Our High-Yield Savings Account Calculator will help you map out your savings strategy. By changing the input numbers, you can learn exactly how much you need to save in a high-yield account in order to reach your goals.

How Does our High Yield Savings Account Calculator Work?

To use our High Yield Savings Calculator to determine the future value of your savings, you’ll need to enter four pieces of information:

-

Current Amount Saved – This can be either your accumulated savings balance, or your initial savings deposit into a high-yield savings account.

-

Monthly Savings Amount – Enter the amount you expect to contribute each month to your savings balance. If you're not able to save a fixed amount every single month, then enter the annual estimate you expect to contribute, and divide it by 12 months.

-

Annual Rate of Return (%) – Enter the current interest rate you're generating on your high-yield savings account.

-

Number of Years – Enter the number of years between now and the future date you want your savings balance to reflect.

The purpose of this calculator is to show how your balance could grow over time in a high yield savings account. For example, your ending balance will be higher if you increase your monthly savings amount, or if you extend the number of years you save. You can play around with the calculator, changing the numbers to run different scenarios. It’s designed to help you plot a workable savings strategy to meet your financial goals.

Example of High Yield Savings Account Calculator

Let’s take a look at an example of how our High-Yield Savings Account Calculator works.

Let’s say you want to purchase a home in five years, and you’ll need $30,000 for the down payment. You currently have $10,000, and you need to know how much you’ll need to save between now and then to reach that goal.

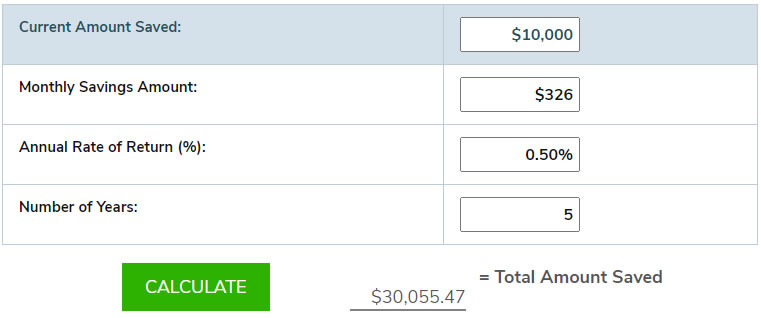

By inputting the following information, we learn you can reach your savings goal in five years by making monthly contributions of $326 to your high yield savings account.

Here’s the input:

Current Amount Saved – $10,000

Monthly Savings Amount – $326

Annual Rate of Return (%) – 0.50%

Number of Years – 5

And here is the result of the numbers above:

Arriving at the monthly savings amount of $326 did take a few attempts. Starting with $300, since it’s an even number, fell short of the goal by about $1,400. It was a matter of increasing the monthly savings amount in small increments to find out exactly what the magic number was.

If you’re unable to increase the monthly savings amount, you can simply increase the number of years. Either way, you’ll know how much you need to save and how long it will take you to reach your goal.

What is a High Yield Savings Account?

A high-yield savings account is one that pays substantially more interest than what is being paid by most banks. In most cases, high-yield savings accounts pay many times more than average rates.

For example, the current national average rate being paid on savings accounts is just 0.06%. But there are high-yield savings accounts that pay 0.50% or more, which is at least eight times higher than the national average.

Because of their lower operating costs, online banks are typically the ones that pay the highest rates on savings accounts. This is due in large part to the fact that online banks don’t have networks of bank branches, and the many employees necessary to staff them. The money they save from lower operating costs is passed on to depositors in the form of higher interest rates.

Savings accounts – as well as money market accounts – are not checking accounts, and thus limit the number of withdrawals that can be taken from the account. Under Federal Reserve Regulation D, savings accounts typically limit withdrawals to no more than six per month.

Some banks will permit more than six withdrawals per month but will charge you an “excess transaction fee” for the privilege. This may be something like $10 for each excess withdrawal. Other banks will refuse over limit withdrawals, while still others will convert your savings account to a checking account if the withdrawal limit is exceeded too frequently.

These accounts are most appropriate for money you may need to access within five years. If your savings goals are more than five years away, then you might want to consider other investment vehicles that have the potential to generate higher returns.

How are High Yield Savings Accounts Taxed?

Interest earned on savings accounts is taxable unless the account is held within an IRA or other tax-sheltered plan. This applies to high-yield savings accounts as well.

The tax you’ll owe on your savings account interest will of course reduce the net rate of return.

For example, if you earn $100 in interest on your savings account and you’re in the 12% tax bracket for federal income tax purposes, and 5% for your state, you’ll owe $17 in income tax. That will include $12 to the IRS, and $5 to your state.

However, one benefit of interest income is that it’s considered unearned income. That means that while you will owe income tax, it won’t be subject to FICA tax the way salary and wages are.

There are also no capital gains taxes involved. Since savings accounts maintain stable dollar values, capital gains aren’t a factor. The only taxable income you’ll earn on the account is the interest income, which will be taxable in each year it’s earned. In addition, contributions aren’t tax-deductible, and withdrawals aren’t taxable.

Banks typically compound interest on a daily basis, but your account isn’t credited for the interest until the end of the month. Only the portion of your interest that’s credited to your account will be taxable. But that works out neatly, because all the interest you earn on your account during the year will be credited by December 31.

You also don’t need to keep records of the interest you’ll earn on your high-yield savings account. The bank will report that interest to you at the end of the year on IRS Form 1099-INT, which you can report on your tax return.

What to Look for in a High Yield Savings Account

Even though a high-yield savings account is a simple vehicle as financial accounts go, there are several criteria you need to be aware of in choosing the right account.

Interest Rate

All things being equal, this is the main reason anyone chooses a high-yield savings account. But you need to look more closely than just the advertised rate. Interest rates on savings accounts are variable and may be adjusted based on changes in other rates, such as the yield on US Treasury securities.

For many, however, rate changes may be subject to nothing more than a change in bank policy. For example, the bank may offer a high rate to draw new customers but lower the rate when their target quota has been reached.

You should also be aware that high interest rates are often promotional. A bank may offer an attractive rate for several months, then lower it.

Interest Rate Balance Tiers

It’s common for banks to offer high rates based on only part of your account balance.

For example, they may pay 0.50% on balances above $10,000, but only 0.10% on the first $10,000 in your account. If your account balance is $12,000, your net return will be considerably lower than the highest advertised rate.

Other banks may offer high rates only if you have other accounts with the same bank. To get the highest rate, you may be required to have a companion checking account. If that account has monthly fees, it may offset the rate of return on your savings account.

Minimum Initial Deposit Requirement

Banks commonly have a minimum deposit either to open an account, or to earn the highest interest rate published. The amount of the initial deposit can vary from zero to $500 or even more.

Account Fees

Though online banks often work with no fees, some charge them but provide options to avoid them.

For example, a bank may charge a $10 monthly service fee on your savings account but waive it if you maintain a minimum balance of, say, $1,000.

Here again, pay close attention to the fine print. Some banks will waive the monthly fee with an average balance of $1,000 per month, while others will require that the balance never falls below that level at any time during the month.

Still other banks will waive the service fee if you maintain another account, such as a checking account, business account, credit card, or investment account (if offered).

There will likely be fees if you exceed the six withdrawals per month limit. Be sure you’re aware of that fee, just in case you may ever need to go over the withdrawal limit.

Linking/Transfers with External Bank Accounts

Though you may initially fund your account with a check or by wire, you’ll probably want to link another bank account with your high-yield savings account. This will be especially important if the bank offering the account doesn’t provide other necessary services, like a checking account.

You’ll need to know if you’ll be able to link the account with multiple external accounts. This can even include investment accounts.

You also need to know what options are available for making those transfers, whether incoming or outgoing. Also important will be any fees involved in transfers, as well as the amount of time it will take for funds to settle after a transfer. Some banks may allow a transfer to settle on the next business day, while others may require several business days.

Other High Yield Savings Account Services

First and foremost is mobile access. That will include the ability to deposit paper checks remotely, as well as to monitor your account and initiate transfers from your mobile device.

Still another important consideration is ATM access. Though ATM access is standard with checking accounts, it’s not always a given when it comes to savings accounts. If you believe you may need to access your savings account, at least occasionally, ATM access will be an important consideration.

Best High Yield Savings Accounts

Below is a list of some of the banks with high-yield savings accounts. But be aware that interest rates are variable, and the lineup of banks paying the highest rates does change periodically.

Marcus by Goldman Sachs

Marcus' High-Yield Online Savings Account currently pays 0.50% APY, with no minimum initial deposit or balance requirements and no monthly fee.

Learn more at Marcus.com.

Ally Bank

Ally Bank's Online Savings Account is currently paying 0.50% APY, has no minimum initial deposit, and charges no monthly fees.

Visit Ally's website to learn more.

Citibank

Citibank's Accelerate High-Yield Savings pays 0.50% APY and requires no minimum balance to open an account. However, Citi charges a monthly service fee of $4.50 unless you maintain a minimum average balance of $500, or keep a specific Citi checking account. The company's exact offerings also vary based which city/state you live in.

Learn more about Citibank's Accelerate High-Yield Savings.

CIT Bank

The CIT Bank Savings Connect account currently pays 0.50% APY, but to earn that rate you’ll need to maintain a linked Qualifying eChecking account, which requires a qualifying deposit of $200 or more. Otherwise, you’ll earn the base rate of 0.42% APY. CIT Bank's savings account requires a minimum initial deposit of $100, but it has no fees.

Learn more about CIT Bank's Savings Connect account.

Synchrony Bank

Synchrony Bank's High Yield Savings Account currently pays 0.50% APY and requires no minimum deposit.

Visit SynchronyBank.com