This article was originally featured in an issue of our Forever Stocks investment advisory.

From the market peak in May 2008 to the market low in March 2009, the S&P 500 lost a whopping 52.8% of its value. More than eight million jobs were lost. The unemployment rate nearly doubled from 5.4% in May 2008 to 10% by October 2009.

But believe it or not, that wasn't a real financial collapse.

Just ask any Argentinean.

Back in 2001, after decades of a repeated inability to repay its national debts, rating agencies finally declared Argentina in 'effective default.'

And then came the chaos.

People rushed to their local banks to pull out what was left of their savings. On November 30, 2001, central bank cash reserves fell by $2 billion in just one day. The president was forced to freeze bank accounts for an entire year and imposed a strict $250 per week limitation on personal bank withdrawals. The next day, mass protests over the withdrawal restrictions began.

Unemployment reached a record-high 18%. Food shortages and the subsequent supermarket looting began just two weeks later. Supermarket owners threw food into the street to protect themselves from destructive and deadly stampedes of people charging through their doors. A week after that, Argentina's president resigned.

By 2002, the country had 23.6% unemployment. An unbelievable 57.5% of the entire population lived in poverty. Annual inflation -- which was low or negative all throughout the 1990s -- grew to 41%. An Argentine peso, worth $1 USD in 1991, was worth only a quarter of that just months after the crisis began.

I'll bet many Argentines wished they kept some physical silver on hand. Their wealth would have been protected, because unlike paper currency which depends on a stable government, silver is held by a worldwide value standard that no single government can control.

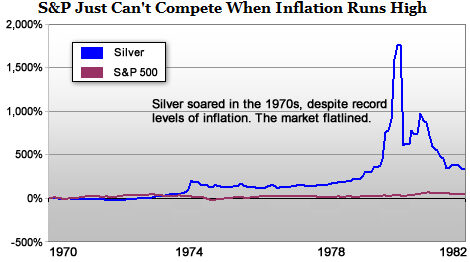

Though a severe currency collapse might not happen in the U.S. anytime soon, we've had our own battles with inflation. And as you probably already know, like gold, silver is a great inflation hedge.

From 1970 until the early 1980s, inflation reached double digits and the S&P 500 flat lined. Meanwhile, silver skyrocketed nearly 1,800%, eventually settling at a still-impressive 330% above its 1970 price by the time inflation subsided.

Owning physical silver isn't just smart, it's easy.

And with the precious metal trading at around $31 per ounce, it's far more affordable than gold. You could buy 51 silver coins for the price of just one gold coin.

Based on a $31 spot price, here are some silver bullion price quotes that I found on Kitco:

[The 'premium' is simply the price an authorized silver dealer adds to the spot price of silver. The premium typically includes the dealer's commission plus the production cost to actually melt/mint that form of physical silver.]

Silver Bars: The majority of .999 fine silver bars come in 10-oz and 100-oz sizes, with the most popular brand names being Engelhard and Johnson Matthey. A brand name bar ensures that the silver weight and purity is verified and recognizable.

.jpg)

While bars typically have some of the lowest premiums of any physical form of silver, many find it difficult to move and store them. If storage is a concern, it probably makes sense to pay a higher premium for smaller forms of physical silver.

Silver Rounds: Silver rounds resemble coins at first glance, but they are produced by non-federal, private mints. They're a popular choice among investors because they're easier to store and trade than silver bars given their smaller size.

Silver rounds are less expensive than silver coins based on the amount of silver they contain, but they aren't legal tender -- meaning you can't pay public or private debts with them. It's also more difficult to verify the weight and purity of rounds versus coins because they are produced differently from mint to mint.

Currently, the American Silver Eagle is the only official silver coin minted in the United States. Expect to pay a higher premium when supplies are limited (as they currently are), and a lower premium when supplies are high.

(You can verify a dealer's American Silver Eagles here to confirm authenticity.)

Other popular federally-minted silver coins include the Canadian Maple Leaf, Canadian Silver Cougar, and the Austrian Silver Philharmonic. All are recognized and traded internationally.

Because official silver coins are nationally recognized and promoted by trusted federal mints, coins typically carry a higher premium than rounds or bars. Regardless, silver coins are popular among investors looking to buy just one beautiful silver coin at a time instead of a larger silver bar that may cost several hundred dollars.

When quantities are in very short supply (as they are today), these special-edition silver coins have significantly higher premiums than their regularly circulated counterparts. The melt value of a proof coin is exactly the same as a normal one-ounce silver coin, but because of its mirror-proof, finished condition, and quality, special edition silver coins tend to be valued more highly among collectors.

Containing 90% silver by weight and volume, junk-silver coins are far from what their name suggests. And if you can find a dealer that sells it, junk silver usually has the lowest premium of any form of physical silver available on the market.

[Learn about investing in silver ETFs -- such as the iShares Silver Trust Fund (NYSE: SLV) -- in my other article, My Favorite Ways to Own Silver Today]

The Investing Answer: Buying physical silver is just as easy as shopping online. Kitco and First Federal Coin are two great places to start. Or, to save on shipping costs, visit your local dealer instead, but be sure to check the U.S. Mint's webpage to find a list of verified precious metal retailers in your area.

For the beginning physical silver investor, I suggest purchasing federally minted silver coins or rounds -- by far the most affordable way to get started. Many dealers will let you buy them by the coin so you can invest a little each month to slowly build up your investment collection and take advantage of today's bargain silver price.