loans also require in-school payments.

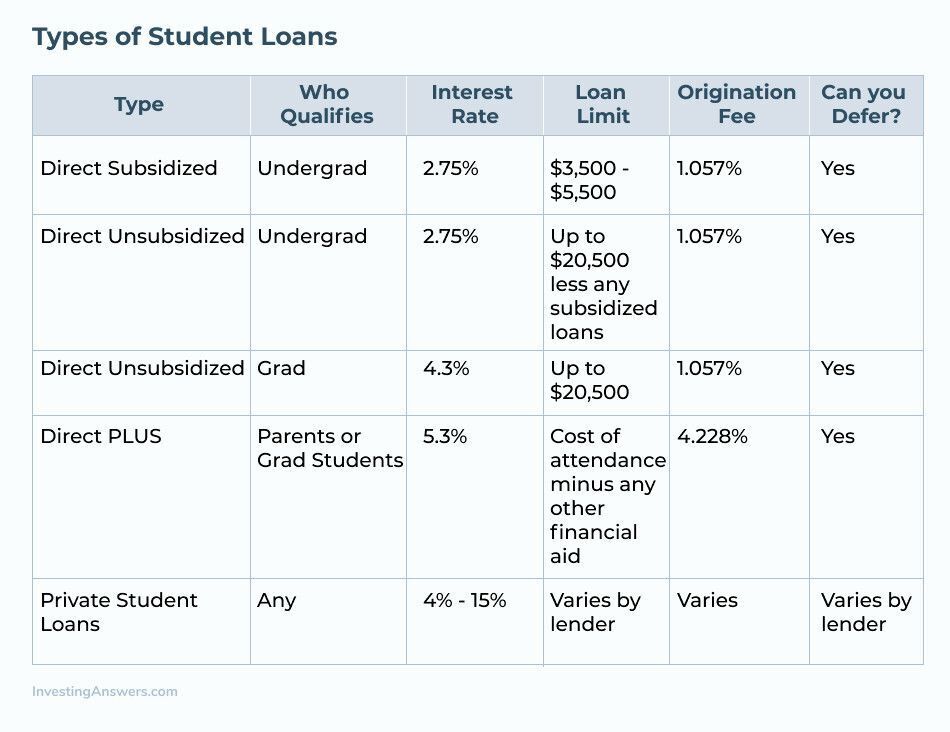

There are several federal student loan options (listed in the table below). While each loan has differing qualifying factors and terms, most utilize deferred payments for students who are in school at least part-time. This means you won’t have to make payments on student loans until you graduate or stop attending school.

Types of Student Loans

There are five different types of student loans:

When Should I Refinance My Student Loans?

Refinancing student loans means that your new lender pays off your existing loans and replaces them with a single loan that comes with new terms.

It doesn’t always make sense to refinance though: Even if you think you could save money on interest, ask yourself the following 4 questions:

1. Do I Have Private Student Loans?

Refinancing may make sense if you can save money on interest, but don’t just look at the interest rate though: What will the new loan cost over its lifetime? Is it less than you’d pay on your existing loan(s) overall?

2. Do I Have Federal Student Loans?

If you have federal student loans, refinancing will result in you losing all federal loan benefits, (including the opportunity for an income-based repayment plan).

Do you see your income changing in the future? More importantly, do you think your income could drop and/or leave you unable to make payments? If you’re willing to lose the federal loan benefits in exchange for saving money on interest, refinancing could be a good option.

3. Have I Recently Defaulted on My Student Loans?

Refinancing may not be easy if you’ve recently defaulted on your student loans. Private lenders don’t look favorably on students who have trouble making payments and may offer higher interest rates. If the interest rate is higher than your current one, it wouldn’t make sense to refinance your student loans.

4. How Long Have I Paid My Student Loans?

If you’re nearing the latter part of your loan term, refinancing will extend the lifetime of your loan. However, if you’ve only recently started paying down your student loans, refinancing could lower your interest rate and decrease the amount paid over the loan term.

What Refinancing Can Do to Your Payment

If refinancing is right for you, it could affect your payment in the following ways:

Lower the total payment by lowering the interest due.

Decrease the total amount of interest you’ll pay over the loan’s term.

Shorten the time it takes to pay your loan off in full (if you take a shorter term).

The best way to determine the effect that refinancing can have on your student loan payment is to use a student loan payment calculator. You’ll need the:

loan amount

loan term (in years or months)

annual interest rate.

The calculator will do the rest, showing you the total cost of the loan and the monthly payments.

Review Private Student Loan Rates for Refinancing

If you’re thinking about refinancing, check out the look at all your private student loan options, as well as the factors that are included (e.g. interest rate, origination fee, total loan amount).

6 Things to Consider Before Taking Out a Student Loan

Student loans may seem like the best (or only) way to go to college, but there are more opportunities for “free” money than most people realize. Before taking out any loan, consider other options like grants and scholarships. A quick Google search and a chat with your school’s financial aid office should help point you in the right direction.

If you still need to take out student loans, consider the following:

1. Type of Loan

Be sure to exhaust all federal student loan options first, including direct subsidized and unsubsidized loans, to take advantage of their benefits.

Direct subsidized loans are offered to undergraduate students that have proven financial need. Your school determines the amount you can borrow and the US Department of Education pays accruing interest during the following timeframes:

While you’re in school at least half-time

The grace period of six months after leaving/graduating school

When you postpone/defer your student loan payments.

Direct unsubsidized loans are offered to all undergraduate and graduate students, even without demonstrating financial need. Your school determines the amount you can borrow, based on their cost and any other financial aid packages. However, you are responsible for paying all of the interest accrued on direct unsubsidized loans – whether you’re in school or not.

2. Interest Rate

Consider the interest paid per month and over the lifetime of the loan. Fixed rates will remain constant for the loan term. Variable rates change monthly or quarterly and are therefore harder to predict.

3. Loan Term

The standard federal student loan has a 10-year repayment term. If you qualify for any repayment assistance, however, you could drag it out as long as 30 years. While it might sound ideal, paying interest for three decades isn’t a sound financial plan.

4. Grace Period

Federal student loans usually come with a six-month grace period after graduation. More simply, you won’t owe payments for six months after graduation (or when you stop attending school as a full- or part-time student). Private student loans may or may not come with a grace period, so always ask before taking out a loan.

5. Salary Outlook

If you anticipate earning a low salary in the future, you’ll want to pursue a student loan with flexible deferment/repayment options for more affordable loan payments. If you start earning more money and can afford higher payments, you can refinance your loans at a later date. On both federal and private loans, you can make extra payments without incurring prepayment penalties.

6. Forgiveness

When taking out a student loan, never assume that they’ll be forgiven later. Before committing to any college financing options, make sure that you’ll be able to afford the monthly payment(s). Even in cases of personal bankruptcy, it’s very difficult to receive student loan forgiveness.